October 28th, 2024 | 07:15 CET

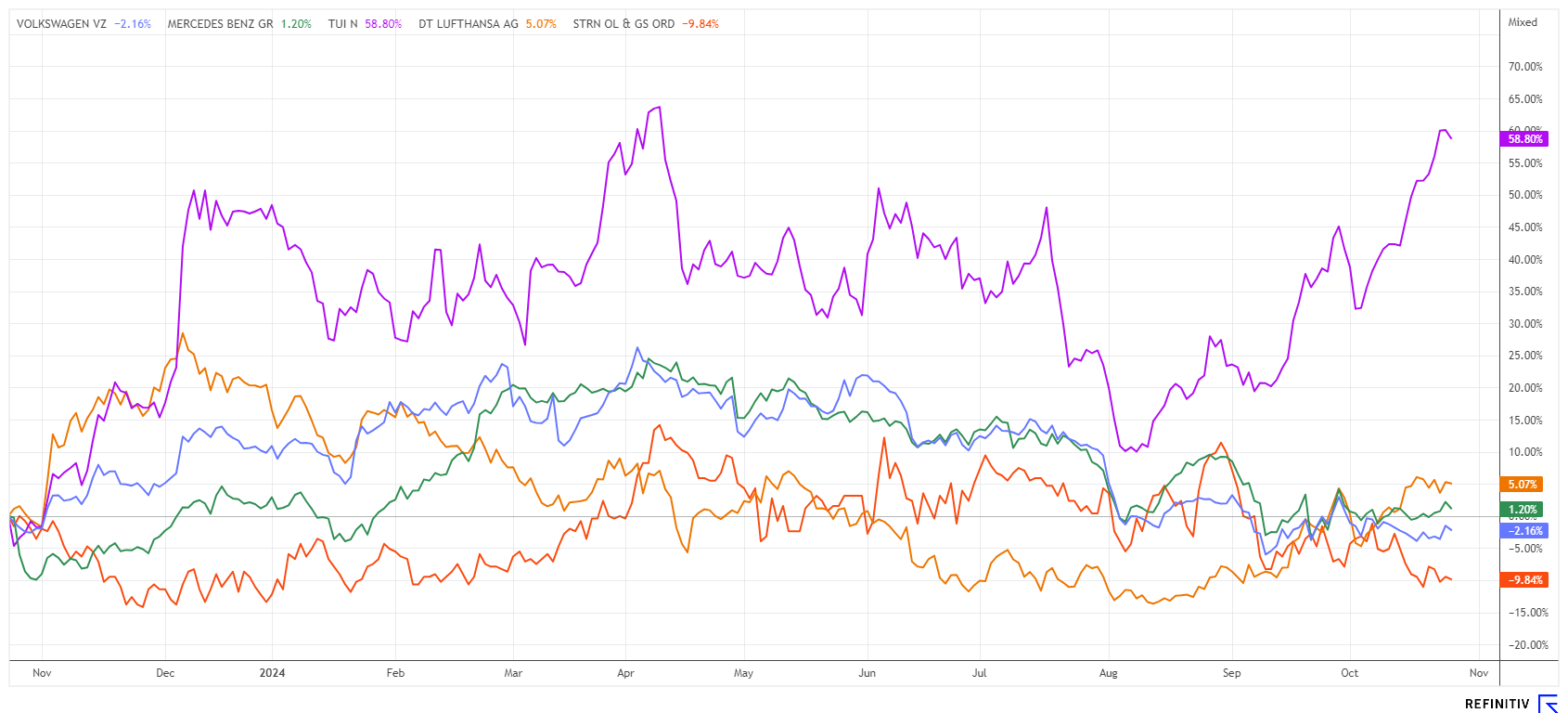

The US election fever is boosting stocks! Mercedes, VW, Saturn Oil + Gas, Lufthansa and TUI are all incredibly cheap!

The stock market is booming! While the NASDAQ has established itself with P/E ratios above 30, the German stock market shows historically low valuations. Europe is in crisis, which is depressing valuations. As a result, international funds now have an overwhelming share of US stocks. For example, the well-known MSCI World: 72% of the index comprises US stocks, with the "Magnificent Seven" now accounting for around 20% of the list. For investors who are invested in these stocks, it has been a long celebration – but right before the US election, it also poses a significant concentration risk. It may be time to rethink, take profits from the top stocks, and consider a value-oriented portfolio with single-digit P/E ratios.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , Saturn Oil + Gas Inc. | CA80412L8832 , LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Lufthansa and TUI – The first lines to the top have been cracked

Since the beginning of August, TUI shares have gained a full 43% - not a bad performance for investors who got in at the bottom. Buying when the cannons are firing has worked brilliantly for the European travel market leader from Hanover. TUI shares are currently benefiting from strong demand for vacations, with the books full for the coming winter season. In addition, interest rates are falling in the Eurozone, which means lower refinancing costs. The recent drop in oil prices also benefits the tour operator. CEO Sebastian Ebel is now seeking to abolish contributions to the German Travel Security Fund (DRSF). In Germany, high costs and overregulation pose risks to package tours, creating a price disadvantage of around 3-5% due to bureaucratic requirements. After years of contributions, the DRSF is sufficiently stocked, so the annual contributions should now be eliminated or reduced. The share is trading just below our initial price target of EUR 8, but if it performs dynamically, EUR 9 is also possible.

The crane airline is still experiencing a bumpy ride, but at least the share price has now left the EUR 6 mark behind it. There are currently warning strikes in Leipzig and Dresden again. The trade union Verdi has called on the employees of the Lufthansa subsidiaries Airport Service Dresden GmbH (ASD) and Airport Service Leipzig GmbH (ASL) to take a two-day strike. Lufthansa had announced its intention to close both companies in the near future. Analysts estimate that Lufthansa will see revenue growth of around 5% annually from 2024. If the airline gets back on track despite all the German headwinds and exploding costs, a 2025 P/E ratio of below 5 is possible. The stock is currently trading at 30% below book value, so there is potential up to EUR 8. Therefore, continue to buy up to EUR 6.80; we had recommended initial positions at EUR 5.85.

Saturn Oil & Gas – With a P/E ratio of 1.5, one of the cheapest stocks in the world

Saturn Oil has undergone a historic transformation in 2024. Since mid-June, the acquisition of the new assets in Saskatchewan has been completed. This time, the deal size was CAD 525 million, bringing daily production capacity up by a further 10,000 barrels (BOE) to a new level of 38,000 to 40,000 BOE. As a result of the successful transaction, Saturn Oil now ranks among the "mid-size producers". It is particularly important for institutional investors that the Company's value is now over CAD 1.5 billion. The excitement lies in the Company's potential to achieve rapid debt reduction with a free cash flow between CAD 350 and 400 million. This will finally make dividend payments and share buybacks possible, as is usual for oil stocks. In particular, pension funds and institutional investors need a return on their investments that benefits those insured for their retirement.

The underperformance of recent months is due, on the one hand, to the 10% lower WTI prices and, on the other hand, to the fact that commodity investors have increasingly focused on precious metals, as there has been a pronounced rally here after several years of stagnation. However, interest in oil and gas stocks will likely return during the winter season. Analysts have recently confirmed their positive assessments, with 5 out of 6 analysts on the Refinitiv Eikon platform issuing a "Buy" recommendation with an average 12-month price target of CAD 5.50. From today's perspective, this represents a 130% opportunity for a stock with a current 2025 P/E ratio of 1.5. The report for the third quarter on November 6 should provide further insights. It does not get any cheaper than this – the current price of CAD 2.30 can prove to be a dream entry point over a 12- to 24-month horizon.

VW and Mercedes – The profit warnings are now priced in

VW is in a transitional year of restructuring! In the third quarter, the Company delivered 2.18 million vehicles of all brands worldwide, 7.1% fewer than in the previous year. Sales of electric vehicles fell by almost 30%, and deliveries to China dropped by 15%. Nevertheless, the share price has now stabilized above the 90-euro mark in mid-October. This is because the restructuring has already reached the minds of investors; it will be painful, and, in particular, the job cuts in Germany could cost several billion. Nevertheless, the 2025 P/E ratio has now fallen to 3.4, 16 out of 28 experts on the Refinitiv Eikon platform are voting "Buy", and the average 12-month price target is EUR 117. That is a potential of 27%; in good years, VW has even had a P/E ratio in the 8s, which would push the stock price well above EUR 200. Our advice: Accumulate until it reaches EUR 93.50!

The premium carmaker from Stuttgart did not fare much better in the third quarter. The Mercedes-Benz Group suffered a sharp drop in profits due to weakness in the important Chinese market. With a 6.7% lower turnover of EUR 34.5 billion, EBIT fell by almost half year-on-year to EUR 2.52 billion. The operating profit margin adjusted for special items collapsed from 12.4% in the previous year to just 4.7%. Mercedes CEO Ola Källenius had already significantly lowered the Company's profit forecasts in September, preventing a downward stock price reaction. Here, too, there is a low 2025 P/E ratio of 5.7 and, on top of that, a dividend yield of 7.4%. A clear buy up to EUR 58.50!

The stock market year is entering the final quarter. Returns are not yet secured unless investors decide to close the door and wait for the US elections. Fund managers see no risk in the election because interest rates are falling and the arms machine is running. Whether Democrat or Republican, announcements from the White House will not negatively impact investors because the US needs a complete overhaul, which costs money and provides companies with generous profits. Geopolitical conflicts now correlate positively with the stock market!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.