April 24th, 2025 | 07:10 CEST

Trump backs down! Investors rejoice with BYD, Power Metallic, Nio, and Deutz

The markets are in turmoil. "Fast market," shouts a trader as prices fluctuate by the second. With news coming in at such a rapid pace, investors' nerves are on edge. But for level-headed investors, there are now bargains to be had that were missing just months ago. However, the selection is not easy because international customs policy also plays a role alongside company balance sheets. If punitive tariffs of over 100% are not withdrawn, the automotive sector could even face a total market collapse. Consumers at the end of the chain will not want to and cannot pay the artificially inflated prices. The economy would inevitably collapse. We are looking at stable business models with medium-term opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , POWER METALLIC MINES INC. | CA73929R1055 , NIO INC.A S.ADR DL-_00025 | US62914V1061 , DEUTZ AG O.N. | DE0006305006

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

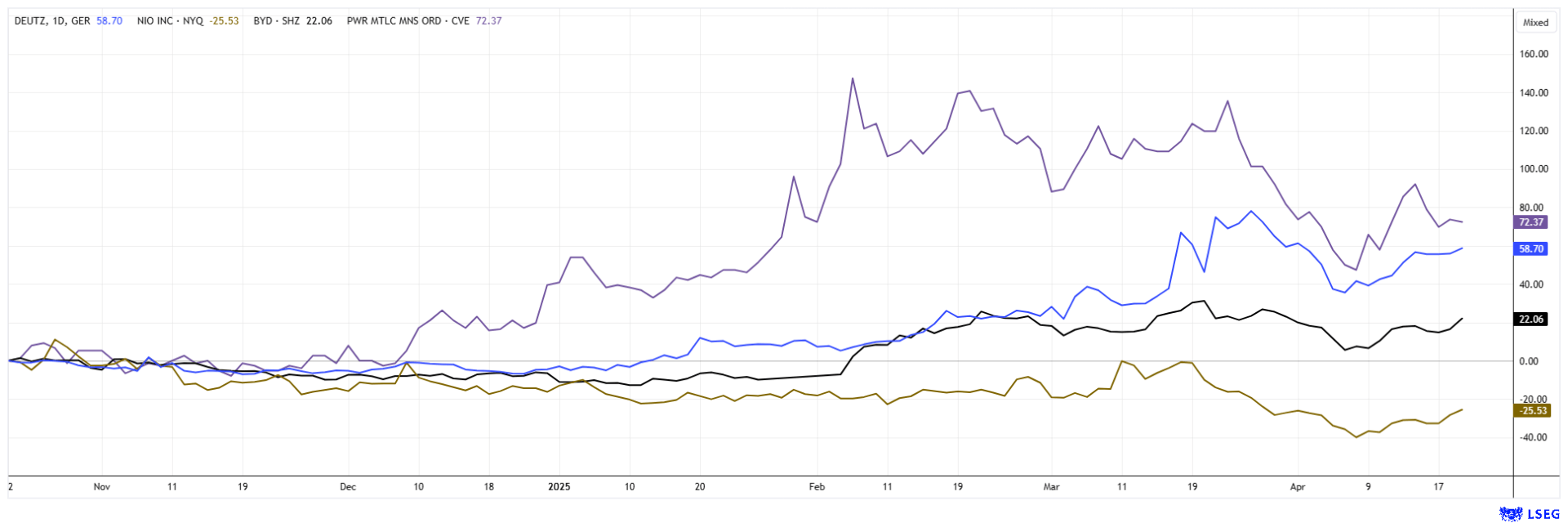

Deutz – A smooth doubling since October

As if straight out of a textbook, Deutz shares jumped after Donald Trump's election. Deutz is regarded as an international engine specialist for large machines. Starting from a 52-week low of EUR 3.70, the share price rose by a full 150% by March. This was naturally supported by the investment program from Berlin, from which the Cologne-based company also hopes to receive new orders. In the short term, defense fantasies even joined the fray. Deutz AG manufactures diesel, gas, hydrogen, and electric engines and is one of the world's leading independent producers of compact diesel engines in the 10 kW to 620 kW power range for road and off-road applications. As part of a strategic realignment, the Company is now positioning itself more strongly as a comprehensive provider of drive solutions. Through joint ventures, such as the cooperation with SANY, one of China's largest construction equipment manufacturers, Deutz is systematically expanding its market position in the Far East. With a share price of around EUR 6.65, the market capitalization is approximately EUR 915 million. This is not too expensive for expected revenue of around EUR 2.19 billion in 2025, especially since the earnings valuation is at a P/E ratio of just 10.7. Even after the revaluation, the Company is trading just above book value. Interesting!

Power Metallic Mines – Consolidation at a high level

Canadian resource explorer Power Metallic Mines has been among the best resource stocks on the Canadian stock market over the past 12 months. Its largest properties are multi-metal resources with very high grades. In an environment of extreme geopolitical instability, industrial producers are looking for a secure supply of strategic metals. With its properties, Power Metallic Mines could become an important supplier in the medium term, as the Nisk property provides the Canadians with numerous industrial metals and gold.

New drilling results from the winter program were published in April. These are four drill holes in the Tiger Zone. They tested off-hole EM anomalies originating from the previously reported drill holes PN-24-090 and 094. All drill holes encountered Lion-style polymetallic mineralization at shallow depths of 50 to 100 meters below surface. Power Metallic explored several zones during the 2025 winter drilling program, including the Lion Zone, the Nisk Zone, the Nisk East Zone, and the Tiger Zone. The winter drilling targets extend over an approximately 8 km strike length with favorable stratigraphy. Tiger is currently the smallest mineralized zone along the Nisk trend but has good potential for a significant polymetallic discovery. In the reported drill holes, PN-25-098 and 101 intersected weak mineralization consistent with Lion-style polymetallic mineralization. However, holes PN-25-099 and 102 intersected significant Lion-style mineralization.

CEO Terry Lynch commented on the results to date at Tiger: "Tiger is becoming increasingly interesting as a stand-alone project. It is not yet at the same level as Lion, but the latest results show clear promise. While operations are paused for the annual goose hunt, we are reviewing new drill data, re-evaluating geophysical data, and preparing Tiger, Lion, and our other zones for a six-rig summer program." The drill results from the remaining 20 holes completed during the 2025 winter program will be logged, sampled, and assayed in the coming weeks. After the rapid rise to CAD 1.95 in February, the PNPN share is now consolidating between CAD 1.30 and CAD 1.50. With good drilling results, the rally should pick up again soon. The environment for explorers has improved significantly with the recent gold rally to USD 3,500.

BYD and NIO – The conquest of Europe is in full swing

While VW struggles with the German framework conditions, international customs policy, and a backward e-strategy, Chinese manufacturers are quietly conquering the European market. The additional tariffs of up to 34% imposed by the EU are not really a problem, as the cost advantages far outweigh this price increase. With eight new models, BYD is now established on the German market, and despite import tariffs, all of its vehicles are still priced below European manufacturers. The technological standard is often so impressive that Chinese vehicles are also winning over customers at the point of sale. In March, BYD delivered 302,459 vehicles, an increase of 46% over the previous year. The forecast for BYD in 2025 is that the Company will sell 5.52 million vehicles, an increase of 25% over the previous year. However, the economic situation could have a negative impact. 31 analysts on the LSEG platform have given "Buy" ratings for the up-and-coming Asian company, with a 12-month average target price of 454 yuan, around 22% above the current trading price of 372 yuan. From 2026, BYD models will be produced in neighboring Hungary, which is exempt from EU tariffs, and then the cards will be reshuffled.

Start-up NIO is launching its compact electric vehicle, the Firefly, on EU roads. The Firefly combines NIO's technology and some key factors with the compact electric vehicle that markets such as Europe are demanding. The rapid rise of the Citroen E-C3 and Renault 5 E-Tech confirms that small and smart electric vehicles are in demand. Firefly will launch in China first. NIO aims to offer the Firefly in over 20 overseas markets by the end of the year. The market launch in the first European countries is scheduled for June to August. Rumor has it that Germany is planned for the fall, but NIO has not confirmed this. NIO shares fell to a 52-week low of EUR 2.75 in April but are now recovering well above EUR 3.40 on the back of the latest news. The Company is still in a loss-making phase and has not yet turned the corner. The risk is, therefore, high and only suitable for speculative investors!

**Volatility is the dominant factor on the stock market. From one day to the next, major indices can move by 5 to 12%. Who can keep a clear head in such a situation? This makes it all the more important to keep an eye on the quality of the selected stocks. Deutz is now back in business, and BYD and NIO are also growing strongly. Power Metallic has quintupled in the last 12 months and has yet to digest this revaluation. However, the consolidation should end soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.