Investments

Commented by André Will-Laudien on June 10th, 2021 | 11:34 CEST

Heidelberger Druck, windeln.de, NEL, Osino Resources - 100% machines!

These are fluctuations! It is not unusual that stock markets tend to caper near their highs. It is currently the order of the day for smaller, relatively insignificant stock exchanges to be traded with extreme price fluctuations in both America and Europe. Yesterday it was Heidelberger Druck and above all windeln.de, which increased about tenfold in 3 trading days. In the USA, the Reddit squeeze of AMC and GameStop is still going on. The shares of Clover Health took the cake yesterday with a 100% increase in one day. We focus on some of the protagonists of this sectoral bull market.

ReadCommented by Stefan Feulner on June 10th, 2021 | 11:00 CEST

AMC Entertainment, wallstreet:online, Nikola, Adler Modemärkte - What a feast!

Thousands of private investors join forces via online forums such as "WallStreetBets" on Reddit to buy shares in a concerted effort to destroy the business of hedge funds that sold the stock short. The phenomenon was first practiced with game retailer GameStop earlier this year. Now other papers shorted by the institutional investors followed, such as AMC Entertainment, Nokia and Blackberry. New opportunities are discussed daily on the forums. Due to the volatility of the stocks and the growing trade in meme stocks, mainly online brokers profit from the lively hustle and bustle.

ReadCommented by Carsten Mainitz on June 9th, 2021 | 10:41 CEST

SAP, RYU Apparel, Zalando - Do not miss it!

The Internet has turned our lives upside down and is now indispensable. According to a forecast by Statista, around EUR 2.37 trillion will be generated in the B2C e-commerce market with physical goods in 2023. According to this forecast, the fashion sector will account for the largest share of sales, at EUR 816.55 billion. The increasing importance of e-commerce is also reflected in the sales performance of global players such as Amazon. Be surprised by three exciting stocks.

ReadCommented by André Will-Laudien on June 8th, 2021 | 11:13 CEST

TUI, TeamViewer, White Metal Resources - Is the breakout to the upside coming?

Calm is different! Actually, with volatility well below 20, there should be a noticeable calm in the market. However, this is not the case. There is high turnover in individual stocks and sectoral movements as not seen for 20 years. The reason for this is the number of active shareholders and market participants willing to trade since the many lockdowns. No longer under the supervision of the bosses, one or two trading platforms are simply running along at home. This increases the depth of trading and turnover on the stock exchanges - and 95% of all speculators are trading long. The percentage of shareholders is also growing steadily; in 2021, it could approach 10% in Germany. We look at stocks with breakout potential.

ReadCommented by André Will-Laudien on June 8th, 2021 | 10:15 CEST

The Power of Digital Media - AMC, ProSieben, Tencent, Aspermont

Sell in May and go away...in 2021, it has not yet worked. The weather in June is much warmer and the markets are rushing from one all-time high to the next. The DAX reached a new high yesterday at 15,732. The mood was outstanding, especially when it came to vehicle values. However, the excesses were slightly slowed down at AMC Entertainment. Now that the Company has placed three capital increases, some calm has returned. We look at a few special situations in this advanced bull market.

ReadCommented by Nico Popp on June 8th, 2021 | 08:25 CEST

Deutsche Bank, Commerzbank, Sierra Growth: Of fast money and true values

Prices are rising ever more sharply. Industrialized countries have now surpassed even the emerging markets in terms of inflation. For banks, the current market phase is rewarding: investment banking has become a mainstay and the prospect of higher interest rates also gives hope for the bread-and-butter business. We look at why investors should nevertheless not bet on bank shares and what alternatives there are.

ReadCommented by Armin Schulz on June 7th, 2021 | 11:06 CEST

QMines, BioNTech, Beyond Meat - Stock pearls with a lot of potential

Commodity prices are rising, Corona is still a major theme and stock gambles, like AMC last week, are still working. As a resourceful investor, you have to do your research and ideally get an information edge over other investors. If you read a lot, you learn a lot and can often profit from it. Today we have picked out three stocks with a lot of potential - one from the commodities sector, another the Corona flagship and a chance on the next AMC.

ReadCommented by Carsten Mainitz on June 7th, 2021 | 10:45 CEST

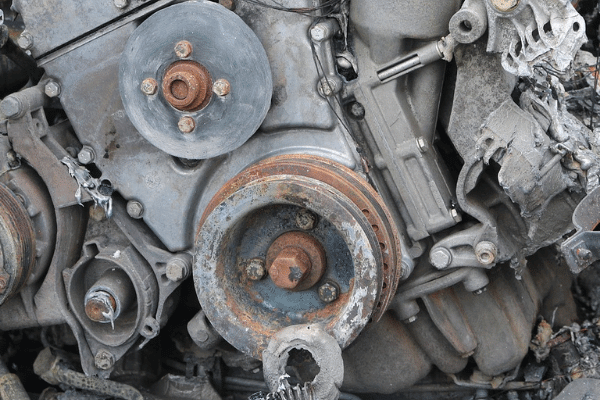

Mineworx Technologies, BASF, Nestlé - Circular economy investment idea

Everything is finite, every material and every raw material. Here is where the idea of a circular economy comes in. The aim is to develop a regenerative system in which resource use and waste production, emissions, and energy waste are minimized by slowing down, reducing, and closing energy and material cycles. The following three companies are all involved in the circular economy in different ways. Shareholders can also benefit from this.

ReadCommented by André Will-Laudien on June 2nd, 2021 | 11:05 CEST

Heidelberger Druck, Steinhoff, Adler Modemärkte, RYU Apparel - These penny stocks are exploding!

Whenever the stock market marks another high, investors think about which stocks might be "left behind." Sure, there are undervalued stocks, yet the market usually has good reasons why stocks are trading low or even in the penny stock range. Often, these are stocks that have reported very low figures or operate an uncompetitive business model. While DAX stocks were able to climb to new highs again yesterday, some stocks still lag or show interesting special movements. We take a closer look at a few stocks that fluctuated strongly.

ReadCommented by Armin Schulz on June 2nd, 2021 | 08:59 CEST

Aspermont, Commerzbank, SGL Carbon - Potential after renewal

Sometimes it is a gradual process, but sometimes it is a sudden event like the Corona pandemic. A company gets into trouble and the management has to develop strategies that will nevertheless lead the business into the future. But increasing efficiency and making quick decisions alone will not help. Ideally, business models should be checked for resilience early enough and not just when the tree is on fire. A realignment also always offers an opportunity. Today, we have taken a look at three stocks that are still in a state of upheaval but offer definite potential for your portfolio.

Read