November 18th, 2025 | 07:25 CET

Nvidia figures ahead, AI correction looming? Doubling alternatives include Planethic Group, Bayer, Eli Lilly, and Novo Nordisk

It does not always have to be Nvidia! If the current level of risk on the NASDAQ feels a bit too high, investors should take a look at some European gems. There may be less AI involved here, but people still work for people. This is particularly interesting as Elon Musk aims to equip the core zone of human interaction with humanoid robots, from cooking together in the kitchen to family life, which could receive "digital offspring" as early as 2027. Because the planet will soon face food and water shortages due to permanent overheating, we are taking a closer look at completely analog topics such as alternative nutrition and the prevention of obesity. This is certainly too boring for the disciples of the digital apocalypse, but it offers plenty of charm for non-digital investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , PLANETHIC GROUP AG | DE000A3E5ED2 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer – That sounds quite conciliatory

After a three-year downward trend, investors were eagerly awaiting Bayer's Q3 figures. The Leverkusen-based company delivered, slightly exceeding expectations with an adjusted sales increase of 1%, and a 21% higher EBITDA before special items. Management confirmed its annual forecast but raised the expected special items related to the pending glyphosate lawsuits for EBITDA and EBIT by a total of EUR 750 million. The Crop Science division performed particularly well, with its EBITDA margin up 3.6 percentage points year-over-year. This improvement is due to both efficiency gains and temporary effects from inventory reductions. Revenue in the pharmaceuticals business remained stable, as strong growth in Nubeqa and Kerendia offset declines in Xarelto and Eylea. Despite the reassuring figures, only 7 out of 22 analysts on the LSEG platform currently recommend Bayer for their portfolios. The mixed 12-month target price is EUR 29.20. After briefly touching the EUR 30 mark, it slipped back to EUR 27.90 at the start of the week. Nevertheless, the challenging bottoming-out phase between EUR 18 and EUR 24 now appears to be over. Following ongoing restructuring, Bayer is trading at a compelling 2027e P/E of 5.4. Time to buy!

Planethic Group – FoodTech becomes a growth engine

Investors should take a closer look here! The development of Veganz into today's Planethic Group is a prime example of how a pioneer in plant-based nutrition can transform itself into a technology-driven FoodTech company. The founders, Jan Bredack and Juliane Kindler, were still pursuing purely vegan product ideas in 2011 and later set up their own production facilities for cheese alternatives, algae salmon, and cashew camembert. However, when the retail business became unprofitable in 2017, the Company increasingly shifted its focus to its own brands, patents, and industrialization.

Mililk®, a 2D-printed milk alternative, ultimately became a strategic core product that is now considered a key growth driver. This technology makes it possible to produce durable, lightweight sheets that can be stored without refrigeration and dissolved in seconds to make beverages such as oat milk or soups. The advantages of this innovation are particularly evident in the food service sector, where portioning and waste reduction are economically crucial. Planethic has now clearly positioned itself as a digital food tech holding company that strategically bundles technologies, trademark rights, and e-commerce.

Analysts assess the prospects positively, especially as capital measures such as the inflow of funds of EUR 7.1 million and the proceeds from the OrbiFarm sale strengthen the operational basis. First Berlin also sees further potential in view of market trends and expansion plans, which is reflected in the price target of EUR 26. The new structure of the Planethic Group, with investments such as IP Innovation Partners and Suplabs, also underscores its focus on scalable technologies. A significant milestone is the global licensing partnership with Vitiprints, the leading provider of edible 2D printing technology. Together, the two companies aim to expand the global production and distribution of Mililk® and other printed beverages. The combination of Planethic's production strength and Vitiprints' patented systems creates an infrastructure that significantly reduces packaging waste and makes supply chains dramatically more efficient.

With its scalable ideas, the Planethic Group's business model demonstrates that technology-based nutrition models work, thus writing the next chapter in plant-based food production. The first financial highlights totaling more than EUR 30 million are in the bag through the staggered sale of the Obifarm stake. Nevertheless, the Company is exploring further strategic options, including a NASDAQ listing in 2026. The 2.12 million shares currently have a market capitalization of just under EUR 14 million. Too little for institutional investors, but certainly a high-growth ESG bargain for private investors.

Novo Nordisk – The price war with Eli Lilly is taking its toll

Vegan nutrition and obesity are probably considered diametrically opposed concepts in the field of nutrition. After a period of enormous price losses, Novo Nordisk is also undergoing a strategic transformation, as weaker sales figures and rising competitive pressure have placed the Company under notable strain. The Danish pharmaceutical giant has now significantly intensified the price war in the US market and lowered its calculations for Wegovy and Ozempic ahead of schedule in order to regain lost market share. The new strategy targets self-pay patients in particular, many of whom had recently switched to cheaper generic drugs. With entry-level prices of USD 199 and a regular price of USD 349, Novo is positioning itself very aggressively against Eli Lilly's Zepbound. This move strengthens competitiveness in the short term, but increases margin pressure in a market that could reach USD 100 billion in the coming years. At the same time, Novo Nordisk is expanding access via platforms such as GoodRx, WeightWatchers, and Costco, and is increasingly supporting telehealth providers to broaden its distribution reach.

A fundamental shift is also apparent at the management level. Immediately after taking office, new CEO Mike Doustdar initiated extensive restructuring measures, including around 9,000 job cuts. Novo is also preparing to offer oral obesity treatments, with entry-level prices expected to start at USD 149 under a government agreement. Whether these measures will help the share price recover remains uncertain. However, 16 out of 28 analysts on the LSEG platform still recommend buying the stock, with an average target price of DKK 422. This makes a price of DKK 312 appear quite attractive, especially since the 2026 P/E ratio has fallen to 12.9 and a dividend of just under 4% is on the table.

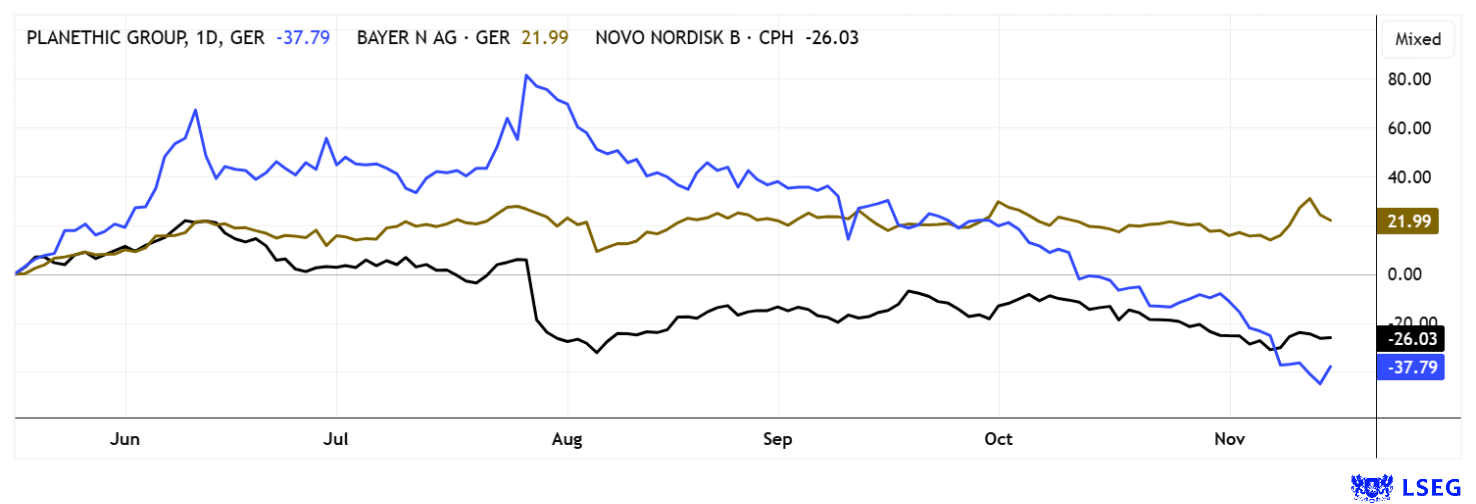

The stock market is now very selective again. While blockbuster stocks such as Nvidia and Palantir are able to play to their strengths in the field of artificial intelligence, the food and drug sector is currently being neglected. However, after a price drop of almost 70%, a year-end rally seems inevitable for Planethic Group.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.