Comments

Commented by André Will-Laudien on May 11th, 2021 | 10:45 CEST

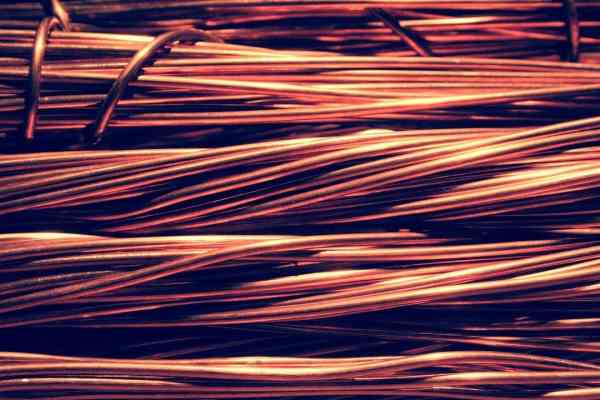

Varta, NIO, Standard Lithium, QMines: Total Copper Boom - Watch out!

Availability of copper is one of the bottlenecks in electromobility. Its price hit a new record high last week at USD 10.445 per ton. Other commodities such as iron ore and uranium have also been in high demand recently. There are reasons for the price boom on both, the demand and supply side. Demand is currently highly driven by the prospect of rapid economic improvement. The accelerating rate for Corona vaccinations gives hope for fewer restrictions and an upturn in economic activity. Supply is currently unable to keep up, especially for technological commodities such as copper, nickel and lithium. We take a look at key industry players.

ReadCommented by Stefan Feulner on May 11th, 2021 | 10:12 CEST

BYD, Silkroad Nickel, Volkswagen - Exciting development in the electric car industry!

So far, the development of the electric car industry has been trouble-free, the sales figures of e-car manufacturers have skyrocketed and the displacement of combustion engines seemed to be only a matter of time. But currently, the first major obstacle is approaching producers. The chip shortage is leading to production stops and short-time work. The issue of scarcity is likely to become the dominant theme of this industry over the next few years. Raw materials for production such as lithium, nickel or cobalt are scarce commodities. The primary beneficiaries of this development are the raw material producers, who are already barely able to meet demand.

ReadCommented by Armin Schulz on May 10th, 2021 | 12:20 CEST

White Metal Resources, Newmont, Bitcoin Group - Fighting inflation with gold and bitcoin

Physical assets are an option investors should consider if they want to protect their money. However, investors should be very careful not to equate or even confuse inflation protection with expected returns when it comes to assets. In this regard, today, we would like to take a closer look at the conservative gold and the more speculative bitcoin. While gold was able to break free from the consolidation last Friday and should now continue to rise, bitcoin has not yet been able to close the gap between April 16 and 19. However, the upward trend in Bitcoin is intact. Today we present attractive paper investments in these asset classes.

ReadCommented by Carsten Mainitz on May 10th, 2021 | 11:47 CEST

Glencore, NSJ Gold Corp., Millennial Lithium - Inflation fear?

In March, prices in the US increased by 0.6% compared to the previous month. The rate of inflation was 2.6%. The reason is bottlenecks in production as well as in transportation, but also rising raw material prices. Economists at Commerzbank have come to this conclusion. Contrary to the Fed's historical policy of halting rising inflation by raising interest rates, Federal Reserve Chairman Powell has reiterated that there are no intentions to curtail loose monetary policy in light of the current difficulties in the Corona pandemic. In general, companies in the commodities and precious metals sectors benefit from an (expected) increase in inflation. Industrial metals and critical commodities with a specific demand and supply situation are worth a closer look. Likewise with precious metals stocks, which often serve as leverage for the "shiny crisis currencies." Here are three investment ideas. Who is making the running?

ReadCommented by André Will-Laudien on May 10th, 2021 | 11:10 CEST

VW, BYD, Plug Power, Almonty - The e-mobility breakthroughs!

Driving electric vehicles is becoming more and more popular! The Volkswagen Group delivered 133,300 electrified vehicles in the first quarter - more than twice as many as in the previous year, as the Wolfsburg-based Company points out. 59,900 buyers (+78%) opted for a fully electric vehicle, while plug-in hybrid drive models still lead the way, reaching sales of 73,400 units (+178%). Tesla, the self-proclaimed e-mobility technology leader, only managed 499,550 vehicles in the whole of 2020 (+36%). What does this mean for the manufacturers' shares?

ReadCommented by Nico Popp on May 10th, 2021 | 09:40 CEST

Ballard Power, Varta, Defense Metals: This trend is still in its infancy

All investors want to invest in the future. But what does this future look like? For many private investors, hydrogen was the topic of the future for many months. But hydrogen investors are now pretty much left out in the cold. Car manufacturers have turned their attention to battery cells, and there are other opportunities for investors to profit from the technologies of the future. But what about the current representatives of hydrogen technology? Are the opportunities for entry favorable right now? Or should investors take to their heels?

ReadCommented by Stefan Feulner on May 10th, 2021 | 09:14 CEST

CureVac, Cardiol, MorphoSys - Huge sensation in the fight against Corona!

The biotechnology sector gained tremendous attention since the start of the Corona pandemic. With vaccine makers such as BioNTech or Moderna, investors have achieved returns beyond 1000% since the end of 2019. Currently, drug research against Sars-CoV-2 is in full swing. More effective and safe drugs along with vaccination and testing strategies are critical to managing the pandemic. For investors, this meant a second chance at the next tenbagger.

ReadCommented by Nico Popp on May 7th, 2021 | 15:24 CEST

Volkswagen, Daimler, dynaCERT: Which share can increase fivefold?

The mobile future is electric. But how sustainable is that? Millions of vehicles with combustion engines are intact and doing their job - whether for the daily commute or as a "family car" for occasional shopping trips or outings. Cars needed for infrequent but long journeys, or cars generally only used very rarely, are too good for the scrap yard from an economic and ecological perspective. A company from Canada offers a solution for this. We analyze where the opportunities for investors are greatest.

ReadCommented by Armin Schulz on May 7th, 2021 | 13:11 CEST

Kodiak Copper, BASF, Varta - Copper study ignored

The International Copper Study Group (ICSG) sees a slight oversupply of the copper market in 2021 and 2022. The main reason for this is said to be dwindling Chinese demand. The demand is decreasing because China is expanding mine production and copper refining by about 3% each. After the study's publication, the price per ton of copper rose again to over USD 10,000. Possibly driven by the news from Chile, which produced 2.2% less copper than last year. Similar news can be heard from other major copper producing countries such as Peru. Copper concentrate supply is low at the moment. We, therefore, look at one copper explorer, one copper producer and one consumer.

ReadCommented by Carsten Mainitz on May 7th, 2021 | 12:30 CEST

Nordex, RYU Apparel, Encavis- Big picture and buy signals

When the macro environment on the stock exchanges, including the sector situation, is stable or positive and individual stocks with intact growth prospects correct sharply, good opportunities can open up. If, in addition, the fundamental data fit and the chart technique does not contradict itself, the ingredients for a successful trade are present. We present three companies where an entry currently appears very tempting.

Read