Oil

Commented by Nico Popp on September 22nd, 2021 | 10:28 CEST

BP, Saturn Oil + Gas, Gazprom: Where growth meets low valuations

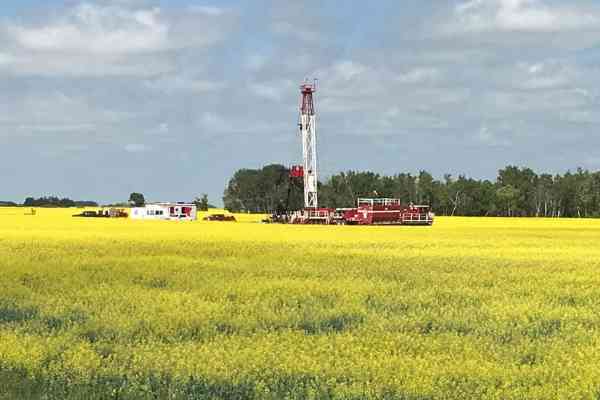

The climate turnaround is coming, but it will not happen overnight. One raw material that will be needed for a long time to come is oil. OPEC recently increased its demand forecast for 2022 by 4.2 million barrels - every day. The oil companies, which are currently valued low on the stock market, will therefore continue to earn good money for a long time to come. But here, too, the companies with the edge are those that are flexible and have a sustainable focus. We present three stocks.

ReadCommented by Stefan Feulner on September 16th, 2021 | 13:17 CEST

FuelCell Energy, Saturn Oil + Gas, Gazprom - The Renaissance of fossil fuels

There is no question that Germany has already achieved a great deal in terms of climate protection. In 2020, about 45% of its electricity came from renewable sources. However, the goal of becoming greenhouse gas neutral by 2045 is still a long way off. For this plan to become a reality, wind power still needs to be expanded significantly. The first half of the current year shows that it will not be possible to do without fossil fuels in the coming years. According to calculations by the Federal Statistical Office, over 56% of the total 258.9 billion kWh of electricity generated in Germany came from conventional sources such as coal, natural gas and nuclear energy.

ReadCommented by Armin Schulz on September 13th, 2021 | 11:47 CEST

Bayer, Saturn Oil + Gas, TUI - Which share will be the first to take off?

We have often heard that the profit is in the purchase; however, it is difficult to predict the low of a share and then enter at that low. Often it is better to wait for a reversal using charting techniques, which increases the probability of finding a profitable trade. Those who buy falling knives have certainly suffered losses more often. But there are always stocks that are not "in" with investors, so it takes longer to get the share price going. Especially companies that have had problems in the past must first regain the trust of their shareholders. Today we analyze the prospects of three companies that have had problems in the past and want to take off.

ReadCommented by Nico Popp on September 13th, 2021 | 10:41 CEST

K+S, Deutsche Rohstoff, Barrick Gold: How investors profit from inflation

Prices are rising and rising! In August, inflation rose more sharply than at any time in the last 28 years. It rose by an average of 3.9% compared with the same month of the previous year. The main price drivers were food and energy commodities. But other products and services are also becoming more and more expensive. Here is how investors can take this trend into account in their portfolios.

ReadCommented by André Will-Laudien on September 9th, 2021 | 12:49 CEST

Royal Dutch Shell, Saturn Oil + Gas, Steinhoff: From 17 to 51 - Triples sought!

Investing in shares consists of striving for a return on the capital invested. In recent months, there have been many stocks that have increased tenfold in price. However, only few investors had persevered. If one lowers one's targets somewhat and still maintains a reasonable profit expectation, even a threefold increase could bring great joy. We take a look at three stocks that stand at just under 17 today and calmly consider whether a 51 could be possible. Impossible, you say - Possible, we say!

ReadCommented by Carsten Mainitz on September 7th, 2021 | 10:40 CEST

Deutsche Rohstoff, Gazprom, Royal Dutch Shell - Do you really want to miss out? Single-digit P/E ratios and share price gains!

Commodities giant BHP is selling its oil and gas business after more than 60 years. However, other companies are pushing to enter and expand in this sector. How does this fit together? Ultimately, it is strategic decisions - focus, diversification or transformation? The high prices for oil and gas are providing producers with high profits. The medium-term outlook is also good. Growth and a favorable valuation are thus enticing. These are the stocks worth taking a closer look at.

ReadCommented by Stefan Feulner on September 6th, 2021 | 13:40 CEST

Steinhoff, Saturn Oil + Gas, NIO - Spectacular transformation

A lot happened in the global capital markets last week. In addition to the OPEC+ meeting, where it was decided to turn on the oil taps further, disappointing labor market data again determined the direction of stock prices. Several second-line stocks, likely to face serious revaluations due to strong quarterly figures or new corporate developments, caused a furor. Position yourself now!

ReadCommented by Armin Schulz on September 3rd, 2021 | 11:51 CEST

Deutsche Rohstoff, K+S, Royal Dutch Shell - Where to invest as fund managers cut equity exposure?

A look at the Global Fund Manager Survey conducted by Bank of America shows the views of Fund managers have changed significantly in the past month. Only 27% now expect the global economy to be strong, compared with almost twice as much optimism the previous month. One reason is the expectation that the FED will noticeably turn off its monetary tap at the end of the year. The money glut has sparked inflation, which can be seen clearly in commodity prices. All these are reasons why the cash quota in the funds is being increased, and the equity quota decreased. The high commodity prices are benefiting commodity producers in particular, which is why we are looking at three companies from this sector today.

ReadCommented by Stefan Feulner on August 30th, 2021 | 11:22 CEST

Huge opportunities at Steinhoff, Saturn Oil + Gas, MorphoSys

The second-quarter reporting season is drawing to a close and was exceptionally strong. Earnings estimates had already been raised in the run-up to the quarter and were even exceeded again due to the economic recovery following the disastrous Corona year 2020. Looking at the forecasts of most companies for the full year, these were also raised. As a result, some stocks are facing a revaluation that the broader market has yet to realize.

ReadCommented by André Will-Laudien on August 26th, 2021 | 12:04 CEST

Deutsche Rohstoff, Royal Dutch Shell, BP, Standard Lithium: Suddenly, oil is back!

Looking at the oil prices is really astonishing. Just last week, the price of a barrel was unwaveringly on its way down, with Brent crude even marking a 3-month low of USD 64.9 on the spot market. Then the direct reversal and a pronounced rally upwards to courses of USD 71.8 yesterday morning. The weaker US dollar and the dwindling fears of the Delta variant, which rages in China's major cities less than initially expected, are sought as reasons. As a result, the short-term demand worries have evaporated again. But another reason is also on the table: The events in Afghanistan are again bringing great unrest to an important oil and raw materials region. That pushes the prices further!

Read