Tungsten

Commented by Fabian Lorenz on September 23rd, 2025 | 07:20 CEST

NATO under pressure! Almonty target price rises! RENK not a favorite at Goldman Sachs! DroneShield hits milestone!

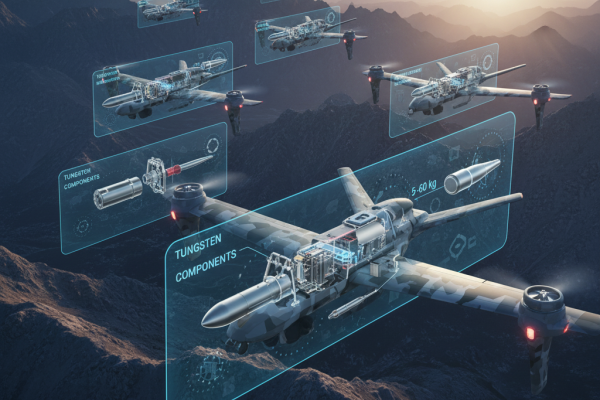

Russia is testing NATO! Drones and fighter jets are repeatedly being spotted in European airspace, showing that de-escalation is not happening. NATO must continue to strengthen its defenses. This offers opportunities for investors across the entire value chain of the defense industry. In the raw materials sector, Almonty shares are a top pick. Analysts expect the tungsten producer to see an explosion in profits in the coming years and are raising their price target. Could the US government even step in? DroneShield has reached a milestone thanks to follow-up orders from the US Department of Defense. The drone defense specialist sees itself well-positioned for the future. Goldman Sachs has commented on RENK for the first time, but the analysts have other favorites.

ReadCommented by Stefan Feulner on September 22nd, 2025 | 07:45 CEST

Almonty Industries, Rheinmetall, D-Wave Quantum – Alarm bells are ringing

Tungsten is one of the most strategically critical raw materials in the global economy. With its extremely high melting point, exceptional density, and hardness, the metal is indispensable, especially in the defense industry and semiconductor technology. Tungsten is also essential in toolmaking, aviation, and medical technology. The problem: over 80% of global production comes from China, a massive dependency that is increasingly viewed critically in times of geopolitical uncertainty. With the global expansion of defense and high-tech, demand is rising rapidly, but secure Western supply chains are virtually non-existent.

ReadCommented by Carsten Mainitz on September 18th, 2025 | 07:00 CEST

Almonty Industries, thyssenkrupp, Nordex – Perfect news!

Rare earths and critical raw materials play a vital role across many sectors of the economy. They are essential for electric motors, permanent magnets, and battery technologies and are of great importance in the defense industry. China controls the majority of global reserves and is restricting exports. Western countries have long been making great efforts to secure deposits outside China, with particular pressure coming from the US. A recently published report by Bloomberg has raised eyebrows.

ReadCommented by Armin Schulz on September 17th, 2025 | 07:10 CEST

Rheinmetall, Almonty Industries, RENK: The next wave of the defense stock mega boom is rolling in

Geopolitical tensions and a paradigm shift toward increased national security are fueling a sustained boom in the defense industry. Rising budgets worldwide are ensuring full order books and unprecedented growth prospects for specialized companies. This development is making defense stocks one of the most dynamic, albeit controversial, investment themes. Three listed companies that are perfectly positioned to capitalize on this environment are Rheinmetall, Almonty Industries, and the RENK Group.

ReadCommented by Nico Popp on September 16th, 2025 | 07:15 CEST

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by André Will-Laudien on September 15th, 2025 | 07:00 CEST

Security is key – Acquisitions continue to drive growth! 100% bull market possible with Almonty, Steyr, Mutares and Deutz

The stock markets are looking for direction! While the Russia-Ukraine conflict enters the next round with the drone incident in Poland, prices for strategic metals continue to rise. Western industries are under pressure from NATO rearmament and are looking for secure jurisdictions to be able to process highly sensitive orders. Supplies of critical raw materials from China have fallen by 90% since March 2025, with only long-term contracts still being fulfilled. But what about the current boom in orders? The price of the critical metal tungsten has doubled within 12 months. The primary beneficiary is Almonty Industries, as it already has active mines in Europe and is about to launch a mega-project in South Korea. Highly exciting, but also a challenge for investors. What happens next?

ReadCommented by Fabian Lorenz on September 11th, 2025 | 07:20 CEST

Almonty set for TAKEOVER? RENK after 260% rally! D-Wave Quantum faces exciting weeks ahead!

Almonty is making headlines with takeover plans in the US – tungsten production on American soil could help solve one of the country's strategic problems. It is difficult to understand why the share price did not react more strongly to the Bloomberg interview. Analysts already see 50% upside potential for Almonty shares and a 2027 P/E ratio of 5. RENK has also impressed with a 260% rally and strong half-year figures. With a new, state-of-the-art transmission for light tracked vehicles, the MDAX company is positioning itself for autonomous military technology. The coming weeks are likely to be exciting for D-Wave. The quantum high-flyer is participating in numerous international conferences. These provide a stage for technological advances and new customer contacts and could catapult the stock out of its sideways movement.

ReadCommented by Armin Schulz on September 10th, 2025 | 07:15 CEST

Critical raw material supply: Rheinmetall's risk, Almonty Industries' opportunity, and Xiaomi's trump card

One strategic metal dominates the plans of military and tech companies: tungsten. Indispensable for high technology, from precision ammunition to powerful electric car motors, its supply is becoming a geopolitical issue. Western nations are fighting for supply independence, catapulting a previously overlooked mining operator into a unique position. This development reveals drastic dependencies and creates clear winners. Three companies exemplify this new reality: Rheinmetall, Almonty Industries, and Xiaomi.

ReadCommented by Nico Popp on September 9th, 2025 | 07:00 CEST

Trump Lifts Tariffs on Tungsten: Implications for Almonty, historical parallels with Nucor and Cameco

There is hardly a trading day without a tariff headline: Over the weekend, US President Donald Trump announced the exemption of several key imports — including gold, uranium, and tungsten — from import tariffs. The measure highlights just how strategically important these two raw materials, in particular, have become for the country. No tariffs should hinder trade in tungsten and other critical materials. This is good news for tungsten producer Almonty Industries, which has only recently relocated its headquarters to the US and has already secured offtake agreements with US industry players. The Company is now preparing to bring its massive Sangdong mine in South Korea into production - a project that could account for more than 40% of the global tungsten supply outside China. It now appears likely that a large portion of this production can be exported to the US tariff-free. We take a closer look at what the US government's measures mean in concrete terms and what opportunities similar market interventions have created for investors in the past, with the examples of Nucor and Cameco.

ReadCommented by Stefan Feulner on September 8th, 2025 | 07:10 CEST

Opendoor, Almonty Industries, BioNTech – Great opportunities outside the tech bubble

While the Nasdaq 100 continued to lose momentum last week, along with leading tech stocks, the crisis metal gold celebrated a new all-time high at USD 3,586 per ounce. The escalating geopolitical crises and the intensifying trade war between the US and China are likely to drive prices for critical raw materials in the long term. Western producers remain attractively valued.

Read