TOTALENERGIES SE

Commented by Stefan Feulner on July 11th, 2023 | 07:10 CEST

End of the downward spiral - Shell, Saturn Oil + Gas, TotalEnergies

With the break of the downward trend established since June 2022, the oil markets, both Brent and WTI, received a significant boost. Fossil fuels are expected to gain further support from the announcement of production cuts by OPEC+ countries, including Saudi Arabia and Russia. The desert state plans to cut its production quota by one million barrels per day, while Russia plans to reduce production by 500,000.

ReadCommented by Stefan Feulner on December 20th, 2022 | 11:43 CET

Analysts optimistic for oil stocks - TotalEnergies, Saturn Oil + Gas, BP

High volatility characterized the oil markets in 2022, a stock market year that will soon come to an end. While oil prices for West Texas Intermediate, WTI, reached over USD 130 per barrel after the outbreak of the Ukraine conflict, the black gold subsequently corrected by more than 40% due to heightened fears of recession. In the long term, analysts agree that oil prices will likely rise significantly due to increased demand and tight supply.

ReadCommented by Armin Schulz on December 7th, 2022 | 09:50 CET

TotalEnergies, Saturn Oil + Gas, Shell - Energy shares as a booster for the portfolio

Now it is here, the oil embargo against Russia. The oil price was volatile before, and now with the new sanctions, it could get even more chaotic. The International Energy Agency fears that Russia could significantly reduce its oil production. That would cause the supply on the market to drop sharply and the oil price to rise. If there is a global recession, this will reduce demand, but due to the steadily increasing population, the need for oil continues to grow. As of November, there are 8 billion people living on our planet. The supply of oil will remain important in the coming years. We, therefore, take a look at three companies in the sector.

ReadCommented by Stefan Feulner on November 16th, 2021 | 12:58 CET

Nordex, Saturn Oil + Gas, TotalEnergies - Good numbers, bad numbers

While the third-quarter figures of many companies in the renewable energies sector were disappointing, oil companies were able to profit from rising oil and natural gas prices. Even though the recently concluded World Climate Conference resolved to move away from fossil fuels, experts believe that oil demand is likely to continue, if not increase, in the coming decade.

ReadCommented by Carsten Mainitz on October 21st, 2021 | 10:11 CEST

Gazprom, Saturn Oil + Gas, TotalEnergies - Rising prices continue to create a party atmosphere

Europe is currently experiencing an energy crisis. Drivers are noticing it clearly at the gas pumps and users of gas heating systems in their bills. The reasons are manifold: the recovery of the economy after Corona, the curbing of coal-fired power generation for climate protection reasons, the growing hunger for energy of emerging economies and, last but not least, weather effects. In Germany, there is an additional reason: the phase-out of nuclear energy is currently causing a strong expansion of gas-fired power generation to secure the baseload. The beneficiaries of this development are the oil and gas producers - and thus their investors.

ReadCommented by Carsten Mainitz on October 14th, 2021 | 13:30 CEST

SMA Solar, dynaCERT, TotalEnergies - Good for the climate, good for your portfolio!

The signs of the times are climate protection: In America, Joe Biden is trying to push his Green New Deal through the legislature, China is phasing out the construction of coal-fired power plants, and in Germany, the Greens will most likely be part of the next government. Industry is also rethinking its position. Recently, an alliance of 69 leading German companies called for an "implementation offensive for climate neutrality" within the first 100 days of a new government. Signatories included heavyweights such as SAP, E.ON and Bayer. The following three stocks should get a tailwind from the new climate awareness.

ReadCommented by Carsten Mainitz on August 6th, 2021 | 10:27 CEST

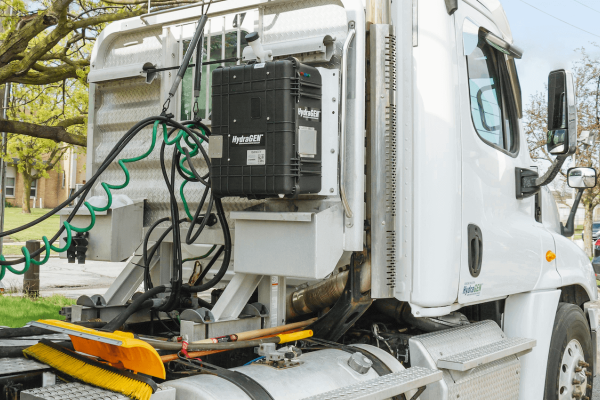

Pure Extraction, Ballard Power, TotalEnergies - Hydrogen: New Opportunities!

Hydrogen is an excellent alternative to battery-powered vehicles. A hydrogen car can be refueled in less than 5 minutes and still achieve long ranges of 400 to 650 kilometers. The fuel cell generates the electricity for the electric drive on board through the reaction of hydrogen with atmospheric oxygen. The by-products are heat and water, but no local emissions. The technology clearly scores with a high system efficiency of around 60%. The fuel cell is thus a much more efficient drive than a combustion engine, which has an efficiency of only 20 to 30%. We show you how you can benefit from the hydrogen revolution.

ReadCommented by Armin Schulz on June 25th, 2021 | 10:58 CEST

Carnavale Resources, Rio Tinto, TotalEnergies - Commodities still in hype

Commodities are in demand, as seen from the Bloomberg Commodity Index, which reached a multi-year high on June 11. Among other things, this is due to China's enormous hunger for raw materials and the infrastructure program of the USA. Inflation fears also drive more investors to commodities, as there is no end in sight to the loose monetary policy. In addition, there is a rethinking of climate protection, giving rise to hypes such as hydrogen or e-mobility. These new technologies require raw materials such as copper or nickel, and so commodity prices are picking up significantly in almost all sectors. That's why we are taking a look at three exciting commodity companies today.

ReadCommented by Carsten Mainitz on April 21st, 2021 | 09:17 CEST

Verbio, dynaCERT, Total - Which fuel share ignites the price turbo?

Bioethanol, hydrogen, conventional oil & gas. Three different types of combustion fuels, all of which have their reason for being, but also their advantages and disadvantages. Oil & gas have enabled the world to industrialize, but what does the future look like in the face of finite resources and climate change? Bioethanol is a sustainable alternative, but how will relevant quantities be produced in the face of limited arable land and an ever-growing world population? Is hydrogen the solution to all our problems? But where will the enormous amounts of energy needed to produce it come from? Will it ultimately come down to a mix? Which companies will come out on top in the end?

ReadCommented by Nico Popp on October 21st, 2020 | 12:08 CEST

Orange, Total, Osino Resources: How to benefit from growth in Africa?

Africa is a booming continent: many raw materials attract investors, and the young population is pushing into future-oriented industries with even better training. It is no wonder that many companies from Europe and North America are also doing profitable business in Africa. Mobile phone provider Orange has recognized that the continent has more to offer than many people still believe. Europe's third-largest telecommunications giant has been making aggressive acquisitions in Africa in recent years. Africa and the Middle East now account for more than 13% of sales. Instead of just telephony, Orange acts as a kind of bank in Africa. Thanks to an app, people can make payments - this is safer and more flexible than cash and is popular with the younger population.

Read