September 11th, 2025 | 07:20 CEST

Almonty set for TAKEOVER? RENK after 260% rally! D-Wave Quantum faces exciting weeks ahead!

Almonty is making headlines with takeover plans in the US – tungsten production on American soil could help solve one of the country's strategic problems. It is difficult to understand why the share price did not react more strongly to the Bloomberg interview. Analysts already see 50% upside potential for Almonty shares and a 2027 P/E ratio of 5. RENK has also impressed with a 260% rally and strong half-year figures. With a new, state-of-the-art transmission for light tracked vehicles, the MDAX company is positioning itself for autonomous military technology. The coming weeks are likely to be exciting for D-Wave. The quantum high-flyer is participating in numerous international conferences. These provide a stage for technological advances and new customer contacts and could catapult the stock out of its sideways movement.

time to read: 5 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , RENK AG O.N. | DE000RENK730 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Almonty Industries: Takeover in the US? 2027 P/E ratio of 5!

It would be a real bombshell: Is Almonty Industries setting up tungsten production in the US? Almonty CEO Lewis Black hinted at this in an interview with Bloomberg on Monday. According to Black, the Company is considering the purchase of a tungsten deposit. This would support the US government in solving a strategic problem. For many years, no tungsten has been produced in the US. As a result, the country is 100% dependent on imports for this critical raw material, which is not only important for defense technology. A situation that the world's largest military power simply cannot afford.

Almonty already produces tungsten in Portugal and is about to begin operations at a massive mine in South Korea. Black had already announced that a large part of the production would go to the US defense industry in the future. The first supply contracts have been signed. With a takeover, the Canadian company, which has also been listed on the Nasdaq since July and will relocate its headquarters to Delaware, would further expand its US presence. It cannot be ruled out that the US government will also take a direct stake in Almonty. Such an investment caused the share price of rare earth manufacturer MP Materials to skyrocket.

Analysts also see Almonty's fair value – not only in comparison to MP Materials – as significantly above the current level. This week, experts at GBC Research raised their price target for Almonty shares to EUR 5.59. The tungsten gem's stock is currently trading at EUR 3.83. In their study, the analysts point to the dynamic development of the tungsten market. Due to Chinese export restrictions – around 80% of global production is mined there – the reference price for ammonium paratungstate rose from USD 350 to USD 500 per ton between March and August 2025 alone. Starting in 2027, US Department of Defense restrictions on tungsten from adversarial countries will further increase structural demand for non-Chinese sources.

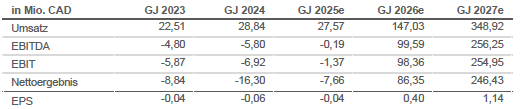

GBC expects Almonty to already achieve earnings per share of CAD 0.40 with the ramp-up of the Sangdong mine next year. By 2027, this figure is expected to rise to CAD 1.14. At a current price of around CAD 6.00, the 2027 P/E ratio is 5. The 50% price potential predicted by GBC analysts, therefore, appears anything but ambitious.

RENK prepares for autonomous vehicles

With a gain of over 260%, RENK shares are clearly among the high flyers of the current year. In order to remain competitive in the future, the MDAX company has unveiled the first model of a new generation of transmissions. It is intended to pave the way for a digitalized powertrain. The HSWL 076 transmission was presented at the DSEI defense exhibition in London, which ends tomorrow. It was developed for the Finnish defense and technology company Patria and specifically addresses the requirements of modern, lightweight tracked vehicles. With its compact design, low weight of approximately 700 kg, high power density, and a top speed of up to 90 km/h, the HSWL 076 is particularly suitable for lightweight tracked vehicles in the 13 to 21 ton range. It is prepared for hybrid drives and has an integrated digital interface and monitoring systems. This means that the transmission is designed for the use of assistance systems and autonomous driving functions.

RENK CEO Dr. Alexander Sagel stated: "With the HSWL 076, we are setting a new standard for propulsion technology in light tracked vehicles. Our goal is to offer our customers reliable, efficient, and future-proof solutions." There is also news regarding transmissions for armored personnel carriers. RENK plans to deliver prototypes of the HMPT 800 transmission to a Ukrainian defense contractor for the further development of an armored personnel carrier. The transmission is manufactured in the US and is already being used in US Army vehicles, among others. With its high power density and compact design, it is intended to improve the mobility of the vehicles. If the trials in Ukraine are successful, a tender for the series production of an already agreed number of units is planned.

D-Wave shareholders take note!

Since June, D-Wave Quantum's stock has been trading in a broad sideways corridor. That could come to an end in the coming weeks. The Company will be participating in several internationally significant technology conferences in September and will use the stage to showcase the progress of its quantum solutions. It is quite possible that investors will gain new insights into technological developments or potential customer relationships.

The first event is SEMICON Taiwan, one of the most important trade fairs for the semiconductor and microelectronics industry, on September 11. In addition to practical examples of current customer applications, D-Wave CEO Dr. Alan Baratz will also report on technological breakthroughs, the use of quantum computing in conjunction with artificial intelligence (AI), and the long-term prospects of annealing technology.

On September 17, D-Wave will once again be in the spotlight: Dr. Andrew King, Senior Distinguished Scientist at the Company, will discuss recent advances in annealing quantum computing at the Quantum World Congress. The focus will be on how these developments are helping companies, research institutions, and government agencies solve complex problems in optimization, materials simulation, and AI. Together with representatives from the US Department of Energy and other industry experts, they will discuss potential application scenarios and market opportunities.

On September 19, all eyes will be on Dublin, where Murray Thom, Vice President of Quantum Technology Evangelism, will present 25 current application examples for the financial sector at Fintech Nation. Of particular interest: New research findings from D-Wave suggest that annealing-based quantum computers could significantly reduce the energy consumption of blockchain applications. This is highly relevant for banks, payment service providers, and crypto companies.

Establishing tungsten production in the US would be a real milestone for Almonty. It is incomprehensible that the Bloomberg interview did not make bigger waves and drive the share price towards the GBC target price. RENK has impressed with its half-year figures, and the latest reports show that it is not resting on its order backlog. Exciting weeks could lie ahead for D-Wave.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.