January 19th, 2023 | 11:19 CET

Nel ASA, First Hydrogen, Landi Renzo, Plug Power - Hydrogen: The 2nd row is booming

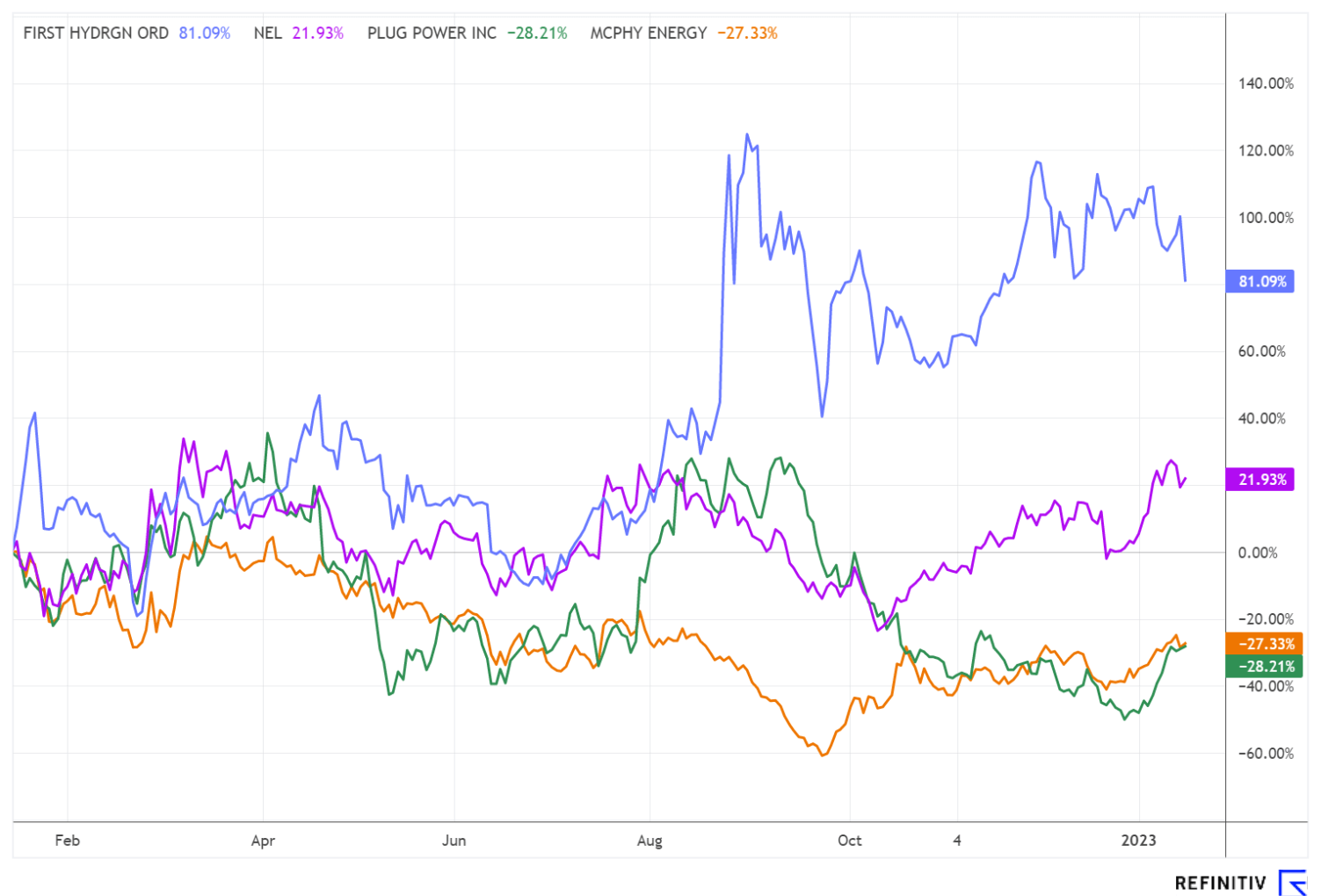

For climate protection and a secure energy supply, the Western world must become independent of fossil fuels. Hydrogen plays a key role in climate change as a substitute for natural gas, oil, and coal. Despite programs worth billions of euros from politicians and excellent prospects for the future, the largest companies in the hydrogen and fuel sector, such as Nel ASA and Plug Power, are still undergoing a profound correction. In contrast, it is mainly second-tier companies attracting attention that could catch up soon based on their technology.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , LANDI RENZO S.P.A. EO-_01 | IT0004210289 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

First Hydrogen - With new partner to series production

First Hydrogen is making great strides towards the mass market. As reported in our last detailed report, with EDAG Group as a design partner, a global market leader has once again been won as a partner. The Company is the world's largest independent engineering service provider for the international mobility industry and provides services in vehicle technology, electronics and production solutions with a global network of around 60 branches. First Hydrogen is supported in vehicle development to make zero-emission vehicles accessible to fleet managers, opening the door to mass production and the mass market. For the Canadians, developing the next-generation vehicles represents another milestone in the Company's young history.

Covering the entire value chain

In addition to developing utility vans, First Hydrogen aims to cover the complete hydrogen value chain with its "Hydrogen-as-a-Service model." The focus is on the development of zero-emission light commercial vehicles, the development of a hydrogen refueling system, and the production and distribution of green hydrogen. A pilot project with the Canadian city of Shawinigan in the Quebec region has now been approved for the development of First Hydrogen's ecosystem. First Hydrogen has already conducted site assessments and has officially begun securing and developing appropriate sites for the local production of green hydrogen and the assembly of zero-emission First Hydrogen commercial vehicles. Despite the increase, First Hydrogen's market capitalization of EUR 142.34 million is moderate compared to peers like Nel ASA (EUR 2.4 billion) or McPhy Energy (EUR 398.41 million).

Landi Renzo - Undiscovered "Hidden Champion"

While companies from the hydrogen sector, such as Nel ASA or Plug Power, are among the most discussed in various boards or communities, only some on the stock exchange know about Landi Renzo, a company that has been in existence since 1954. The Company, based in Reggio Emilia, Italy, has a presence in over 50 countries, making it one of the most important players in the field of technologies that enable more environmentally friendly mobility. In its core business Green Transportation, Landi Renzo develops, produces and sells components and alternative drive systems for gas and hydrogen mobility and is one of the leading suppliers of natural gas, LPG, biogas and hydrogen fuel systems for passenger cars as well as for medium and heavy-duty commercial vehicles. Its customer list includes installers and dealers in addition to the world's largest car and truck manufacturers. The acquisition at the end of 2021 of the Italian company Metatron, a specialist supplier of components for gas and hydrogen mobility in the truck sector, has significantly strengthened the portfolio in the area of hydrogen solutions, creating excellent conditions for strong future growth in the truck segment.

In the second segment, Clean Tech Solutions, the Italians focus on developing, producing and selling compressors for processing and distributing hydrogen, natural gas or biogas through their joint venture SAFE-CEC, in which Landi Renzo holds 51%.

The latest 9-month figures showed continued strong growth despite difficult market conditions. Sales between January and September, for example, grew by 33.1% year-on-year to EUR 216.35 million. In addition, the operating result (EBITDA) increased significantly by 18.8% to EUR 7.07 million compared to the same period last year. For the full year 2022, analysts at GBC AG forecast revenues of EUR 287.74 million and EBITDA of EUR 16.77 million. For the current fiscal year 2023, the experts estimate revenues of EUR 323.88 million, EBITDA of EUR 30.61 million and a positive net result of EUR 4.64 million. The analysts' verdict is "buy". According to the current study, the price target is EUR 0.98, which corresponds to a potential of around 60% at the current price of EUR 0.60.

Hydrogen is existential for the success of climate change. Nevertheless, loss-making companies such as Nel ASA or Plug Power, which still have high valuations, are correcting. In contrast, second-tier companies are moving to the forefront. First Hydrogen is striving to cover the entire value chain of the hydrogen industry. Landi Renzo was able to continue its growth course despite challenging market conditions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.