Comments

Commented by Nico Popp on May 3rd, 2021 | 07:25 CEST

BioNTech, CureVac, Cardiol Therapeutics: In on the next blockbuster from the start

The two German companies BioNTech and CureVac, have been causing quite a stir since the outbreak of the pandemic. At first, the biotech newcomers were known only to hard-nosed investors who are used to seizing long-term opportunities and accepting initial uncertainty to do so. Even during the first months of the pandemic, it was far from clear whether BioNTech and CureVac would be successful. Only a few insiders had the right instinct early on thanks to the necessary background knowledge and are pleased with BioNTech's annual performance of 260%. But what characterizes the success of innovative biotech companies? And where are the next opportunities lurking? We outline some exciting investment stories.

ReadCommented by André Will-Laudien on May 2nd, 2021 | 19:04 CEST

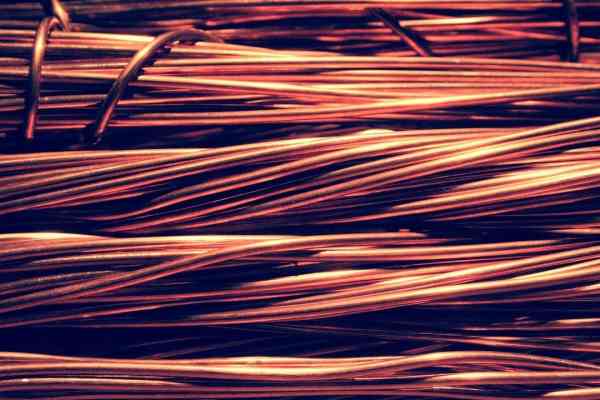

BYD, NIO, Varta, Kodiak Copper: No e-mobility without copper!

The copper price is just about to climb the USD 10,000 mark. For many market participants, the scenario for the industrial metal is set. Because since the public declaration of the automotive industry to make the e-vehicle the No. 1 means of transportation, the demand for copper and battery metals is shooting through the roof. Mine operators worldwide are alarmed, but how do you increase capacity in the short term when there are too few developed projects? We dive into the market.

ReadCommented by Stefan Feulner on May 2nd, 2021 | 18:54 CEST

Aixtron, SunMirror, Everfuel - Emergency braking for electric mobility!

The chip shortage triggered by the blow-up of supply chains due to the Corona lockdowns is hitting the automotive industry with full force at the moment. Daimler has already had to put thousands of employees on short-time work at its plants in Rastatt and Bremen. The situation is similar at VW and even at the Korean carmaker Hyundai. The procurement of the necessary raw materials, caused by the increased demand due to the energy transition, will also be a considerable challenge in the future, not only for the electric car industry.

ReadCommented by Armin Schulz on April 30th, 2021 | 08:40 CEST

Nvidia, NSJ Gold, Coinbase - How to counter inflationary pressures?

Historically, tangible assets have performed poorly compared to equity investments. According to a Bank of America study, that may now be starting to change. The constant printing of money is fueling inflation. Tangible assets such as real estate, precious metals or collectibles are suitable as a hedge against inflation. While the first two categories are self-explanatory, there are new categories, especially in collectibles. The familiar areas are wine and art objects. Recent additions are cryptocurrencies, first and foremost Bitcoin, of course. In the course of this hype, high-performance graphics cards have also become rare. These are now traded at more than double the recommended retail price. So today, we take a look at Nvidia, NSJ Gold and Coinbase.

ReadCommented by Nico Popp on April 30th, 2021 | 08:40 CEST

BASF, Saturn Oil & Gas, K+S: Three stocks for a yield kick

Investors who want to add a few yield drivers to their portfolio have several options. In addition to solid blue chips, which offer little share price excitement but steady dividends, investors can also focus on growth stocks and small caps. Although there are always those who categorically rule out growth stocks for cautious investors, this is not entirely true. Those who control risk via position size can also invest speculatively without having to abandon their fundamental strategy.

ReadCommented by André Will-Laudien on April 29th, 2021 | 19:10 CEST

Newmont Gold, Sibanye-Stillwater, Troilus Gold, NEL - Invest selectively in quality!

After such an extended bull market as we have experienced in the last 3 years, it is difficult for some investors to separate the wheat from the chaff. There are long-term fundamental trends, so-called megatrends such as digitalization or e-mobility, and currently also mining. Here, the medium-term parameters coincide with critical economic trends. But then there are also short-term, so-called hyped trends about which it can be argued how long they will last. While crypto attracts additional money, the hydrogen hype is already breaking off - and again, an important criterion comes to light: Timing!

ReadCommented by Carsten Mainitz on April 29th, 2021 | 09:03 CEST

ThyssenKrupp, Defense Metals, Rheinmetall - Equipment for the portfolio

Every day, in our private and professional lives, we ask for products and services. And we expect "it" to work. When things do not go as planned for an extended period of time - and this does not necessarily mean a global pandemic that paralyzes supply chains - we feel the effects. In the following, we take a look at two areas that are essential for us: Energy and critical raw materials. We also have three pearls of return for your portfolio.

ReadCommented by André Will-Laudien on April 29th, 2021 | 08:57 CEST

Deutsche Bank, Heidelberger Druck, Steinhoff International, Desert Gold - The turnaround is coming!

Besides the leading stocks, there is always a market on the stock exchange for smaller and neglected stocks. Often, these stocks are awakened completely by chance, e.g., because a competitor company delivers good figures. Yesterday, the good figures of Deutsche Bank immediately pulled the whole sector up; even the boring Commerzbank was able to gain 3% at the peak. Good old Deutsche shot the bird with plus 11%, a long-awaited reawakening. From a chart perspective, the way would be clear from around EUR 11.30. But there are other stocks that should be put back on the radar.

ReadCommented by Armin Schulz on April 29th, 2021 | 08:52 CEST

First Majestic, Silver Viper, Nordex: Silver only at the beginning?

The printing presses keep running and that fuels the fear of inflation. The precious metal silver is currently showing strength, even against gold. Why is that? Silver has always been an important raw material for industry, but since the hype around e-mobility and renewable energies, more is needed. There are also initial successes reported in the use of silver in rechargeable batteries. At the University of California San Diego, a silver oxide-zinc battery has been developed that has 5-10 times the power of a lithium-ion battery. The manufacturing process is inexpensive and scalable. The automotive industry alone projects a 40% increase in silver demand by 2025, an excellent reason to take a closer look at stocks in these sectors.

ReadCommented by Stefan Feulner on April 29th, 2021 | 08:47 CEST

NIO, Deutsche Rohstoff, BP - Demand is exploding!

The massive inventory overhang, which still existed on the oil market last year and led to the crash due to the Corona pandemic, will be used up by the second quarter of 2021. With vaccination programs well underway and the economies of China and the United States recovering quickly, further demand is rising rapidly. Currently, it looks more like a fundamental supply deficit of black gold, with rising prices in the coming months. Experts already foresee a supercycle with oil prices just below USD 200 per barrel.

Read