Mining

Commented by Stefan Feulner on February 25th, 2025 | 07:00 CET

Rheinmetall, XXIX Metal, Newmont – The Merz trade is on

The traffic light coalition is history. Chancellor Olaf Scholz suffered a shipwreck and achieved the worst election result for the SPD in the post-war period. The new strong man at the helm, CDU frontman Friedrich Merz, already stated in advance that Germany would support Ukraine even more strongly, which means that armaments companies are likely to be among the long-term profiteers. The price of gold also performed strongly afterwards, heading towards the USD 3,000 per ounce mark. Copper could also continue its turnaround, benefiting undervalued producers and exploration companies.

ReadCommented by Fabian Lorenz on February 24th, 2025 | 07:10 CET

BUY RECOMMENDATION for Hensoldt! TUI with 60% upside potential! Resource Gem Nova Pacific Metals!

Analysts have recently declared a supercycle for the European defense industry. Regardless of who will govern Germany in the future, billions will flow into armaments. One profiteer is Hensoldt. Despite the strong performance, analysts recommend buying the stock. Nova Pacific Metals also appears attractive. The explorer is sitting on a treasure trove of raw materials and has just expanded its territory. The hidden gem not only benefits from the gold supercycle but also from a wide range of raw materials. Positive news flow should drive the share this year. And what is TUI doing? Is the tourism supercycle really over? "No," says a board member and buys shares. Experts see a 60% price opportunity!

ReadCommented by André Will-Laudien on February 24th, 2025 | 07:00 CET

Chancellor election 2025 - now it is getting exciting! Explosive news at Palantir, D-Wave, European Lithium, and SAP

Germany has voted. With 28% of the vote, the CDU leaves the field as the winner. However, difficult coalition talks will now follow. Those expecting a lot of "change" may still be disappointed because many urgent topics do not seem urgent enough yet. How the CDU will proceed with the blocking parties will become an exciting topic in the coming weeks. The stock market experienced a slight dip on Friday, indicating that investors, accustomed to a bull market, are shifting to the safe side before the election results are clear. After all, as of Friday, around 30% of eligible voters were still undecided. Some stocks should be on the radar, as significant movements are expected.

ReadCommented by Juliane Zielonka on February 21st, 2025 | 07:00 CET

RWE, First Nordic Metals, and Siemens Energy: Europe's new energy independence is gathering pace

Germany is still feeling the effects of the sabotage of the Russian gas pipelines years later. Expensive energy costs are driving industry to the brink of ruin. Solutions are needed to bring the European country back to the forefront economically. Energy company RWE is setting a good example by launching large-scale battery storage systems in two cities that can provide energy for critical infrastructure within seconds. This project demonstrates how Germany is future-proofing its energy supply. First Nordic Metals is working to make Europe independent of raw materials and is conducting exploration projects with a focus on gold in Scandinavia. This precious metal offers a solid hedge, especially in times of crisis. Adam Cegielski, recently appointed president, strengthens the team with his 25 years of industry experience. Siemens Energy is banking on growth on the French coast: the Company is investing EUR 200 million to build offshore wind turbine rotor blades. This will not only create 200 new jobs but also send a strong signal for Europe's path toward energy independence.

ReadCommented by André Will-Laudien on February 20th, 2025 | 07:50 CET

DAX makes a decent correction – Gold sets its sights on the USD 3,000 mark! Caution advised with Palantir, Barrick, Desert Gold, Lufthansa, and TUI

After weeks of gains, the DAX 40 index saw its first noticeable correction yesterday. It rose to 22,935 in the morning, but by the evening, it had fallen to just 22,450. Hardly anyone had considered that the one-way street of rising valuations would eventually come to an end. Will the correction continue and perhaps go really deep? The opposite is currently true for gold. The inflation figures from the UK of a smooth 3% in January are causing the central bank to break out in a cold sweat. Adieu interest rate cuts – instead, gold is appreciating again and reached a new all-time high of USD 2,945. We look at the winners and losers. It is time to position yourself correctly.

ReadCommented by Juliane Zielonka on February 20th, 2025 | 07:20 CET

Rheinmetall, European Lithium, and Intel: Geopolitical tensions are shaping technology and commodity markets

The tensions between the US and Europe in the context of the Ukraine conflict are already showing far-reaching economic changes on both sides of the Atlantic. The EU is preparing an enormous EUR 700 billion aid package for Ukraine. Given this news, the share price of the German arms company Rheinmetall is continuing to rise. After breaking through the EUR 900 mark, analysts expect four-digit prices in the near future. Europe needs to become less dependent on raw materials. With the explorer European Lithium and its lithium property in Carinthia, Austria, this can be achieved step by step because the demand for the battery metal is unabated. On the other side of the Atlantic, semiconductor giant Intel is undergoing major restructuring: a possible split caused the share price to jump by 13%. This may enable Intel to regain its competitiveness against rivals such as AMD and Nvidia.

ReadCommented by Fabian Lorenz on February 20th, 2025 | 07:10 CET

Renk in a SUPERCYCLE! Elon Musk wants gold! USD 3,500 an ounce? Barrick off to a good start, but Globex Mining does better!

Will Renk shares soon reach an all-time high? The EUR 30 mark was broken yesterday. According to analysts, the defense stock will likely continue its FOMO rally. Like Hensoldt and Rheinmetall, the transmission manufacturer is in the supercycle. There is also news from Elon Musk. He wants to examine US gold reserves! This is once again leading to conspiracy theories – this time, the question is whether there is actually gold in Fort Knox. Meanwhile, experts see the gold price marching towards USD 3,500. The rally has now even reached the crisis-stricken Barrick Gold, with the stock climbing after recent announcements. Is all the bad news priced in? The stock of Globex Mining is performing significantly better than Barrick. And at the mine incubator, the price is being driven by positive newsflow. With its risk-diversified commodity portfolio, the stock still has potential.

ReadCommented by Armin Schulz on February 20th, 2025 | 07:00 CET

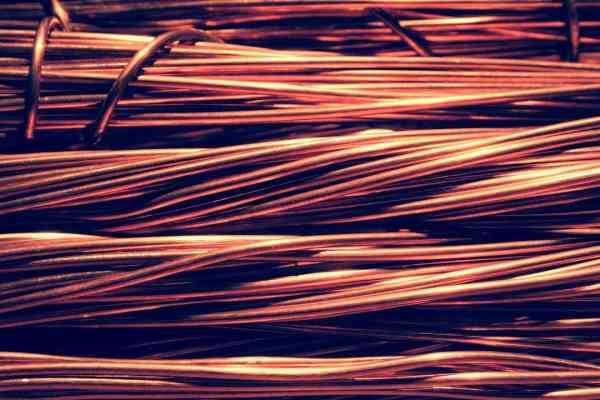

BYD, Benton Resources, Nordex – Copper Boom: The hidden treasure of the greentech industry

In a world balancing between climate targets and geopolitical tensions, three companies are working on the future of the energy and mobility transition and depend on critical raw materials like copper. While the 2025 German federal election is reigniting the debate on renewable energies – with demands for clear framework conditions for wind power and critical voices from the political arena – other players are pushing ahead with disruptive technologies. BYD showcases the future with AI-driven assistance systems. Benton Resources is unlocking key resources for green technologies like copper, nickel, zinc, and gold, and Nordex receives record orders despite uncertain markets. These companies have more in common than their focus on sustainability: they represent a new era of innovation in which strategic decisions made today determine tomorrow's competitiveness.

ReadCommented by Stefan Feulner on February 19th, 2025 | 07:50 CET

BYD, First Phosphate, AppLovin – Unstoppable

After the numbers season reached its peak last week, the US stock markets remained closed due to Presidents' Day, which is celebrated every year on the third Monday in February and honors the Presidents of the United States, particularly George Washington and Abraham Lincoln. Nevertheless, the markets were in turmoil, partly due to US Vice President J.D. Vance's speech at the Munich Security Conference. The Ukrainian index continued to rise on the back of expected peace talks between the US and Russia, while the DAX continued its record streak, surpassing 22,700 points.

ReadCommented by Armin Schulz on February 19th, 2025 | 07:35 CET

thyssenkrupp, Golden Cariboo Resources, Intel – Which comeback strategy will pay off?

In a world where raw materials are becoming scarcer, markets more volatile, and technologies more disruptive, companies face a threefold challenge: they must transform, innovate, and, at the same time, preserve their roots. This balance between tradition and the future currently shapes three publicly traded companies that could not be more different – yet all three have long histories to look back on. thyssenkrupp, a former industrial giant, is in the midst of a transformation. Golden Cariboo Resources, with its "Quesnelle Gold Quartz Mine," can trace its history back to 1865 and has recently presented exciting drilling results. Meanwhile, Intel, a semiconductor giant, is grappling with the aftermath of a technological sprint that has catapulted the industry into a new era.

Read