XPeng Inc ADR

Commented by Stefan Feulner on October 29th, 2021 | 14:13 CEST

XPeng, Graphano Energy, K+S - The fear of emptiness

There are shortages in all sectors. In addition to the chip shortage, which is affecting the automotive industry, there are also shortages of metal, plastic, and even packaging material for Christmas presents. Even at technology giant Apple, there is concern about whether the all-important final quarter can be spared supply disruptions due to fragile global supply chains. There is no end to this problem in sight in the longer term; on the contrary, the shortage of raw materials due to the energy transition exacerbates this circumstance.

ReadCommented by Stefan Feulner on October 13th, 2021 | 12:19 CEST

XPeng, Central African Gold, Volkswagen - It will not work without metals

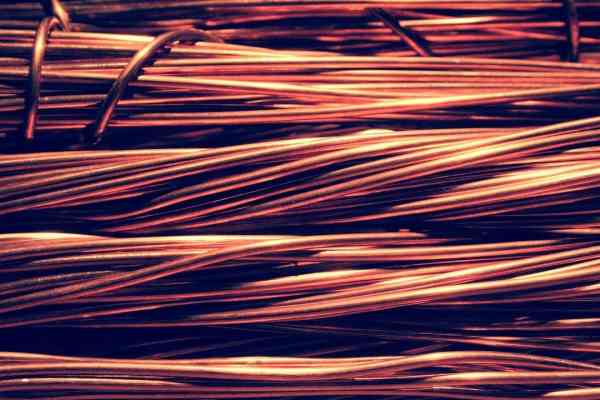

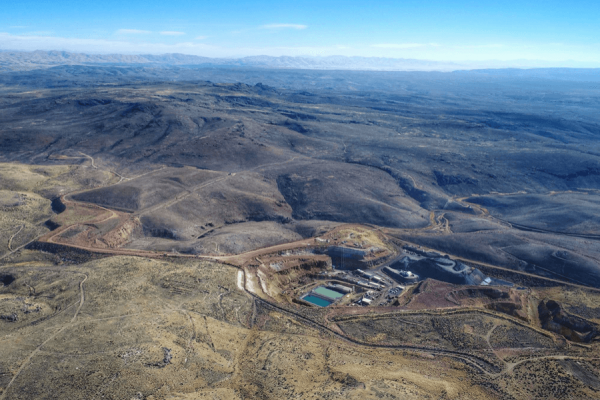

Decarbonization is the magic word when it comes to achieving the ever-tighter climate targets. The phase-out of coal and the move away from fossil fuels, oil and natural gas is a done deal. However, considerable quantities of copper, lithium, cobalt and nickel are needed to ensure the energy turnaround, whether for electromobility, solar or wind technology. A limited supply is already matching the enormous demand. A stalling of ambitious plans is already preprogrammed.

ReadCommented by Stefan Feulner on August 30th, 2021 | 13:22 CEST

BYD, AdTiger, Xpeng - Way clear for further share price gains

As expected, the highly anticipated symposium in Jackson Hole turned into a non-event. Although FED Chairman Jerome Powell is concerned about inflation at current levels, he considers the price increases to be a temporary phenomenon that does not require any changes in key interest rates. Nor was a specific date given for scaling back bond purchases. The ultra-loose monetary policy is thus preparing the ground for further price rises in the asset classes of equities, real estate and precious metals.

ReadCommented by Stefan Feulner on July 7th, 2021 | 11:49 CEST

BYD, QMines, Xpeng - Play the Trend

In recent weeks, there have been shortages of many commodities and intermediate goods. The shutdown of production during the Corona pandemic led to supply shortages of lumber, semiconductors and chemicals. In contrast, demand for consumer goods rose sharply after the economy eased. The result was significantly increasing prices due to the shortage. In the long term, this phenomenon will also occur for metals needed for the energy transition. The first tendencies are already becoming apparent. Take advantage of the cycle!

ReadCommented by Stefan Feulner on June 9th, 2021 | 08:56 CEST

Plug Power, NewPeak Metals, Xpeng - Turbo stocks for your portfolio

Stock market stars of 2020, the shares of companies in the hydrogen, electromobility and fuel cell technology sectors, recovered after heavy losses in the first quarter and are currently on the verge of further price gains. Future prospects for these sectors remain intact. Due to the demand resulting from the energy transition, investors are also focusing on the necessary raw materials. In this context, the shift to a low-carbon economy is only at the beginning of a major upheaval.

ReadCommented by Stefan Feulner on May 20th, 2021 | 09:24 CEST

XPeng, Kodiak Copper, NIO - Megatrend scarcity

Bitcoin, Etherum and the entire crypto family are rushing into the basement. The reason for this is once again the Middle Kingdom. After a statement by the Chinese central bank that one may not use digital currencies for payment purposes, they lost more than 20% in value yesterday. China's market power is even greater when it comes to raw materials for the energy transition. Due to the scarcity of the corresponding metals, prices will rise enormously in the long term. Producers who offer alternatives in the Western industrialized countries can profit significantly from this.

ReadCommented by Stefan Feulner on March 4th, 2021 | 09:03 CET

NIO, Royal Helium, Xpeng - the fierce battle for raw materials!

The market price is determined by supply and demand. Due to the global climate programs of politics, the pressure increases and the demand grows enormously in the coming years. Raw materials such as rare earth metals, lithium, helium, copper or even silver will become extremely scarce commodities. There is a threat of drastic price increases. In recent years, significant investments in raw material projects have been neglected. To provide more supply, it will now be a race against time. In any case, the producers will profit.

ReadCommented by Stefan Feulner on February 3rd, 2021 | 08:00 CET

Xpeng, Q&M Dental, SAP - Incredible growth opportunities!

One surprise of the past year was the sudden boom in IPOs, especially in the US. This trend is likely to accelerate in the year ahead. The IPO of SAP's subsidiary whets the appetite for more. The Asian middle class is also hungry for more. Consumption is exploding as a result of the enormous growth in purchasing power. Sectors such as wellness and aesthetics are set to experience unprecedented hype in the coming years.

ReadCommented by Stefan Feulner on January 20th, 2021 | 10:21 CET

BYD, Kodiak Copper, Xpeng - then it will explode!

The energy transition is in full swing. Month after month, electric manufacturers are posting new sales records. This development is just the beginning and will accelerate in the coming years. However, the demand for raw materials, which are urgently needed for industries such as e-mobility or renewable energies, will also accelerate. There is a threat of enormous shortages of several raw materials in the medium term. The result will be an extreme price explosion.

ReadCommented by Stefan Feulner on January 5th, 2021 | 08:27 CET

BYD, Blackrock Gold, Xpeng - electric cars, where's the limit?

The disruptive replacement of combustion engines with electric motors is in full swing. Pioneers of e-mobility such as Tesla, BYD, NIO and soon Apple, are overrunning the traditional car manufacturers. The latter have either underestimated the development in recent years or do not have the necessary technical know-how. This development can be seen impressively in both the sales increases and the stock market values. The trend seems unbroken, and there is little to suggest a change in the near future.

Read