JINKOSOLAR ADR/4 DL-00002

Commented by Stefan Feulner on January 4th, 2022 | 07:10 CET

BYD, CoinAnalyst, JinkoSolar - Ambitious targets

What awaits investors in 2022? Will shares of vaccine makers such as BioNTech and Moderna continue to run upward, or will the massive overvaluation be reduced over the course of the year? Will industry leader Tesla keep its place in the sun? And what is next for cryptocurrencies and NFTs, which rose like a phoenix from the ashes last year? The new year offers many opportunities. Stay tuned and bet on the winners starting now.

ReadCommented by Armin Schulz on December 23rd, 2021 | 12:39 CET

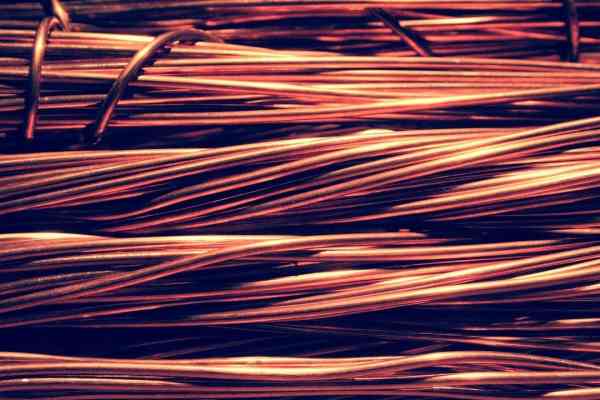

Varta, Nevada Copper, JinkoSolar - Copper in desperate demand

The world is changing. Efforts are increasingly being made to protect the climate, and entire branches of industry are being converted as a result. The energy industry is increasingly relying on renewable energies, and the automotive industry has proclaimed the end of the combustion engine. The new technologies emerging, as a result, require a wide variety of raw materials, but above all, copper. Demand will increase faster than supply can be expanded. The result - rising copper prices. Not for nothing has this raw material been called the red gold. The coming years promise to be exciting on the copper market.

ReadCommented by Nico Popp on December 22nd, 2021 | 12:50 CET

Varta, Graphano Energy, JinkoSolar: Is the climate turnaround off?

New technology offers excellent growth potential. One just has to think of smartphones, tablets or e-cars. Today, numerous electric cars line the roads. A few years ago, electrically powered vehicles were the exception rather than the rule, and passersby would stare at the silent vehicles. By 2030, combustion engines will be the exception. We will outline what this means for investors using three stocks as examples.

ReadCommented by Stefan Feulner on December 10th, 2021 | 13:54 CET

Bayer, Almonty Industries, JinkoSolar - Still considerable room for improvement

Inflation is growing relentlessly. In November, Germany's barometer for price increases climbed to 5.2%; a level last reached 29 years ago. Rising energy prices and exploding commodity prices are found to be the culprits here. Given the energy turnaround, the materials required for this, such as lithium, copper and cobalt, are in fact close to their highs. However, tungsten, which will be essential for electromobility in the future, still has some catching-up potential.

ReadCommented by Stefan Feulner on December 2nd, 2021 | 12:11 CET

Steinhoff, Triumph Gold, JinkoSolar - On a knife-edge

The DAX was on the verge of falling below the 15,000 point mark, which had been successfully tested several times, and the nerves of traders and asset managers were put to the test concerning an impending sell-off in the leading index. Then the market turned around, and the chart picture brightened considerably. Chances for a conciliatory end of the year are still there, partly because on the part of science, at least a little confidence was spread concerning the omicron variant.

ReadCommented by Stefan Feulner on December 2nd, 2021 | 11:02 CET

Bayer, Ayurcann, JinkoSolar - Excellent prospects

"Release the hemp!" cult presenter Stefan Raab called for the legalization of cannabis years ago in a song he produced himself. But not Jamaica, but the traffic light coalition with SPD, FDP and the Greens caused jubilation in the various communities. The release of the drug opens up great opportunities for young companies as well as investors. In contrast to Germany, other countries have already made more progress. Currently, the cannabis sector is in correction mode on the stock market, but the long-term prospects are excellent.

ReadCommented by André Will-Laudien on November 26th, 2021 | 11:28 CET

The copper sensation continues! Nordex, Nevada Copper, JinkoSolar, Daimler

When it comes to calculating the copper market in the next few years, expert opinions differ. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to approximately 25 million tons by 2030. The main argument for further rising prices remains the global copper shortage because demand continuously exceeds supply, and recycling rates cannot cover industrial stockpiling either. The German copper smelter Aurubis is trading at an all-time high and wants to build a multi-metal plant in the USA. Such news is confirmation of an awakening among investors to allow new mining and processing operations to emerge. There are few new mines in sight at the moment, but there is news from Nevada.

ReadCommented by Nico Popp on November 23rd, 2021 | 10:12 CET

Nordex, Memiontec, JinkoSolar: Where sustainable returns await

The motto "After me, the deluge" has had its day. Today, industrial companies have to take responsibility for their actions. That includes cleaning up pollution and offsetting CO2 emissions from production. Hence the trade in emission rights. It is also favorable for a company's image if it is sustainable and communicates this to its customers. We present three stocks that can score points with sustainability.

ReadCommented by Nico Popp on November 18th, 2021 | 12:07 CET

RWE, Nordex, Water Ways, JinkoSolar: These shares are just starting to blossom

Sustainability pays off! Even utility RWE believes that the EUR 50 billion the Company plans to invest in transforming its corporate structure is capital well spent and expects profit increases of up to 10% annually in the course of the measures. Since operating sites also determine whether a company's sustainability account is in the green or not, photovoltaic suppliers are also likely to benefit from climate change. Industrial companies will also fare better in the long term with renewable energy - companies like Nordex are already looking forward to it. This article explains where opportunities are waiting around climate change and whether there are still niches that have received little attention from the market.

ReadCommented by Nico Popp on November 11th, 2021 | 11:34 CET

Rock Tech Lithium, Noram Lithium, JinkoSolar: Investing in Tesla's neighbors

Electromobility and renewable energies are the hot topics of the moment. Only yesterday, the Tesla rival Rivian made a brilliant stock market debut. VW, too, announced that it wants to make even greater inroads in the field of electromobility. All these plans create a market worth billions for the automotive suppliers of tomorrow. At the same time, governments are doing everything they can to support the new lithium and battery supplier industry, creating significant opportunities for investors. We highlight two lithium stocks and look at a company that is winning the fuel of the future.

Read