XPeng Inc ADR

Commented by Carsten Mainitz on November 18th, 2025 | 06:00 CET

Playing megatrends with the right stocks – NEO Battery Materials, XPeng, BYD

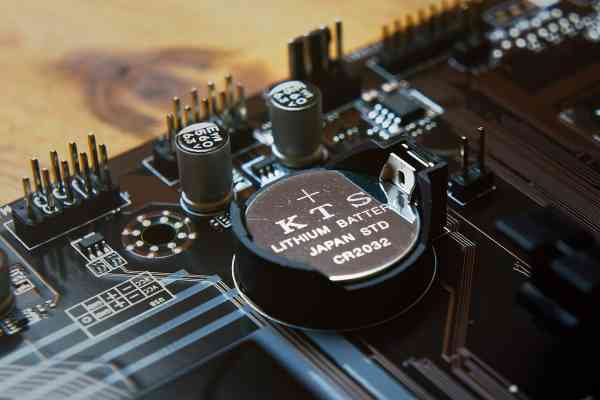

"The trend is your friend" – this is a well-known stock market adage that advises investors to take advantage of a stock's upward trend and let profits run. For investors, it is often worthwhile to focus on so-called megatrends - sectors expected to achieve dynamic growth over the coming years or decades, thanks to sustained high demand, for example, in terms of technology or socio-demographics. Artificial intelligence and robotics, as well as everything related to the defense industry, are currently very popular. Equally exciting are the areas of electromobility and battery technology. China dominates the market, and this strong position is unlikely to change in the foreseeable future. However, innovations from players outside China, such as those from NEO Battery Materials, are particularly exciting. The Canadian company is implementing innovative approaches and processes that could contribute to meaningful advancements in the global battery market.

ReadCommented by Stefan Feulner on January 7th, 2025 | 07:00 CET

MicroStrategy, Almonty Industries and XPeng make headlines

The markets continued to rise in the first trading week of the new year. The DAX has managed to climb past the 20,000-point mark. Bitcoin is also working on reclaiming the magical USD 100,000 mark. For some market experts, this is just the beginning of an unstoppable run for the world's largest cryptocurrency. Less covered in the media but significantly more critical is the Western world's focus on securing vital raw materials. One company is on the launchpad and could soar to new heights after production begins.

ReadCommented by Stefan Feulner on March 26th, 2024 | 07:15 CET

BYD, First Hydrogen, XPeng - When will the rebound follow?

In addition to the DAX and the Dow Jones, the technology-heavy Nasdaq also celebrated another all-time high. With three more interest rate cuts forecasted by the Fed for this year, there is still significant upside potential for the more capital-intensive stocks. The rally is mainly being driven by the Magnificent Seven. Behind them are promising companies that are still lagging far behind their price potential.

ReadCommented by Stefan Feulner on July 4th, 2023 | 07:30 CEST

Records upon records at Tesla, BYD, Almonty Industries and XPeng!

Led by the innovation driver Tesla, which delivered better-than-expected quarterly delivery figures, Chinese competitors also boasted record sales. Thus, Elon Musk's plan to boost volumes through discounts worked. The increasing sales raise the demand for critical metals for the production of electric vehicles, benefiting the producers of these scarce resources in the long run.

ReadCommented by Stefan Feulner on September 6th, 2022 | 10:43 CEST

XPeng, Infinity Stone Ventures, Rock Tech Lithium - Enormous growth potential

Bad news for all BYD shareholders, stock market legend Warren Buffett is selling off part of his shares, causing the recently strongly performing stock to falter. Despite the short-term share price turbulence of the Chinese market leader, e-mobility is set for exponential growth in the coming years due to the achievement of climate targets. This development, in turn, is fueling global lithium demand. The raw material needed to build electric car batteries is already becoming scarce. The main beneficiaries of the shortage are likely to be producers of the metal.

ReadCommented by Stefan Feulner on August 25th, 2022 | 10:38 CEST

Rock Tech Lithium, Globex Mining, XPeng - Time to act

It is all or nothing for climate change. The supply of critical raw materials is already barely guaranteed in the Western world for many urgently needed materials. Dependence on China is crushing. The Canadian government has now signed memoranda of understanding with German automakers Volkswagen AG and Mercedes-Benz Group AG to develop supply chains for nickel, lithium, cobalt and other key minerals used in electric vehicles. At least this is a first step, but it will be far from sufficient. The primary beneficiaries, on the other hand, are the mining companies, especially in North America.

ReadCommented by Stefan Feulner on July 4th, 2022 | 12:11 CEST

Extreme growth in demand for Ganfeng and Edison Lithium, XPeng and NIO with solid sales figures

The auto industry faces a massive supply problem in the coming years. The reason for this lies in the exploding demand for lithium, an elementary raw material for electromobility. While the lithium market was 33,000t per year globally in 2015, it rose to 85,000t by 2022. By 2030, when the German government plans to have 15 million electric cars on German roads, experts predict an annual demand of up to 400,000t. There is already a clear shortage of supply. The profiteers here are the lithium producers. After a sharp correction in the lithium sector, new opportunities are opening up in the long term.

ReadCommented by Stefan Feulner on May 4th, 2022 | 10:22 CEST

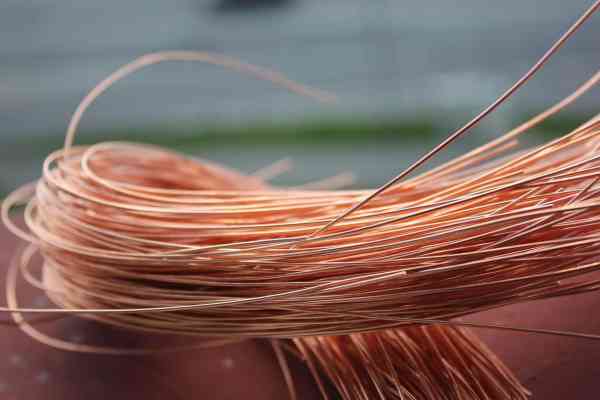

BYD, Nevada Copper, XPeng - New opportunities for copper shares

After a brilliant year on the stock market in 2021 and reaching new 10-year highs, the copper price reached new highs again at the beginning of March, after the start of the Ukraine conflict. Since then, the base price has been correcting at a high level. However, due to the plan of politicians to practice an even faster switch to renewable energies, the demand for the elementary red metal is increasing significantly. Experts forecast a new supercycle for the next few years. Producers of the scarce commodity are the primary beneficiaries of this trend.

ReadCommented by Stefan Feulner on February 3rd, 2022 | 10:19 CET

TeamViewer, Kodiak Copper, XPeng - Opportunities after the setback

It is numbers season again. The Goeppingen-based company TeamViewer achieved its forecasts, which had been revised downwards twice. Whether the remote maintenance business is sustainable after the pandemic has subsided remains to be seen. By contrast, demand for raw materials for the energy transition is almost sure to be sustainable. In particular, the eminently essential copper is likely to be subject to a further increase in demand for years to come.

ReadCommented by Stefan Feulner on November 25th, 2021 | 13:42 CET

XPeng, Meta Materials, Aixtron - Welcome to the Metaverse

Sound fundamental analysis is essential to be successful in the stock market in the long term; at least, this was the basic rule before the Reddit hype about GameStop & Co. The news that Facebook wants to reinvent itself under the name "Meta" prompted investors to buy shares in the Company of the same name. The Company is quite promising and has great potential in the long term due to the development of new materials for 5G, photovoltaics and consumer electronics. From our side, "Congratulations, dear Meta shareholders."

Read