Drones

Commented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Armin Schulz on December 4th, 2025 | 07:20 CET

Take advantage of the panic: Why buy Rheinmetall, Almonty Industries, and DroneShield now?

A sharp drop in share prices is shaking the defense industry. Triggered by short-term hopes for peace, the markets are ignoring the unchanged robust fundamentals: bulging order books and rising global defense budgets. This discrepancy opens up strategic entry opportunities. Three key companies, artillery and vehicle manufacturer Rheinmetall, critical raw materials supplier Almonty Industries, and drone defense specialist DroneShield, are in focus and stand to benefit from sustained demand.

ReadCommented by André Will-Laudien on December 3rd, 2025 | 07:30 CET

Gold, drones, and specialty glass! Just like that, 200% gains out of nowhere with DroneShield, AJN Resources, and Gerresheimer

The stock market is showing its volatile side. While AI, defense, and tech stocks are consolidating, gold and silver are skyrocketing. Sector rotation is therefore in full swing at the end of the year. It is time to take a closer look at some notable movements, because every bull and bear market contains the seeds of the next reversal. DroneShield up 1,000% and then down 75%, AJN Resources suddenly up 200% from a standing start, and Gerresheimer, a fallen angel down 60%, a battered member of the German SME sector. We take a closer look at these stocks – where is it worth taking action?

ReadCommented by Armin Schulz on December 3rd, 2025 | 06:55 CET

Benefit from the megatrends of electrification, AI, and security with BYD, NEO Battery Materials, and DroneShield

The next technological revolution is unfolding not only on the roads, but also in the air and in data centers. Outstanding high-performance batteries that offer more energy, faster charging times, and maximum safety are driving this development far beyond the automotive industry. They are fueling a race for the optimal cell chemistry and opening up great opportunities in future markets such as artificial intelligence, robotics, and defense. This momentum is strengthening electric vehicle market leader BYD, Canadian battery specialist NEO Battery Materials, and drone security expert DroneShield.

ReadCommented by Fabian Lorenz on November 28th, 2025 | 15:40 CET

Takeover of Puma? Buy DroneShield and Antimony shares now?

A bombshell at Puma! Takeover rumors surrounding the sporting goods group are gaining momentum again. The share price exploded by over 14% yesterday. Could there even be a short squeeze? Commodity investors take note. Antimony Resources has established itself among investors this year, celebrated operational successes, and its shares still appear to be inexpensive. In the latest report, the resource estimate for the antimony project in North America was doubled. The potential for this critical metal is expected to be finalized as early as the first quarter of 2026. With an order in the bag, DroneShield's stock gained more than 20% this week. A rebound or a new upward trend?

ReadCommented by André Will-Laudien on November 25th, 2025 | 07:35 CET

Trump makes peace – Maybe? Strong profit prospects for BYD, Pasinex Resources, and DroneShield

In the daily battle for returns, selecting the right assets is becoming increasingly complex. Markets have risen sharply despite the generally sluggish sentiment in global economies. First, there was the celebration of Donald Trump, then the bull market due to lower-than-expected tariffs, and most recently, a super rally in AI and high-tech stocks. Defense and armaments stocks have also been consistently on the shopping list for two years now. After 25 years of disarmament and a 180-degree political shift among left-green parties, defense has suddenly become the cure-all for Western societies. For years, frowned upon and subject to lawsuits in Germany's Constitutional Court, arms exports now appear to represent the highest ethical stage a company can reach. But now a taboo word is making the rounds: "peace." And with that, defense stocks are once again treated like clearance items, and prices are falling. A politically fueled boom and bust cycle at its finest. Rheinmetall is now even included in ESG-oriented funds - what a farce. Very few can still see clearly through this nine-lane highway of contradictions, but we are here to help.

ReadCommented by Fabian Lorenz on November 24th, 2025 | 07:30 CET

MAJOR SHAKE-UP and 300% upside potential! DroneShield, SMA Solar, Planethic Group

A company is valued at EUR 10 million on the stock market, yet analysts expect revenue of more than EUR 100 million in 2027. The analysts' price target is more than 300% above the current price level. This is the current situation at Planethic Group (formerly Veganz Group). On Friday, the CEO was dismissed. Is this the turning point the share has been waiting for? Shareholders at DroneShield are also hoping for a rebound. The investor favorite has suffered a nightmare week with a share price drop of more than 40%. How did this happen, and what can we expect next? SMA Solar, on the other hand, has pulled off a textbook turnaround. In less than three months, the stock has doubled. Following the quarterly figures, analysts have raised their price targets.

ReadCommented by Fabian Lorenz on November 21st, 2025 | 07:20 CET

DroneShield crashes! TeamViewer and UMT with AI fantasy!?

DroneShield shares are also currently under heavy pressure! The stock of the drone defense specialist is being dropped hard by the stock market. Is this justified, or is now the time to get in? After Nvidia's convincing figures, the AI rally continues. A German newcomer in this field is UMT United Mobility Technology. The Company is currently reinventing itself entirely and aims to save companies time and money with its "AI colleague." And what is TeamViewer doing? An AI agent is set to give the software stock new momentum. But analysts and investors are reacting cautiously.

ReadCommented by André Will-Laudien on November 19th, 2025 | 07:40 CET

Gold above USD 4,000, Bitcoin and NASDAQ reeling! Formation Metals on the rise, panic at Metaplanet and DroneShield

A few weeks ago, the US government declared a state of emergency over critical metals. This triggered a massive run on all stocks related to strategic metals such as rare earths, uranium, and lithium. The announcement also proved decisive for the gold and silver markets, which have been setting new all-time highs since October before recently entering a consolidation phase. At the start of the week, buying interest in gold and silver returned, while former tech high-flyers like Metaplanet and DroneShield suffered heavy losses. For investors, the current panic across parts of the tech sector could present an opportunity. Commodity markets have been dormant for years and are now being flooded with unprecedented amounts of capital. Where should investors position themselves now?

ReadCommented by Nico Popp on November 19th, 2025 | 06:00 CET

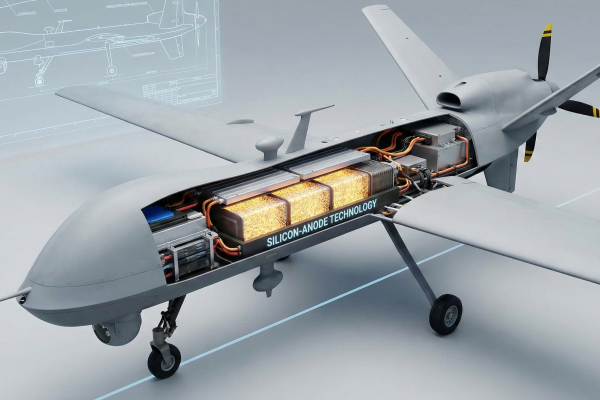

New developments in drones – Is a growth spurt on the horizon? NEO Battery Materials, LG Chem, Albemarle

The war in Ukraine has triggered a boom in micro drones – and with it, a surge in demand for specialized battery technology. Ukrainian forces are increasingly relying on swarms of low-cost mini drones to counter larger unmanned combat aerial vehicles (UCAVs), such as Iranian Shahed drones. Several trends are emerging here for investors: demand for high-performance small drone batteries is soaring, while stable supply chains free of geopolitical risks are becoming more critical than ever. This is precisely where the up-and-coming company NEO Battery Materials comes into play.

Read