Mining

Commented by André Will-Laudien on January 14th, 2025 | 08:00 CET

THE VOLATILITY TRAP: Sell-off in Bitcoin, gold on the rise! Desert Gold, MicroStrategy, Lufthansa, and Nel ASA

After a record year for equities in 2024, the new year is entering a challenging phase. Hopes of interest rate cuts look bleak, with inflation remaining too high. The mega rally in Bitcoin also needs to be deflated soon. This hits BTC collector MicroStrategy quite hard. Nel ASA, which had started the year on a hopeful note, now has to announce a production stoppage! Lufthansa, meanwhile, is working on acquiring the state-owned Italian airline ITA. Volatility is rising dangerously, signaling that a correction is due. These developments are positive for the safe haven of gold. The key now is consistent action!

ReadCommented by Stefan Feulner on January 13th, 2025 | 07:00 CET

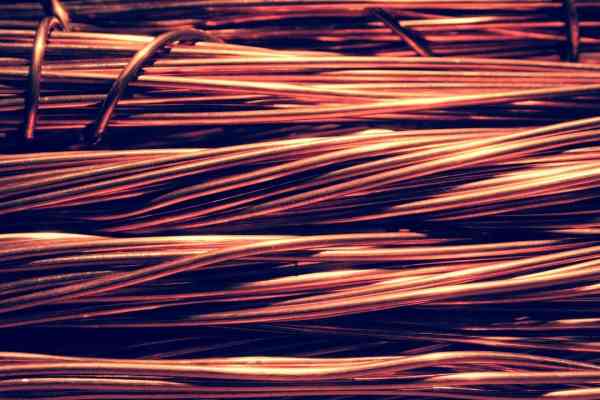

Nordex, XXIX Metal, D-Wave Quantum – Demand is driving prices

The decarbonization of the energy industry and the accelerated expansion of data centres for calculating artificial intelligence are creating a steadily increasing demand for energy sources that are as clean and efficient as possible. In addition to the ramp-up of solar energy, wind power plays a major role. The energy transition is leading to an enormous increase in the demand for copper. Forecasts assume that the demand for copper could increase by around 50–70% by 2030. By contrast, the past decade has seen a failure to meet rising demand by developing new projects. As a result, the few copper producers are likely to benefit from rising prices in the long term.

ReadCommented by Juliane Zielonka on January 10th, 2025 | 07:00 CET

Gold and security: Barrick, Desert Gold and Rheinmetall are profiting from geopolitical change

The global security landscape is changing rapidly, whether in the Middle East, on NATO borders, or in Asia. Savvy investors recognize the links between demand for commodities such as gold, technology and defense. One of the major gold producers, Barrick Gold, is receiving positive analyst evaluations and appears to be on a growth trajectory for 2025. The same is true for Desert Gold. The exploration and resource development company has discovered promising new gold deposits in Mali, West Africa, and has also raised the necessary capital for the next development phase. Meanwhile, Rheinmetall is strengthening the medical capabilities of the German armed forces. With state-of-the-art mobile rescue stations, soldiers will have access to care and support anytime. While gold producers and explorers are tapping into valuable precious metal resources, Rheinmetall provides the technology for a secure future. There is enormous investment potential for investors.

ReadCommented by Fabian Lorenz on January 9th, 2025 | 07:00 CET

Plug Power share price explodes! Golden times ahead for Siemens Energy and F3 Uranium?

The saying "those declared dead live longer" applies to the stock market - and seemingly to Plug Power. The hydrogen stock rose by almost 50% in the first few days of trading, although it has recently struggled to maintain this level. Is this the breakthrough, or is it going down again? Siemens Energy and F3 Uranium could be on the verge of golden times. Both are benefiting from the boom in data centres. In the past few days alone, billion-dollar investments have been announced in the US. To supply energy to the data centres for artificial intelligence, grids and nuclear power plants are needed. However, analyst sentiment is weighing on the price of Siemens Energy. In contrast, F3 Uranium appears ripe for a breakout from the sideways movement, with the potential for its stock to double.

ReadCommented by André Will-Laudien on January 7th, 2025 | 07:30 CET

Super Rally 2025: Artificial intelligence, crypto and the hunger for energy! TOP performance with MicroStrategy, XXIX Metal, BYD and Mercedes

The sudden cancellation of the government environmental bonus for e-vehicles at the end of 2023 has led to a significant drop in the number of electric vehicles being registered. However, interest in electric vehicles remains, albeit constrained, partly due to the high prices of many electric models. New government measures are expected to boost electric mobility again starting in 2025, with potential incentives of up to EUR 3,600 – though the implementation will likely only happen after the elections. What is being treated as an election promise for Germany has become the norm for the rest of the world. The increasing demand for energy driven by the electrification of various sectors, from high-tech and artificial intelligence to the crypto arena, which is even now being considered as a "reserve currency," highlights how quickly the world is changing in this disruptive environment. However, what all economic and political trends have in common is the need for access to strategic metals, especially copper! Where are the opportunities for investors?

ReadCommented by Stefan Feulner on January 7th, 2025 | 07:00 CET

MicroStrategy, Almonty Industries and XPeng make headlines

The markets continued to rise in the first trading week of the new year. The DAX has managed to climb past the 20,000-point mark. Bitcoin is also working on reclaiming the magical USD 100,000 mark. For some market experts, this is just the beginning of an unstoppable run for the world's largest cryptocurrency. Less covered in the media but significantly more critical is the Western world's focus on securing vital raw materials. One company is on the launchpad and could soar to new heights after production begins.

ReadCommented by Stefan Feulner on January 6th, 2025 | 07:30 CET

Lilium, Saturn Oil + Gas, D-Wave Quantum – Big opportunities in the new stock market year

Companies in the artificial intelligence sector were undoubtedly the stock market stars of the past stock market year, 2024. This trend will also likely remain in favour with investors over the next 12 months. In addition, quantum computing stocks have come to the fore in recent weeks, and some have multiplied. After a weaker year overall in 2024, oil producers will likely become interesting following the correction. The future US president, Donald Trump, strongly advocates for fossil fuels, prioritizing them far above alternatives like wind power or photovoltaics.

ReadCommented by Armin Schulz on January 6th, 2025 | 07:15 CET

Volkswagen undervalued! What about European Lithium and BYD?

Looking at the market for electric vehicles in Germany, the outlook seems bleak. However, taking a broader view, the global picture tells a different story. Battery production is also steadily rising, driving a growing demand for lithium. Currently, the lithium supply is still sufficient, but experts predict that by 2030 demand will exceed supply. The reason for this is not only the automotive industry but also the demand for energy storage for renewable energies. We take a look at three companies and their current situation.

ReadCommented by André Will-Laudien on January 2nd, 2025 | 07:20 CET

Uranium and defense – Rally expected in 2025! Renk, F3 Uranium, Hensoldt, Rheinmetall and thyssenkrupp in focus

After nearly 19% gains in 2024, many investors wonder whether such dream returns are repeatable in 2025. We believe so, although the growth will be selective. Stocks are no longer rising across the board; instead, they are rising due to their strength in the sectors or because of an extraordinary competitive position. Underperformers will still be abundant, and investors should, therefore, position their portfolios to weather the storm. There is a significant risk of a lower valuation in certain NASDAQ-listed stocks, which have already reached P/E ratios of over 40. One indicator of such exaggerations is the so-called Shiller P/E ratio. At 24.8, the MSCI World is currently well above its long-term average, mainly due to stocks in the technology and communications sectors, which are trading relatively well above their historical valuation median. The time has, therefore, come for a sector rotation – here are a few ideas.

ReadCommented by Fabian Lorenz on January 2nd, 2025 | 07:15 CET

MOMENTUM stocks for 2025: Rheinmetall, Bayer, Almonty Industries - Should you buy now?

Rheinmetall and Almonty Industries are entering the new year with momentum and are on the hunt for new all-time highs: Almonty is one of the strong performers in the commodities sector in 2024, and 2025 should be even better. The Company plans to bring the largest tungsten mine outside of China into production. Based on the explosion in sales and profits in the coming years, analysts see more than 200% upside potential. Things are also going well at Rheinmetall. The defense company plans to double its profit by 2027, suggesting the stock is not expensive. However, there is also potential for a setback. Unfortunately, Bayer experienced only downward momentum in 2024. Is a turnaround in sight for the once-largest DAX company?

Read