VARTA AG O.N.

Commented by André Will-Laudien on June 22nd, 2021 | 12:07 CEST

Varta, BYD, NIO, Tesla, Almonty Industries - Battery becomes next billion-dollar topic!

The extent to which reality sometimes diverges from stock market trends is especially noticeable in hotly traded stocks. Early last week, it was the postponement of CureVac's vaccine launch that caused the stock price to lose 50% briefly. Then on Friday, there was the virtual AGM of Varta AG. The mood was very good in the run-up and the share reached a 5-month high of EUR 142. But then there was a correction of over 10% and the price found itself yesterday at EUR 127. The reason: premium manufacturers like Porsche are now going into battery research themselves. This opens up a competitor for Varta among the intended customers - they certainly had not bet on this, but the battery issue is a billion-dollar thing!

ReadCommented by Nico Popp on June 21st, 2021 | 11:25 CEST

BYD, QMines, Varta: Investors must now think outside the box

E-cars are back! It is not just on the roads that we see more and more electric cars. Shares related to electromobility have also been at the top of the price list again for a few days. After major car manufacturers had already ventured to move toward electromobility months ago, the air was out for some shares. Now, however, the stocks are starting to jump again. In the slipstream of BYD and Co., other shares could pick up. We present some attractive stocks.

ReadCommented by Armin Schulz on June 18th, 2021 | 12:33 CEST

Kodiak Copper, Deutsche Telekom, Varta - What is going on in commodities?

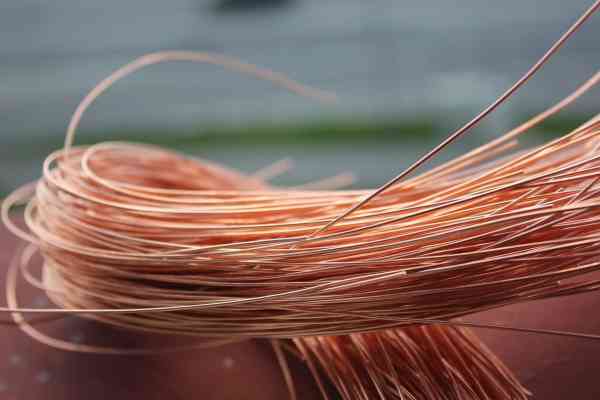

The hype around wood lasted until May 25, after which the rally ended and the price consolidated by a whopping 40%. Gold was trading above USD 1,900 last week. In parallel to this article's writing, the price is below USD 1,800. A minus of about 5.5% within five days, and the industrial metal for electrification and copper, dropped by 8%. Currently, all factors speak for a further increase in commodity prices. Real interest rates are still negative, and inflation should also remain high. The Fed could not help calm the markets, although interest rate hikes were not announced until 2023. However, the Fed intends to continue its bond purchases. Consolidation can always occur after strong increases, and so we will see long-term rising commodity prices, especially for precious metals and copper.

ReadCommented by André Will-Laudien on June 17th, 2021 | 11:04 CEST

Varta, Apple, BYD, EuroSports Global - The stock market stars of electric mobility

The number of companies focusing on the electric mobility sector has been rising sharply for the past 2 years. Different business models and the majority of the companies are suppliers to larger integrators. Then there are many followers and startups that still want to harvest a piece of the future pie. For many ideas, time is ticking - time to market is the keyword - because the race for ready and in-demand products started about 5 years ago. Those who are just starting out today could be too late to market once the lengthy and costly development and testing phases have been completed. Apple and Google are investing billions to be part of it. We deal with a few of these protagonists.

ReadCommented by Nico Popp on June 15th, 2021 | 11:22 CEST

Varta, BYD, NSJ Gold: What investors should watch out for

The die is cast: Cars will go electric in the future. A clear course has also emerged in monetary policy in recent years: Central banks tolerate more inflation and stimulate the economy. Governments are also in a spending mood: infrastructure, state aid, investments for the future - at the latest since the outbreak of the pandemic, the powers that be have been governing according to the principle of "What is the cost of the world?" We present three shares that can profit.

ReadCommented by André Will-Laudien on June 11th, 2021 | 08:26 CEST

Varta, MorphoSys, Theta Gold Mines - Strong tailwind from politics!

As an entrepreneur, it is a particular challenge today to find business models that will come into political focus in the near future. We had this at the turn of the millennium in mobile communications when licenses were sold for future generations. In the meantime, there have been important changes in infrastructure and energy policy - one man's joy is another man's sorrow - and now the government is considering the expansion in the direction of climate protection, only approving new houses with mandatory solar installations. Another major intervention, but certainly in the right direction!

ReadCommented by Nico Popp on June 10th, 2021 | 10:25 CEST

BYD, Varta, Deutsche Rohstoff: These are the stocks of the future

New technologies are turning the markets upside down. Electromobility is fundamentally changing the automotive industry. Whereas in the past, it was engine technology that mattered, today, it is the batteries that determine which cars are considered modern and which are not. The trend toward renewable energy sources is also changing as wind turbines and solar cells require many different raw materials and drive demand. We highlight three companies along the supply chain.

ReadCommented by Carsten Mainitz on June 8th, 2021 | 11:25 CEST

BYD, GSP Resource, Varta - Where do we go from here?

Electromobility is experiencing strong growth rates. The International Copper Association forecasts a considerable increase in demand for copper over the next 10 years, driven mainly by e-vehicles but also by industry and technology. Copper, lithium & Co are making the triumphant advance of electrification possible in the first place. We present you with exciting shares of the megatrend.

ReadCommented by Carsten Mainitz on May 21st, 2021 | 09:14 CEST

Silkroad Nickel, NIO, Varta - Pre-programmed bottlenecks = price opportunities

Electromobility and battery technology are inextricably linked. Sales figures for e-vehicles are rising rapidly and will multiply in the next few years. This global increase in production will become challenging in many places. Not just with the competitive situation, which is becoming increasingly intense as Chinese players gain strength, but also the availability of the critical raw materials for battery production. There are signs of a huge supply deficit in nickel over the next few years. We show you how to invest with foresight and profitably.

ReadCommented by André Will-Laudien on May 20th, 2021 | 08:23 CEST

Varta, PlugPower, FuelCell, Mineworx Technologies - Environmental stocks are booming!

The stock market is showing initial downward reactions. Having trended close to its high of 15,508 points again at the beginning of the week, the DAX saw a sell-off in growth stocks yesterday. Again, hydrogen stocks, e-mobility and especially crypto stocks were targeted by sellers. The crypto collapse of up to 50% was once again fueled by the Chinese government yesterday. The nationwide trading ban declared since 2013 was repeated accordingly. One can well imagine that trader turnover will soon be controlled and sanctioned on the Internet as well. The crypto community reacted in shock to this news.

Read