June 13th, 2025 | 07:00 CEST

The three IT musketeers – AI, high tech, quantum computing! NetraMark Holdings, Bayer, Novo Nordisk, and D-Wave

A new edition of GTC 2025 is currently underway in the French capital, Paris, where NVIDIA CEO Jensen Huang spoke at length about the future of artificial intelligence. As usual, he also made some interesting comments about quantum computers. In the eyes of the NVIDIA CEO, quantum computer technology has reached a decisive turning point and will soon be able to solve some interesting problems that would take even NVIDIA's most advanced AI systems years of computing time to solve. The requirements go beyond pattern recognition, automation, and real-time decisions. Recently, AI has also been playing a significant role in medicine and pharmaceutical development. For some stocks, there is, therefore, a daily reason to reach new highs. Now is the time for investors to focus!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NETRAMARK HOLDINGS INC | CA64119M1059 , BAYER AG NA O.N. | DE000BAY0017 , NOVO NORDISK A/S | DK0062498333 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

NetraMark Holdings – Revolutionizing results, reducing costs

Pharmaceuticals used to be an industry where the sun always shone, but now things are going downhill. Examples such as Bayer and Pfizer show where share prices can end up when costs get out of hand. US President Donald Trump is also unhappy about the high margins in the pharmaceutical industry. He wants to halve prices while making the US an attractive location. This is a major challenge that can only be solved with technology. Some industry representatives have recognized the signs of the times and are stepping on the gas. What NVIDIA's CEO recently shared in Paris is already daily practice for the Canadian AI technology company NetraMark Holdings Inc. (AIAI). Big data analytics and artificial intelligence (AI) applications have been used successfully in clinical trials for some time now, speeding up processes, significantly reducing costs, and dramatically increasing validity. AI can analyze large amounts of data from electronic health records, genome data, and patient registries to identify suitable participants for clinical trials more quickly and accurately. This significantly shortens recruitment times and improves accuracy. It is too early to say whether quantum computers will also be used in the near future.

The pharmaceutical industry is the major client for NetraMark's projects, as it is increasingly using artificial intelligence to make clinical trials more accurate and cost-effective. The results so far point to a quantum leap, as the NetraAI 2.0 platform addresses one of the most pressing challenges in clinical research: the interface between efficacy and feasibility. CEO George Achilleos knows that a high percentage of all clinical trials fail, especially in Phases 2 and 3, which is why the Company is working intensively to revolutionize the results of these trials through improved design and evaluation methods.

Investors discovered the stock at low cent prices in 2024, and since then, a revaluation has taken place. Now, however, investors also know how dynamically the business can develop. With gross margins of over 90%, the current valuation of CAD 112 million certainly reflects the intrinsic value of the business model. Given the high level of momentum, investors should consider positioning themselves early, as further development milestones can be reported at any time! Then the next rocket will take off.

CEO George Achilleos presented NetraMark Holdings at the 15th International Investment Forum on May 21, 2025. Click here for the video.

Novo Nordisk and Bayer – Lots of potential to catch up

Novo Nordisk and Bayer are two major players in the European pharmaceutical sector. Both experienced a huge sell-off of their shares, which in Bayer's case was due to the dire situation caused by glyphosate lawsuits in the US. The acquired Monsanto businesses are already facing bankruptcy if the highest courts rule against the Company. In the case of Novo Nordisk, the slump was due to lower expectations for the obesity drug business due to emerging competition. Both companies are currently undergoing a tough restructuring process and are incorporating AI into their operating processes in order to save further costs. Bayer launched a collaboration with Exscientia in 2020. The aim is to support the AI-assisted discovery of new drug candidates in the fields of cardiology and oncology. Generative AI is used to predict optimal reaction conditions in chemical syntheses. Bayer uses AI specifically for target identification, molecule design, and optimized laboratory processes.

Novo Nordisk uses AI for drug design, patient selection, and research and development. To this end, it has been working since 2024 on an AI platform from Microsoft Research to build a cloud-based research infrastructure, including data integration from 1,600 past studies. For some time now, the Danish company has also been collaborating with technology companies Valo Health on an AI-supported "human-centric" platform for obesity, diabetes, and cardiovascular programs, as well as with Gensaic in the field of cardiometabolism. Novo Nordisk integrates AI into all phases of drug development – from data collection and target identification to design, patient selection, and regulatory documents.

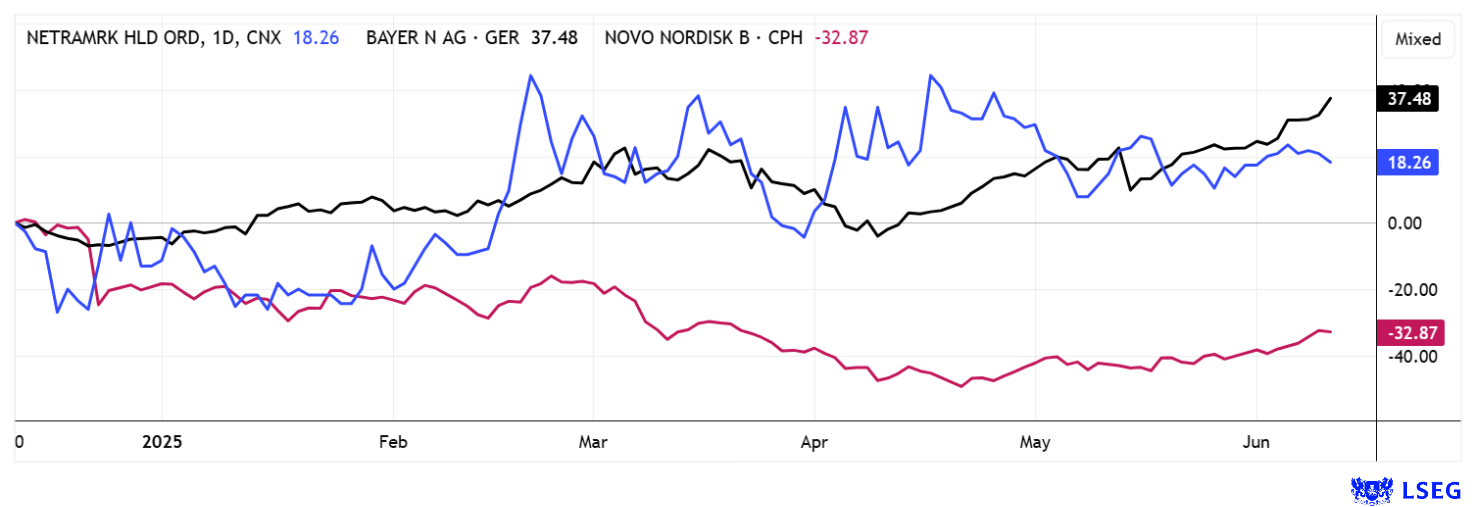

The outlook for the shares of the two pharmaceutical giants has been improving recently. Bayer completed a lower technical reversal in the EUR 22.50 to EUR 24.50 zone and recently shot up to EUR 27.80. Analysts on the LSEG platform see 12-month price targets averaging EUR 28.30 – corresponding upgrades are likely to follow. The sell-off at Novo Nordisk also appears to be over. However, it will likely be years before the old highs of EUR 137 reappear. Both stocks are now highly interesting.

D-Wave – NVIDIA CEO fuels quantum computing

Quantum computing could prove to be the solution to complex computing problems in the coming years, as it is faster and uses significantly less energy. In this context, the stock market is celebrating new stocks on the price screen every day. The latest wave of buying was once again triggered by comments from NVIDIA co-founder and CEO Jensen Huang. In the CEO's view, quantum computer technology has reached a decisive turning point. He believes that the problem-solving capabilities of these systems will increase dramatically. Even NVIDIA's most advanced AI systems would need years of computing time to achieve this. The chip manufacturer is focusing on developing the necessary infrastructure and powerful software that will make quantum computers truly usable. A typical representative and currently highly hyped quantum stock is D-Wave. The expert in architectures and data processing services only generated revenue of USD 8.8 million in 2024, but as of yesterday, it had already surpassed the USD 5 billion mark. The Company recently reported that USD 95.8 million was raised overnight through the exercise of warrants. This means it now has sufficient funding to complete its major plans to distribute its new products. Analysts on the LSEG platform estimate revenue of around USD 25 million for the current year. Anyone who still thinks D-Wave's valuation is too low should jump on board!

Artificial intelligence has long since conquered all areas of the economy. In the pharmaceutical sector, Bayer and Novo Nordisk are already quite advanced in their use of new AI technologies. NetraMark is making a name for itself with a highly innovative approach, and its shares are also very attractively valued, given the wealth of expertise and patents it possesses. Investors should stay on the ball and make selective purchases.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.