E.ON SE NA O.N.

Commented by Carsten Mainitz on July 6th, 2022 | 12:23 CEST

Aspermont, SAP, E.ON - Market leaders for challenging times on the stock markets

Digitization and the energy transition are two major megatrends that also carry great weight on the capital markets. Market position and scalability of the solutions offered often determine whether a company can stand out or float along with the broad masses. The companies discussed today are among the leading players in their industries and have set the course for growth.

ReadCommented by Armin Schulz on May 17th, 2022 | 10:29 CEST

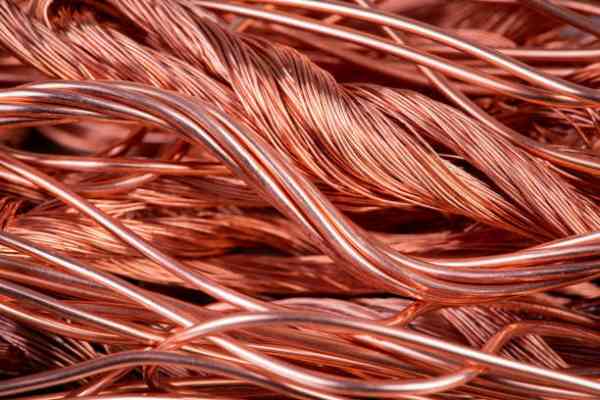

Varta, Nevada Copper, E.ON - Shares for the electrification of tomorrow

More and more people are gaining access to electricity. In order to make this possible, copper is needed because this industrial metal is the best conductor of electricity. Due to the upheaval in the energy industry towards renewable energies and the electrification of vehicles, demand is increasing. Supply cannot keep pace. Although 2021 copper production has increased by 2.2%, it is only 0.3% above the pre-Corona level. That explains the significant increase in copper prices, and we can expect a supply deficit in 2022 as well. We look at three companies for the electrification of tomorrow.

ReadCommented by Carsten Mainitz on March 10th, 2022 | 12:09 CET

Nordex, Phoenix Copper, E.ON - Under power

The Ukraine war is making the stock markets nervous. Once again, we realize that normality can end overnight. Massive sanctions have hit Russia. The dependence on our eastern neighbor for energy and raw materials is becoming abundantly clear. The oil and gas prices are soaring, which again strengthens the desire to rely on renewable energies. The growth of electromobility should gain further momentum due to current developments.

ReadCommented by Carsten Mainitz on February 21st, 2022 | 14:49 CET

E.ON, Nevada Copper, Nordex - The only way it works

In the course of the energy transition, renewable energies such as hydroelectric and solar power, wind energy, geothermal energy and renewable raw materials are replacing fossil fuels. By 2050, renewable energy sources are to cover around 60% of national consumption. Another key challenge is to increase energy efficiency. New storage concepts and intelligent energy networks play a central role here. Not to be forgotten are the essential raw materials such as copper, from whose expected price increases commodity producers can profit.

ReadCommented by Armin Schulz on February 4th, 2022 | 13:56 CET

Infineon, MAS Gold, E.ON - Inflation and supply bottlenecks cause rising prices

According to the Federal Statistical Office, inflation in Germany was 4.9% in January. Experts had expected only 4.4%. Inflation rates were particularly high for energy prices. According to ECB President Lagarde, an interest rate increase is not currently under discussion. However, since Lagarde had already miscalculated the inflation rate, there are more and more voices saying that the ECB will have to raise interest rates after all. The Fed has already hinted at an interest rate hike in March. In addition to inflation, supply bottlenecks are causing prices to rise. The automotive industry still has too few chips to ramp up production again. Today, we look at three companies benefiting from the circumstances.

ReadCommented by André Will-Laudien on January 11th, 2022 | 12:03 CET

Gazprom, Memiontec, E.ON, Siemens Energy - Water is the oil of tomorrow!

In the mind of current politics, the world of tomorrow is supposed to get by without oil and petroleum products. Modern fuels with fewer emissions and the abandonment of plastic packaging could reduce the amount of oil and plastic products needed. But with this line of thinking, all countries would have to act in unison and put the petrochemical industry on the sidelines. Whether this will result in less plastic ending up in the Pacific remains questionable, but we are already experiencing one effect: a noticeable increase in the price of all energy and utility services. Green policies are nice, but they slow down economic performance considerably. Who will benefit from the long-term policy choices?

ReadCommented by Carsten Mainitz on December 30th, 2021 | 11:30 CET

Nevada Copper, Nordex E.ON - What is next in 2022?

Several ingredients are needed to make the energy transition and electromobility a sustainable success. First and foremost, raw materials such as copper and lithium. Then there is a need for energy sources such as solar and wind, and finally, a suitable infrastructure. Therefore, within the megatrend, there are various starting points for profiting with corresponding shares. We have three promising stocks in our bag. Who will win the race in 2022?

ReadCommented by Nico Popp on December 27th, 2021 | 07:53 CET

RWE, Memiontec, E.ON: You know what you've got here

Utilities have long been considered boring. Then they were unpopular for a long time because of their involvement in nuclear power. That has left its mark. Utilities are still out of favor with many investors. But share price developments have long since spoken a different language. Some utilities are even benefiting from the hype surrounding renewable energy. We present three solid shares that are anything but boring.

ReadCommented by Carsten Mainitz on December 16th, 2021 | 12:43 CET

Memiontec, E.ON, RWE - Fighting the crisis with basic services!

A ghost is haunting the world - the ghost of inflation. With 6.8% for November, the USA reports the highest rate since June 1982. 5.2% inflation in Germany was also the highest in 30 years. Central banks are under pressure to act, and tension is rising on the stock markets. Experts expect inflationary pressure to ease again somewhat in 2022. However, no one knows whether new variants of the Coronavirus will again trigger disruptions in supply chains. In such cases, in addition to tangible assets and commodities, shares in companies that provide basic supplies are recommended. Here are interesting candidates that could provide a safe haven for investment.

ReadCommented by André Will-Laudien on December 7th, 2021 | 10:51 CET

E.ON, Memiontec, Nordex, Siemens Energy - Well supplied with water, wind and sun!

Utility stocks led a shadowy existence for a long time. Too little sexy, too little growth! But with the political closing of ranks in Glasgow, the tide has turned worldwide in favor of climate investments. Again, it is about the old discussions on coal and a nuclear phase-out in exchange for the further expansion of renewable energies such as water, wind and sun. However, there are already 30,000 wind turbines in Germany with a combined capacity of 56 gigawatts and another 60 gigawatts of installed photovoltaic peak capacity, which already replaces a good 80 nuclear power plants - if the wind blows constantly and the sun shines properly. Who else can grow in this environment?

Read