E.ON SE NA O.N.

Commented by Carsten Mainitz on September 23rd, 2021 | 12:51 CEST

Kodiak Copper, Nordex, E.ON - It is not too late!

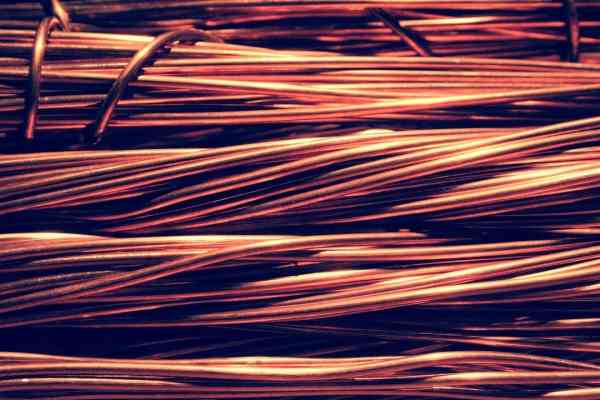

Certain framework conditions must be in place to successfully implement the energy transition and the roll-out of electromobility. First, sufficient electricity must be produced from renewable energies. Secondly, an efficient energy infrastructure must be established and thirdly, large quantities of relevant raw materials such as copper are required. The three companies below cover the central fields and should therefore be among the winners. Who is making the running?

ReadCommented by André Will-Laudien on August 19th, 2021 | 13:27 CEST

BYD, Fisker, Kodiak Copper, E.ON: Copper remains the linchpin!

According to the Paris Protocol, the implementation of the climate targets is based on the conversion to electric drives, the use of renewable energies, and sustainable raw material management. In addition to the development of new raw material deposits, especially in the field of battery metals, the topic of recycling is coming up. Here, too, it is crucial which resources are used to recover the metals. Currently, some copper projects are under development, but it will take 2-3 years before they can deliver. Part of the whole castling will also be the power companies because they have to provide the planned power purchase for the coming years, and this could be tight, especially for Germany.

ReadCommented by André Will-Laudien on May 14th, 2021 | 05:40 CEST

E.ON, Commerzbank, Scottie Resources - Surprisingly good figures!

That was a Father's Day stock market! German holidays are always a popular time for corrections because only half of the otherwise usual market participants are actually involved. The crypto values had to give up a lot after Elon Musk announced on Twitter that he would no longer allow Bitcoins as a means of payment at Tesla in the future, as their extraction is highly negative for the climate. At the same time, he called for the development of a "green coin" that can be obtained with sustainable technologies. Bitcoin lost 12%. In the group of altcoins, there were discounts up to 50%. We take a look at some stocks with special movements.

ReadCommented by Armin Schulz on April 28th, 2021 | 07:36 CEST

VW, Silkroad Nickel, E.ON - Mega electricity storage, the next big thing

We all want clean electricity. Currently, we face the problem that some of the sustainable electricity "disappears" unused. The reason is that we cannot store it and so, hours of Gigawatt electricity go to waste.

Extensive electricity storage facilities are needed, such as the 300 megawatts Tesla has built in California. What hardly anyone knows - Tesla is planning the same mega electricity storage sales in the long term as its car division. In Germany, STEAG also wants to build a mega electricity storage facility with 250 megawatts, expanding to 500 megawatts. We, therefore, look at three stocks from this sector: VW, Silkroad Nickel and E.ON.

Commented by Carsten Mainitz on April 26th, 2021 | 09:37 CEST

NewPeak Metals, Barrick Gold, E.ON - These are the favorites until the end of 2021!

Stock indices at all-time highs, volatility falls, bitcoin falls, precious metal prices consolidate - with these few words, we can outline the mixed situation on the stock exchanges. However, the threat of inflation, rising interest rates and disappointments during the current reporting season due to very high expectations could lead to a jolting deterioration in sentiment on the stock markets. It is worth taking a look at the crisis currency gold and its little brother silver. A few days ago, the World Silver Institute published the study "World Silver Survey 2021" and reached an interesting conclusion. Based on the emerging demand and supply situation, a price level of USD 32 is forecast in the second half of the year.

ReadCommented by Carsten Mainitz on March 29th, 2021 | 14:50 CEST

Osino Resources, Yamana Gold, E.ON - Traders and Contrarians beware!

Falling yields on the bond market and rising inflation could very soon trigger a crash on the bond market that would also affect the stock market - in the short term. In such a scenario, crisis currencies like gold will benefit. Companies with good projects that produce the precious metal or are on their way to do so will benefit disproportionately from the rise in precious metal prices. We show you where you should position yourself.

ReadCommented by Carsten Mainitz on March 1st, 2021 | 09:48 CET

E.ON, Defense Metals, SAP - Outperform with strong sustainability companies!

Sustainable investments play an increasingly important, sometimes decisive role for asset managers and institutional asset management. The embedding of ESG (Environment, Social and Governance) criteria in the corporate philosophy of the "money multipliers" and in particular in the process of investing money serves to differentiate from the competition, to improve risk management, to open up new business areas and to act in anticipation of possible EU regulations. For listed companies, this means making themselves attractive to investors through a transparent and comprehensive ESG policy. Several examples show that investors can outperform the broad market with ESG stocks. We present three promising investments.

ReadCommented by Nico Popp on December 16th, 2020 | 09:55 CET

E.ON, Sartorius, Defense Metals: The scarcer the goods, the higher the price

Only in times of need do you realize what matters, and this is precisely what many businesses and private individuals are experiencing during the lockdown. Industry, too, can quickly find itself in need. The best example was the first few months of the pandemic when global supply chains broke down. Today, Asia is back on the growth path and the cargo ships are fully loaded. But the industry could still be in trouble - for example, if the energy supply collapses. Only recently, it became known that increasing electromobility is causing load peaks in the power grids - for example, after work. Utilities such as E.ON want to take countermeasures and, if need be, implement so-called "peak smoothing." This implementation plan would mean that charging stations would no longer be supplied with electricity when the grid load is high. Anyone still wanting to drive an electric vehicle in the evening would be left out in the cold.

ReadCommented by Nico Popp on November 20th, 2020 | 10:59 CET

E.ON, RWE, Defense Metals: Energy investments - from boring to speculative

The experts of the investment house Clearbridge Investments report that the world could be facing a phase of economic recovery. Decisive factors for this development could be not only the measures of the central banks but also the investments in infrastructure. As the experts emphasize, investments of USD 100 billion would already create about one million jobs. Moreover, every dollar that is invested will pay off several times over in decades and contribute to growth. In contrast to previous years, not only the classic tech stocks should benefit from this growth, but also traditional sectors such as utilities.

ReadCommented by Mario Hose on January 10th, 2020 | 05:50 CET

E.ON, iWater Group, K+S - Water as a safety factor

Clean water is a high social good. In water management, different standards apply to safety depending on the use. For example, the requirements for drinking water supply and wastewater disposal are particularly high, as these areas are part of the critical infrastructure in Germany. In this context, utilities and plant operators are subject to particularly high IT security standards. An impairment caused by a cyber attack could possibly lead to supply bottlenecks and disruptions to public safety.

Read