July 9th, 2024 | 07:25 CEST

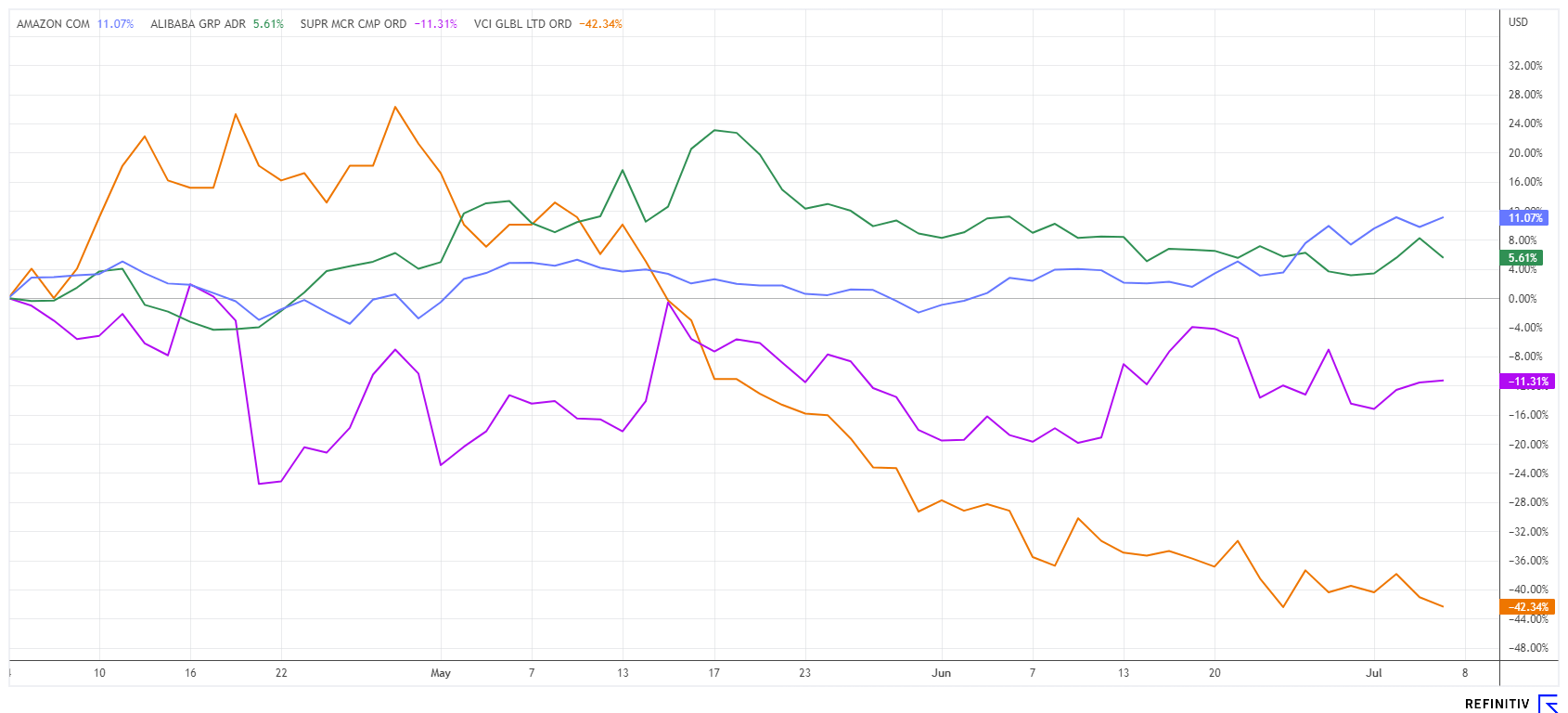

NASDAQ Super Boom! 100% returns still lurk with Alibaba, VCI Global, and Super Micro Computer; Amazon founder sells

Experts expect the use of artificial intelligence (AI) to lead to double-digit productivity gains in digitally configurable processes over the next few years. Not since the introduction of industrial robots have there been such leaps. The major Internet companies have long since prepared themselves for these developments. High computing power, automated sales processes, and a pool of trillions of user data points play into the multinationals' hands. They achieve billion-dollar profits with their networks almost effortlessly. Consumers are served exactly what interests them most and, above all, what they consume regularly. However, not all high-tech shares have been able to take off so far. What should investors pay attention to now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALIBABA GR.HLDG SP.ADR 8 | US01609W1027 , VCI GLOBAL LIMITED | VGG982181031 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba Group - Fully involved in the European Championship, otherwise little-noticed

Anyone actively following the European Championship will have long remembered the major sponsors. The banner advertising of the Alibaba Group is unmistakable and appears repeatedly. With its subsidiaries AliPay and AliExpress, the Alibaba Group is omnipresent in all stadiums. They all belong to the empire of internet guru Jack Ma and his listed Alibaba Group. The Company was one of the first Chinese blockbusters on the Nasdaq and celebrated a heyday on the Nasdaq in 2019 and 2020. Its capitalization reached almost EUR 600 billion, roughly four times the turnover that Alibaba will achieve in its group in the current year.

Due to the ongoing sabre-rattling between the US and China, star investors such as Cathy Wood have abandoned Chinese shares altogether. The ADRs of internet giants such as Alibaba, Baidu, and Tencent now lead only a shadowy existence on the ever-bullish NASDAQ. Despite all the fears of expropriation among investors, it should not be overlooked that the valuations of Chinese stocks have now reached very low levels, sometimes single-digit P/E ratios. 40 out of 47 experts on the Refinitiv Eikon platform recommend Alibaba as a "Buy" from a fundamental perspective; political implications are not included here. The average price expectation in 12 months is USD 108.20, around 50% above the current price. The price/sales ratio (P/S ratio) for 2024 is currently 1.5 with a P/E ratio of 17 - for comparison, Amazon trades with a P/S ratio of 6 and a P/E ratio of 55. The growth rates of both companies are around 15% per annum. It will, therefore, be interesting to see when the investment community rediscovers Chinese stocks.

VCI Global Ltd - Asian high-tech multi-disciplinary makes acquisitions in Germany

Based not in China but in Malaysia, is the globally active VCI Global Ltd (VCIG), a diversified holding company focusing on technological hotspots. Through its subsidiaries, it focuses on Web 3.0, fintech, artificial intelligence (AI), robotics, cyber security, and real estate. However, the Company's core competence is primarily consulting services for companies with an affinity for the stock market. VCIG has set itself the task of promoting companies with high growth potential through first-class consulting, investing at an early stage, and later realizing the increased company values via the capital markets. This creates substantial added value in VCI Global's portfolio.

The Company has set up its own financing platform for the rapidly growing technology sector. A recent announcement has drawn attention. By acquiring the secure messaging platform "Socializer" from the German company Cogia AG, the Malaysians will be able to offer secure, encrypted communication for governments and security-relevant organizations internationally. The deal was concluded on a share basis and means compensation for Frankfurt-based Cogia of 3.5 million VCIG shares plus USD 1.5 million in shares of Treasure Global Inc. (TGL) - a cooperation partner of VCI - for subscription within the next 12 months. When combining these components, the transaction value amounts to USD 3.3 million. Cogia AG is currently valued at only EUR 1.4 million, having recently surprised with the full integration of elastic.io GmbH. VCIG aims to list the messenger platform on the Nasdaq in the future, which will increase its transparency and value.

Another deal also caused quite a stir at the beginning of July. VCIG is investing up to USD 30 million in the next capital round of the TalkingData Group. The holding company is one of Asia's largest providers of big data analysis and AI-supported solutions and serves major global brands such as Google, Yahoo, L'Oréal, PepsiCo, and Nike. Prominent investors are already on board, including China Resources Capital, Softbanks SB China Venture Capital, JD.com, VMS Asset Management, Northern Light Venture Capital and others. This investment gives VCI exclusive rights to TalkingData's data AI products and services in Southeast Asia. Another curiosity for interested investors is VCI Global's current market capitalization of only USD 33 million. According to the Company, the share has been sold short for months. Given the current news, however, the attacker should soon run out of steam.

Super Micro Computer - In the shadow of Nvidia in no time at all

We have recently reported on several occasions on Nvidia and Super Micro Computer (SMCI). Nvidia's split is now around the corner, and contrary to expectations, the share price initially led to a 25% correction and only rose again slightly last week. The cooperation partner Super Micro Computer takes care of the cooling of mainframes, which have been built on a massive scale at companies since the introduction of AI. The market believes in growth rates of more than 40% per annum for the next 5 years. As of June 30, 2024, SMCI can report a doubling of turnover to just under USD 15 billion. This figure is expected to rise to USD 24 billion in the current year, with earnings per share increasing from USD 11.8 to USD 23.9. At a share price of USD 846, the P/E ratio calculates to a factor of 35. A look at the high growth certainly allows this valuation, but nothing should go wrong with these estimates. Technically, there are new buy signals above USD 880, and confident traders expect a stock split similar to Nvidia soon.

Amazon - Jeff Bezos liquidates 25 million shares

What applies to normal shares cannot be applied to the "Magnificent 7". It is not only the valuations that are remarkable but, above all, the unique selling points in the segments in which they operate. One of the seven blockbusters is Amazon. The mail-order company was founded in Seattle in 1994 and is preparing to conquer all areas of human life because, in addition to its market leadership in e-commerce, it also offers banking, leasing, and insurance services. With a market capitalization of USD 2 trillion and share prices of over USD 200, AMZN shares have recently moved up to fifth place in the global ranking. Therefore, the announced sale of 25 million of the founder's shares worth around USD 5 billion is not a problem. Even Jeff Bezos needs cash in his pocket sometimes.

High-tech stocks like Amazon and Super Micro Computer are in high demand on the NASDAQ. Around the globe, however, the situation looks somewhat more subdued. China's Alibaba is very cheaply valued and is being ignored. At the technology holding company VCI Global, one deal follows the next, but the share price seems to be artificially depressed. Investors should, therefore, be on their guard, as everything can quickly turn around.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.