Investments

Commented by Stefan Feulner on June 28th, 2021 | 12:07 CEST

Nel ASA, Mineworx Technologies, Volkswagen - The next stage ignited

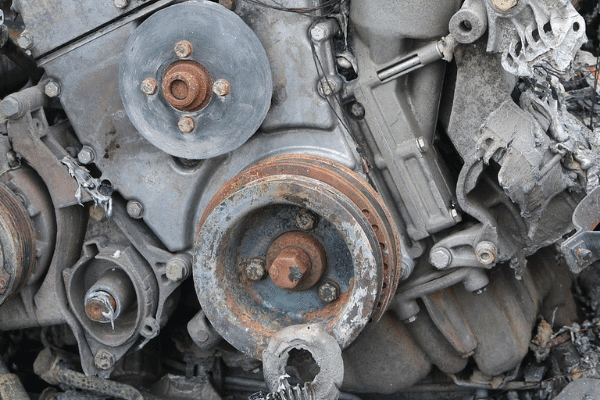

Without question, electric cars are the big winners of the mobility revolution. If Germany wants to meet the targets of the Paris climate agreement, CO2 emissions are to fall by at least 50% by 2030. This seals the slow farewell to combustion engines. But now, new problems are emerging concerning electromobility. In addition to the scarcity of the required raw materials, the issue of recycling the batteries and recovering the raw materials is coming up. Here, a market worth billions opens up with huge potential for the respective companies.

ReadCommented by André Will-Laudien on June 24th, 2021 | 15:51 CEST

windeln.de, Steinhoff, Mineworx Technologies - Can you believe it?

The capital markets are going in circles! A new round every day. Usually weak in the morning and up again in the evening as Wall Street rises. A never-ending game at absolute top levels. The slogan of the investment banks is "buy on any dips" because they naturally want to continue their business with the lucrative new issues. The pressure to refinance becomes stronger in an inflationary environment for companies because they first have to lay out preliminary products that have become expensive. Investors are therefore demanding more risk premium today than they were a few months ago. Once large stocks have taken off, investors are also turning their attention to smaller stocks. Penny stocks, in particular, are being moved back and forth with the help of social media slogans.

ReadCommented by Armin Schulz on June 23rd, 2021 | 12:21 CEST

Commerzbank, wallstreet:online, Volkswagen - What is the German stock market doing?

Last Friday, there was the so-called witches' Sabbath, and the DAX fell by over 300 points, but by Monday, the buyers returned. All signs point to economic recovery, also in the USA. The FED has announced that it does not intend to raise interest rates before 2023, despite inflation significantly higher than Germany. The European Central Bank has not yet announced anything about raising interest rates. They are trying to keep the economy going, and Mr. Draghi had tried to fan inflation for a long time but failed at the time. The ECB would undoubtedly like to see inflation of 2-3% over a more extended period, and that makes investing in stocks or other tangible assets still attractive.

ReadCommented by Nico Popp on June 22nd, 2021 | 15:02 CEST

JinkoSolar, Defense Metals, Gazprom: Values for the yield kick

The fight against climate change is an ideological issue in many places. That is why there are bitter opponents of the measures. But clean energy should be in everyone's interest - at least if it is profitable to produce. Many people rightly have reservations about pushing technology onto the market solely based on subsidies. History has shown that this creates the wrong incentives and even restricts the development of technology that could become established in the long term.

ReadCommented by Stefan Feulner on June 22nd, 2021 | 14:07 CEST

Steinhoff, Barsele Minerals, Bayer - This is explosive for the stock markets

Will the central banks change their direction, or will "the policy of cheap money" remain in place with unlimited bond purchases and zero interest rates to benefit growth? Last week, the markets were already caught on the wrong foot after the FED forecast two interest rate hikes for 2023. Then, the President of the St. Louis Fed, James Bullard, added even more salt to investors' wounds. He sees an accelerated tightening of monetary policy as a normal reaction to economic growth and rampant inflation in the wake of the economy's return from the Corona shock.

ReadCommented by Armin Schulz on June 21st, 2021 | 13:32 CEST

Royal Dutch Shell, Sierra Growth, Nel ASA - Stocks with increased profit opportunities

Since the markets have been climbing incessantly, it is not easy to find exciting stocks with potential. Most of the time, the ratios are already much too high, such as the price-earnings ratio (P/E) or the price-sales ratio (P/S). It is crucial to quickly detect new trends and get in on time before the party is over. In the coming week, an important date is coming up for the large US big tech companies. The House Judiciary Committee will vote on some anti-trust legislation. As a result, tech stocks should be cautious. Today we have picked out three stocks where we think profit opportunities are particularly promising.

ReadCommented by Carsten Mainitz on June 18th, 2021 | 15:10 CEST

MorphoSys, Biogen, Sierra Growth - What is next?

Pharmaceutical stocks are a bit like that: Giants like Johnson & Johnson or Novartis have an extensive product portfolio and can cushion failures of individual products quite well. It is often a matter of life and death for smaller, specialized companies with every development. Just yesterday, this could be observed in the CureVac share after its Corona vaccine candidate only achieved an efficacy of 47% in the clinical 2b/3 phase. Within a very short time, it disintegrated the stock price. Meanwhile, biotech pioneer Biogen surprised with an unjustified share price rally, which, however, could come to an abrupt end after a new setback. The situation is different for MorphoSys. Its planned acquisition of Constellation Pharmaceuticals initially weighed heavily on the share price, but it holds exciting potential. And the Canadian mining Company Sierra Growth is operating in a completely different environment; however, it has a top opportunity to offer in the current inflationary environment and should not go unmentioned.

ReadCommented by Nico Popp on June 18th, 2021 | 09:56 CEST

Adler Modemärkte, Steinhoff, Osino Resources: Which penny stocks have substance?

Penny stocks often have something disreputable about them - at least in Germany. As soon as a share is quoted at less than EUR 1 in Germany, it is considered to be at risk of insolvency. The reason for this is that the minimum nominal value of German stock corporations is EUR 1. Abroad, however, things are quite different: In Australia, it is not uncommon for shares to trade even below one cent. For investors who are used to this, it is anything but disreputable. In concrete terms, it all depends on the companies themselves anyway. We profile three companies that are either penny stocks or were, not long ago.

ReadCommented by Nico Popp on June 17th, 2021 | 13:52 CEST

Daimler, Mineworx Technologies, BASF: Investing in the mobility revolution

The world keeps spinning - faster and faster, it feels. New technology is causing certain industries to rethink. Electromobility is one such catalyst: mining companies and companies from the chemical industry and other suppliers must prepare themselves because soon, most cars will run on batteries. There are great opportunities here - for carmakers who are on their toes and for resourceful experts in the field of recycling.

ReadCommented by Carsten Mainitz on June 15th, 2021 | 11:29 CEST

Aixtron, Aspermont, LPKF - Starting signal for further price gains

The general conditions on the capital markets remain positive in the short-term perspective. An excess of liquidity, government aid and support programs, and progress in combating the pandemic means that critical factors such as the massive rise in inflation are fading into the background. When things are going well, they go well. So why not bet on stocks in the uptrend that have recently delivered excellent news and with which investors can undoubtedly outperform the market? We present three promising stocks. Who is winning the race?

Read