December 10th, 2025 | 07:20 CET

Top performers for 2026 wanted! Siemens Energy, Globex Mining, JinkoSolar, and Nordex in focus

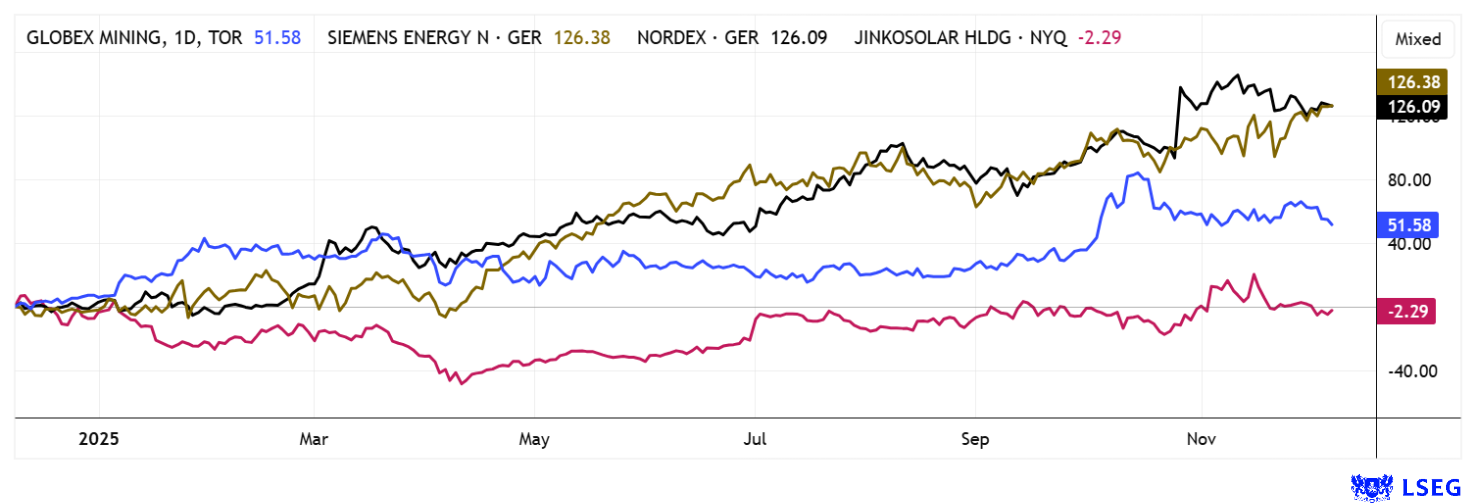

The 2025 investment year is nearing its end, with gains of just under 20% in both the DAX 40 and NASDAQ 100 indices. These two benchmarks remain the focus of attention for European investors, as they represent the benchmark for portfolios in their respective areas. Asset managers did not have an easy time of it until the middle of the year, as they had to switch back to "normal mode" very quickly after Trump's tariff correction in April, despite all the uncertainties. This meant bringing their clients' portfolios back into "risk-on" mode, which is very nerve-wracking in the current environment. Excessive government debt, never-ending geopolitical conflicts, and creeping inflation are leading to higher interest rates, which are considered poison for growth-oriented equity investments. Where can money be made in 2026? With today's selection, we attempt to navigate our way forward through the fog.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , GLOBEX MINING ENTPRS INC. | CA3799005093 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] Our SMSZ project is the largest contiguous land package of any exploration company in the region at 400km2 and overlays a 38km portion of the prolific Senegal Mali Shear Zone. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy versus Nordex – What do the analysts say?

The European public is keeping a close eye on companies that are active in greentech and have climate change efforts written into their statutes. Nordex and Siemens Energy have emerged as clear winners in the greentech scene in Germany, achieving impressive gains of over 120%, or six times the DAX return. The key question now is whether this surge can continue. Analysts estimate Nordex's revenues for 2025/26 to be between EUR 7.5 and 8.3 billion, with an EBITDA margin of around 7%. However, the Company's own margin target of 8% leaves little room for improvement and dampens expectations somewhat. As a result, 7 of the 16 experts surveyed now recommend cautious investment. The consolidated 12-month price target of EUR 27.60 promises only moderate upside potential.

The valuation debate is also lively at Siemens Energy: A 10% increase in revenue is expected for 2026, while the current P/E ratio for 2025/26 is hovering around high values of 30. Some analysts consider this ratio to be ambitious. New momentum is being generated by the entry of an activist US investor who is calling for the spin-off of the troubled wind power division in order to make the group more profitable. This move is being interpreted by the market as a potential breakthrough. 18 out of 27 experts are still giving the thumbs up. The trend proves them right, as the EUR 120 mark was broken in the first week of December with a new all-time high. Will the fairy tale continue? In either case, adjust your stops. For Nordex, EUR 25.70 is a good option – for Siemens Energy, the EUR 112 mark should not fall below.

Globex Mining – Cash flow machine in the commodity supercycle

Globex Mining Enterprises (GMX) has established itself as a stable player in the North American commodities sector since the 1970s. The Company operates a low-risk business model based on the acquisition, optioning, and subsequent licensing of properties. With a portfolio of over 260 projects, including more than 100 royalty interests, the Company is now one of the most diversified rights holders in the industry. The Company is debt-free, has cash and securities of approximately CAD 35 million, and is thus able to take advantage of growth opportunities without diluting capital. CEO and geologist Jack Stoch has led the holding company for decades with a clear focus on intrinsic value and cash flow stability.

One factor in its success is its clear geographical focus on Canada, where stable legal structures, infrastructure, and good relations with indigenous communities offer long-term planning security. Globex is currently strengthening its strategic position through projects in the field of precious metals and critical raw materials, which are of central importance for decarbonization and security of supply in North America. Operationally, new exploration results from Québec demonstrate the momentum of the portfolio. At the 100% owned Rouyn-Merger project, Globex reported initial drill results of 3.44 g/t gold over 38.7 meters and additional high-grade intervals of over 12 g/t gold. These results demonstrate the potential of the region along the gold-bearing Cadillac Fault and reinforce the prospect of resource expansion. A parallel drilling program is underway at the Lyndhurst Copper Project, testing a deep geophysical anomaly. Partner companies are also providing positive momentum. Antimony Resources confirmed a significant expansion of antimony deposits at Globex's Bald Hill Project in New Brunswick, significantly increasing the value of the license rights. According to estimates, up to 108,000 tons of this strategically important metal could be stored there. At the Duquesne-West gold project, Emperor Metals is working on an extensive drill program that is expected to significantly expand the resource definition. These advances reflect the strength of the diversified royalty portfolio, which ranges from silver to battery metals.

The stock market is sustainably enthusiastic. Between the end of 2024 and March 2025, the share price doubled before consolidating and then rising to over CAD 2. This brought GMX shares to their highest level in 13 years. The market is clearly rewarding the growing depth of value creation and the solid balance sheet. Securing domestic raw material flows is increasingly becoming a strategic goal, coupled with a structurally secure revenue model, a broad raw material base, and consistent exploration activity. After a brief consolidation, buy orders can now be successful again at CAD 1.70. Globex is a 100% top pick for 2026!

JinkoSolar – Entering a new era with energy storage

JinkoSolar shares are completely out of the positive range. The solar module manufacturer recorded a 16.7% decline in shipments in the third quarter, while revenue fell by a much steeper 34.1% due to the ongoing price decline in the solar industry, which is plagued by overcapacity. Overcapacity has been weighing on the industry for over a year, and government consolidation efforts in China have had little effect so far. The Company slipped deep into the red with a net loss of CNY 750 million, after posting a slight profit in the previous year. Despite the weakness in its core business, the gross margin improved sequentially from -2.5% in the first quarter to 2.9% in the second quarter and now 7.3% in the third quarter. This recovery signals at least an operational stabilization, even though the margin remains well below the previous year's figure of 15.7%. The newly established energy storage systems business stands out positively and is increasingly becoming a strategic growth driver. With over 3.3 GWh of storage systems delivered in the first three quarters and an annual target of 6 GWh, management sees considerable potential. CEO Li Xiande expects the storage business to make significant contributions to profits from 2026 onwards. However, analysts on the LSEG platform expect an average of only USD 27, with Jinko currently trading at USD 24.70. Skepticism prevails!**

**The stock market does not seem to have fully completed its rally for 2025. Enormous buying pressure still prevails, as asset managers clearly want to remain invested in the best stocks. They need to document on their investment lists that they were involved in the most important stories; otherwise, they risk losing their mandates. Our peer group above showed strong performance figures, and no one has anything to hide here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.