JINKOSOLAR ADR/4 DL-00002

Commented by André Will-Laudien on March 31st, 2022 | 11:57 CEST

Varta, Phoenix Copper, JinkoSolar, Nordex: Numbers upon numbers, where is the explosive?

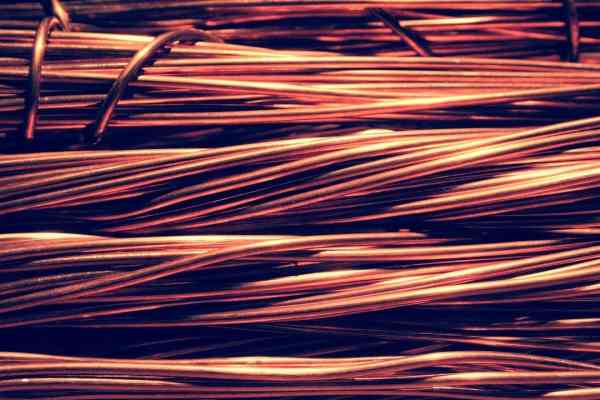

The copper price reached its preliminary high on March 7, 2022, at around USD 10,730. Since then, we have seen a standard consolidation of 3-4%, which is not an unusual occurrence in the present uptrend. Thus, the coveted metal has exploded by over 100% since the beginning of 2020. Large mining groups and copper mines have often been able to post a multiple of this performance for themselves in the same period. For many market participants, the medium-term upward scenario for the industrial metal remains set. Since the political closing of ranks on e-mobility, demand for copper and battery metals has shot through the roof. Mine operators and governments worldwide are alarmed because the current recoverable capacities cover just 85% of the current year's demand. Who can close the gap?

ReadCommented by Nico Popp on March 14th, 2022 | 10:17 CET

Mercedes-Benz Group, Phoenix Copper, JinkoSolar: Learning from history

Investors who kept a cool head after the outbreak of the Corona pandemic in March 2020 were able to enjoy high profits in the months that followed. Immediately after the outbreak began, share prices around the world plummeted. The media proclaimed the end of the economy as we know it. While this was partly true, the markets' conclusions were initially wrong. Instead of economic decline, scarcity determined prices - until today. Even now, the markets are painting a gloomy scenario, right up to the apocalypse. It looks as if supply and demand will ultimately determine prices after all. For investors with a sharp focus and clear understanding, this can be an opportunity. We present three shares.

ReadCommented by Carsten Mainitz on February 3rd, 2022 | 14:18 CET

JinkoSolar, Memiontec, Nordex - Elementary profit opportunities!

Fire, Water, Earth and Air - according to ancient teachings, these are the determining elements of our universe. The question is how we can harness them in the future without destroying ourselves in the process. On the one hand, this is about future possibilities of use, but on the other hand, it is also about the question of how we can create fair access for all people in order to avert impending distribution conflicts. Below are three companies whose profits are based on one each of these four elements.

ReadCommented by André Will-Laudien on February 2nd, 2022 | 13:48 CET

Nordex, Nevada Copper, JinkoSolar: Earning in the copper decade!

According to a 2020 study by the International Copper Study Group (ICSG), Chile, Peru, China and the US were the largest copper producers in the world. Other significant deposits can be found in Australia, Indonesia, Russia, Canada, Zambia, Poland, Kazakhstan and Mexico. While most mines have copper concentrations between 0.2 and 0.8%, there are even deposits in Central and South Africa that can contain 5 - 6% copper. In Europe, the largest copper deposits are found in Russia and Poland. Expert opinions differ considerably when calculating the copper market for the next few years. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to about 25 million tons by 2030. And ore is already in more than short supply today. Where are the opportunities for investors?

ReadCommented by Stefan Feulner on January 31st, 2022 | 11:28 CET

Steinhoff, Hong Lai Huat, JinkoSolar - Is the lid flying off?

Will international furniture group Steinhoff get back on its feet after the accounting scandal of 2017? The settlement with creditors has been confirmed, and now it is all about reducing the horrendous mountain of debt. The situation in the German real estate market is quite different. Here, the German Federal Bank is already warning of overheating following the sharp rise in prices in recent years. There is more potential on other continents of the world, especially in Southeast Asia.

ReadCommented by André Will-Laudien on January 27th, 2022 | 13:10 CET

Varta, JinkoSolar, Barsele Minerals - Green tech: After the sell-off is before the rally!

Green tech stocks were the clear favorites of investors in 2021. Many stocks from the energy, climate or metals sectors reached multi-year highs. First, the hydrogen hype ran, then the stock market focused on battery makers and e-mobility, and toward the end of the year, uranium and lithium suppliers were bullish. A healthy rotation of green themes, further spurred by the Glasgow climate conference in November. Now some prudence has returned, prices fell slowly at first and then violently in the last few days. Where are the opportunities now?

ReadCommented by Stefan Feulner on January 18th, 2022 | 11:30 CET

Taiwan Semiconductor, BrainChip, JinkoSolar - Markup in the chip industry

The chip crisis was one of the most discussed topics of 2021. The shortage of semiconductors led to production stops, short-time work in the automotive industry, and skyrocketing prices. Even for the current year, manufacturers still do not see any relief on the market. In general, the semiconductor industry is in a strong state of flux. With the development of chips based on artificial intelligence, a new generation is now finding its way to the mass market. The best example is the Australian Company BrainChip, for which the doors to commercialization have been opened wide.

ReadCommented by Nico Popp on January 13th, 2022 | 10:23 CET

JinkoSolar, Barsele Minerals, Barrick Gold: Where challenges are opportunities

The road to success is sometimes rocky and characterized by imponderables. Especially on the stock market, unclear situations can be good opportunities in the long run. Sometimes the market doesn't buy a company's long-term plans, or a fundamental situation overshadows what is actually a good investment story. We present three companies where there is currently a bit of sand in the gears and explain whether opportunities can arise.

ReadCommented by Stefan Feulner on January 7th, 2022 | 10:38 CET

JinkoSolar, Triumph Gold, Palantir - At attractive levels

The precious metals sector was one of the disappointments on the capital market last year. Gold mining stocks are still stuck in a correction despite historically low interest rates and rising inflation. Yet business in the mining sector is booming. Producers are sitting on high cash reserves and beckon with attractive dividend yields. Many shares in the tech sector have also corrected and currently offer attractive entry levels.

ReadCommented by Fabian Lorenz on January 6th, 2022 | 11:26 CET

The beginning of the end at BioNTech? Positive start for JinkoSolar and Diamcor

Is Omicron the beginning of the end of the Corona pandemic? Not only stock market players are asking themselves this question. Because as it seems, the virus variant is more contagious but seemingly leads to less severe sickness. As a result, the shares of vaccine manufacturers such as BioNTech, Moderna and Valneva have recently suffered. However, there are positive things to report, especially for BioNTech. While the Mainz-based Company is optimizing its vaccine for the Omicron variant, there is also positive news from the USA. Not only the COVID-19 vaccine is in demand worldwide, but also diamonds. Most recently, Israel reported a significant increase in demand. Tiffany & Co. partner Diamcor is benefiting from this demand. JinkoSolar's share price is heading north again in the first few days of trading after the heavy losses before Christmas. The IPO of the subsidiary is taking shape.

Read