cloud

Commented by Fabian Lorenz on October 1st, 2025 | 07:20 CEST

1,000% not enough for D-Wave? 70% price potential for Zalando! Will Walmart partner MiMedia's stock now take off?

After a meteoric 1,000% rise in just 12 months, D-Wave Quantum shares continue to attract attention. Analysts are significantly raising their price targets - is the next short squeeze already looming? Meanwhile, bargain hunters should take a closer look at MiMedia. The Walmart partner's shares have halved since July, yet the Company is making strong progress in expanding its cloud platform. A rebound of up to 100% back to its previous high is possible. And in Europe, Zalando is back on investors' radar. Analysts see up to 70% upside potential, while the chart is also looking more favorable again. However, the weak consumer climate continues to weigh on business sentiment.

ReadCommented by Armin Schulz on September 16th, 2025 | 07:20 CEST

Building wealth with network effects and AI: How Palantir, MiMedia, and Alibaba are making investors rich

The global economy is being driven by a new type of company: scalable platform ecosystems with predictable, recurring revenues. They leverage network effects for exponential growth and are resilient to economic fluctuations. These disruptive business models, at the intersection of AI, data, and digital connectivity, generate steady cash flows and define the investment opportunities of tomorrow. Three companies that perfectly embody this strategy are Palantir, MiMedia Holdings and Alibaba.

ReadCommented by Armin Schulz on September 15th, 2025 | 07:25 CEST

Beyond FAANG, German tech companies such as SAP, Finexity and TeamViewer also offer potential for your portfolio

While US tech giants like Meta and Google dominate the headlines, other technology companies in Germany receive little attention. But here too, on the other side of the Atlantic, innovative companies with disruptive technologies and robust business models are shaping the future and offering unique opportunities for capital growth. Reason enough to take a closer look at three German companies: SAP, Finexity and TeamViewer. We analyze the strategic decisions and innovations that will shape the next investment success story.

ReadCommented by Nico Popp on September 9th, 2025 | 07:15 CEST

MENA region offers growth opportunities: What can MiMedia learn from Anghami and Thomson Reuters?

Regional opportunities on the stock market still exist: The Arabic-speaking countries of the Middle East and North Africa (MENA region) are among the most dynamic growth markets for digital services. A rapidly growing, young population with increasing smartphone penetration is driving demand for cloud services, streaming offerings, and digital information. MarkNtel Advisors forecasts annual growth rates of 18% for cloud solutions in the MENA region through 2028. White-label cloud provider MiMedia has just rolled out its app in Arabic and anticipates significant growth. Role models could be the streaming platform Anghami and the data service provider Thomson Reuters, which have already discovered the region for themselves.

ReadCommented by Fabian Lorenz on September 1st, 2025 | 07:30 CEST

ALERT at Nel ASA! BUYING OPPORTUNITIES in BYD and Walmart partner MiMedia stock?

Is everything getting worse at Nel ASA? The silence from the usually communicative hydrogen specialist is indeed alarming. The partnership with Samsung has long since fizzled out, and after weak order intake in Q2, there is no improvement in sight. In contrast, Walmart partner MiMedia now offers an attractive entry opportunity following a decline in its share price. The latest operational reports from the cloud company are certainly promising. And BYD? The Chinese electric vehicle giant continues to grow dynamically despite fierce price competition – and is gaining momentum in Europe. However, the stock market did not seem convinced on Friday.

ReadCommented by André Will-Laudien on August 21st, 2025 | 07:15 CEST

High-tech correction! A brief pause, then the party continues at Palantir, Deutsche Telekom, MiMedia, and SAP

Oops – there it is. The first correction at Palantir was somewhat severe. But after a 1000% increase in 24 months – who cares? The blockbuster themes of artificial intelligence, cloud computing, and big data continue to dominate the stock market, leading to significant daily price gains. Investors seem to view the capital markets as an almost one-way success story in which valuations play hardly any role. Europe is increasingly taking the lead, with the EURO STOXX 50 rising by around 20% since the tariff dip in April. Despite apparent risks, many investors are sticking to the bull market, although the S&P 500's high Shiller P/E ratio of over 38 is sending out a clear warning signal. Deutsche Telekom is generating excitement with the announcement of another innovation push in the form of its first AI-based smartphone. The coming weeks therefore offer exciting opportunities for investors who, despite the warning signs, are betting on the continued momentum of the market. Where to invest?

ReadCommented by Nico Popp on August 12th, 2025 | 07:05 CEST

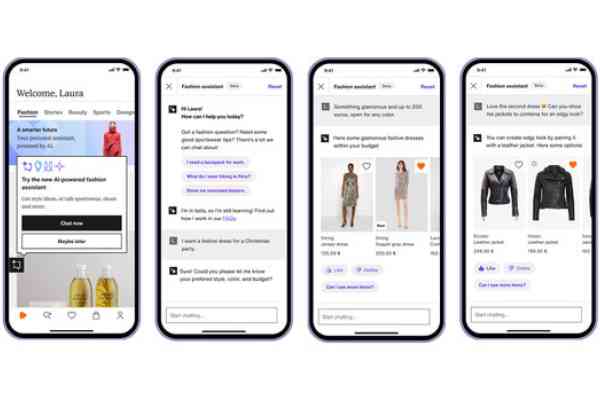

Where big tech fails and new opportunities arise: Amazon, Apple, MiMedia

The major tech players dream of the distant future and, in doing so, neglect their bread-and-butter business of serving everyday customers. One example is personal cloud storage and media management. According to market researchers at Thread Gold Consulting, 2.3 billion people are already using such services today. By 2031, the market is expected to grow by 24% annually, reaching USD 366 billion. Industry giants like Apple and Amazon offer cloud storage only within their own ecosystems. White label products? Not a chance! We explain the lucrative investment niche that is emerging in cloud services and how investors can benefit from it.

ReadCommented by Armin Schulz on August 8th, 2025 | 07:10 CEST

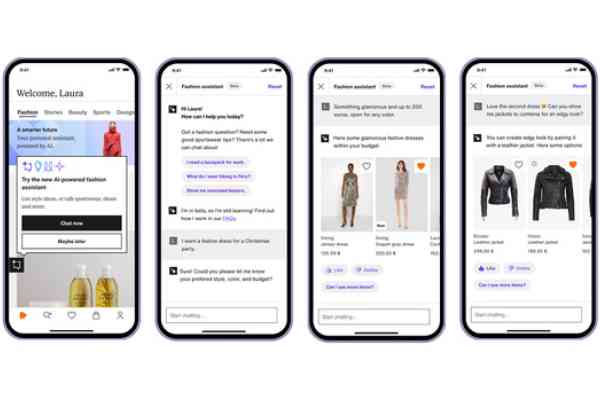

Profit with Cloud & AI: Why SAP, MiMedia Holdings, and Palantir must be your focus NOW

Global tech euphoria is reaching new highs in the summer of 2025, driven by much more than just artificial intelligence. Cloud computing, automation, and intelligent systems are the new strategic assets that are revolutionizing markets and shifting revenue streams. Companies are competing for speed, scalability, and data-sovereign solutions in an environment of dizzying valuations and disruptive innovations. Those who choose the right partners now will secure a decisive competitive edge. Three companies stand out: SAP, MiMedia, and Palantir. We take a closer look at their strategies.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:05 CEST

270% surprise! Rheinmetall, Zalando, Walmart partner MiMedia – Time to buy shares?

With a strong performance of 270%, MiMedia shares are one of this year's surprises. And the chances are good that the stock will continue to perform well in the future. With strong partners such as Walmart behind it, the cloud specialist aims to grow significantly in the coming years. Rheinmetall needs to grow massively to justify its ambitious valuation. However, the supercycle in the defense industry promises golden years ahead. The group also wants to carve out a large slice of the billion-dollar pie in other European countries. After a strong start to the year, Zalando shares have slipped considerably. The takeover of competitor AboutYou has now been completed, and analysts see upside potential.

ReadCommented by André Will-Laudien on July 24th, 2025 | 07:15 CEST

Buying frenzy on the NASDAQ – Another 200% with D-Wave, MiMedia, and Super Micro Computer?

New record highs every day – a joy for investors, but a source of stress for fund managers. Time and again in history, stock markets have risen unchecked, only to be followed by an equally unexpected correction. This usually happens when there is a high degree of complacency. One indicator of investor sentiment is the so-called Fear & Greed Index. With values above 75 out of 100, it has been in the "Extreme Greed" zone for weeks now. But as a famous quote from the 1987 movie "Wall Street" said: "Greed is good!" We examine a few stocks with promising prospects and are betting on a continuation of the remarkable rally.

Read