AI

Commented by Nico Popp on February 3rd, 2026 | 07:00 CET

Crash as a reality check for AMD and First Majestic: Why silver and AI are correcting while Almonty stands firm on rising tungsten prices

Market sentiment has shifted sharply in recent weeks: what began as profit-taking has developed into a real stress test for investors' nerves. The sectors most celebrated in recent months – AI stocks and precious metals – have taken a beating. Yet amid this turmoil, one phenomenon is emerging that should make investors sit up and take notice: the tungsten market is completely decoupled from the crash and, seemingly immune to Wall Street panic, is hitting new highs. Tungsten, the indispensable backbone of Western defense and heavy industry, is becoming more expensive while almost everything else is falling. In this environment, Almonty Industries is emerging as a quasi-monopolist with excellent prospects to deliver long-term gains for its shareholders.

ReadCommented by Fabian Lorenz on February 2nd, 2026 | 07:45 CET

Plug Power under pressure! 2G Energy and the AI BOOM! 100% PRICE POTENTIAL for A.H.T. Syngas shares!

Analysts see over 100% upside potential for A.H.T. Syngas shares. Experts believe the company is on the verge of a growth spurt. The market potential for synthetic natural gas substitutes from biogenic residues is huge. In addition, the company is in the process of transforming itself from a pure plant manufacturer to an energy producer. While A.H.T. is only worth around EUR 10 million on the stock market, 2G Energy is already worth EUR 600 million. This is also raising shareholders' expectations. The latest order intake failed to provide any impetus, with everyone waiting for news from the US. There is currently a sense of alarm at Plug Power in the US. At an extraordinary general meeting, shareholders are to decide on the future of the hydrogen specialist. The postponement of the event is causing uncertainty.

ReadCommented by Fabian Lorenz on January 30th, 2026 | 09:00 CET

DroneShield disappoints! Plug Power fights for survival! American Atomics stock poised for an overdue rally?!

Tech analyst Pip Klöckner paints a clear picture for 2026: he expects NVIDIA CEO Jensen Huang to become the world's most influential energy lobbyist. Without additional, reliable energy, data centers cannot operate - and without data centers, no one will buy NVIDIA chips. Meta is already fully committed to nuclear energy, underlining how critical stable baseload power has become in the AI race. American Atomics stands to benefit from this development. After all, uranium is needed regardless of who builds the nuclear power plants or ultimately wins the AI arms race. Importantly, American Atomics is developing several promising projects directly in the United States. The AI-driven energy boom has also lifted hydrogen stocks in the past, including Plug Power, but the euphoria has faded, and the Copmany is now fighting for survival. And what about DroneShield? The drone defense specialist's shares have taken a sharp hit in recent days. Was the sell-off triggered by the latest quarterly figures, or is something else at play?

ReadCommented by Armin Schulz on January 30th, 2026 | 07:35 CET

Electromobility needs graphite just as much as AI needs energy – a closer look at BYD, Graphano Energy, and Intel

The energy transition will reach a critical point in 2026: storage facilities will become systemically important infrastructure, driven by electromobility and the exploding demand for electricity from AI. This boom is driving demand for high-performance batteries and essential raw materials such as graphite to unprecedented heights. Anyone who wants to identify the structural winners of this megatrend should keep an eye on three key players: e-mobility pioneer BYD, raw materials specialist Graphano Energy, and chip giant Intel.

ReadCommented by Armin Schulz on January 26th, 2026 | 07:00 CET

The strategic move – How American Atomics is securing fuel for the AI age

Artificial intelligence is changing our world, but its enormous appetite for energy threatens to push power grids to their limits. Tech giants are faced with the fundamental question of how to reliably supply data centers with clean electricity. Data centers will soon consume double-digit percentages of total electricity. The answer leads directly to a renaissance of nuclear energy. But this restart has a sore spot: the fragile global fuel chain. American Atomics is positioning itself in this gap between exploding demand and scarce supply with a clever two-pronged approach.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

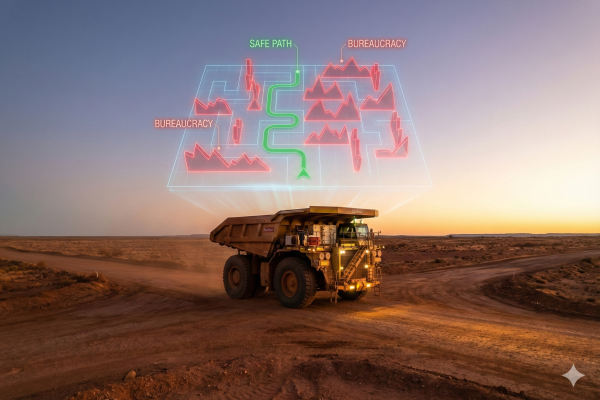

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Fabian Lorenz on January 22nd, 2026 | 07:00 CET

Winner of the AI boom! RE Royalties shares jump and offer a dividend yield of over 10%!

This stock has finally broken through. We have repeatedly highlighted the pent-up potential at RE Royalties in recent months. The Company stands out with a diversified business model in the renewable energy sector, with a significant portion of its activities based in the United States. Driven by the AI boom, energy production capacities equivalent to more than half of Germany's total electricity consumption will have to be connected to the grid in the US over the next two years alone. RE Royalties is well-positioned to benefit from this development. And if that still is not enough to make the case, the dividend yield is currently above 10%.

ReadCommented by Nico Popp on January 22nd, 2026 | 06:55 CET

AI and the uranium comeback: How American Atomics is becoming the winner of the energy transition and what that has to do with Meta Platforms and Infineon

The era of artificial intelligence (AI) is not only an era of enormous productivity gains, but above all an era of infrastructure and gigantic energy consumption. While the last decade was dominated by software, the future will be all about hardware. Generative AI and the path toward artificial general intelligence (AGI) are transforming data from an intangible asset into a massive consumer of power. Analysts at Goldman Sachs estimate that investments by major US tech companies in energy infrastructure could reach the astronomical sum of over USD 500 billion by 2027. This new reality is forcing a two-pronged energy strategy: on the one hand, the massive expansion of storage and efficiency technologies, and on the other, the inevitable return to the only CO2-free energy source that reliably provides base load – nuclear power. We explain what tech titan Meta Platforms and chip manufacturer Infineon have to do with this development and why American Atomics is considered a highly speculative but strategically brilliant bet on the uranium comeback.

ReadCommented by Fabian Lorenz on January 19th, 2026 | 07:05 CET

Undiscovered energy stock for the AI boom! CHAR Technologies set for breakthrough in 2026!

In 2026, investors are once again rushing to buy energy stocks that are benefiting from the AI boom in the US. Bloom Energy, for example, has already exploded by over 50% in the early part of the year. However, with a value of USD 35 billion, the Company is anything but a bargain. CHAR Technologies is still an undiscovered gem in this sector. The Canadians produce coal and gas substitutes from waste materials. Research is no longer being conducted; instead, production is taking place on an industrial scale this year. The stock appears to be far too cheap and should take off in 2026.

ReadCommented by Fabian Lorenz on January 16th, 2026 | 07:15 CET

ENERGY decides the AI race between the US and China: Siemens Energy, Oklo, and American Atomics stand to benefit

The race between the US and China for superior artificial intelligence (AI) is in full swing. More and more experts expect that the winner will not be decided by semiconductors from NVIDIA & Co., but by something much simpler: who has the cheapest energy! As a result, the US is investing heavily in nuclear energy. Old reactors are being brought out of retirement, and new ones are to be built in record time. It is therefore not surprising that Siemens Energy's stock outperformed NVIDIA and Alphabet last year. Can the DAX-listed company continue this performance? Oklo and American Atomics are also among the beneficiaries. Who is cheap?

Read