VARTA AG O.N.

Commented by Stefan Feulner on May 14th, 2021 | 15:56 CEST

BYD, Saturn Oil + Gas, Varta - Now the lid is flying off!

In April of last year, the outbreak of the Corona pandemic caused a crash in the oil markets. A sharp drop in demand due to global lockdowns and a massive supply overhang caused the sell-off and caused oil prices to drop below USD 20. Oil producers tried to save what could be saved by hedging and shutting down production. In contrast, other players used the Crisis as an opportunity and took over distressed competitors at bargain prices. One Company is now announcing a long-planned takeover of a major project that will multiply both sales and profits in one fell swoop - The rise to a new dimension with revaluation.

ReadCommented by André Will-Laudien on May 11th, 2021 | 10:45 CEST

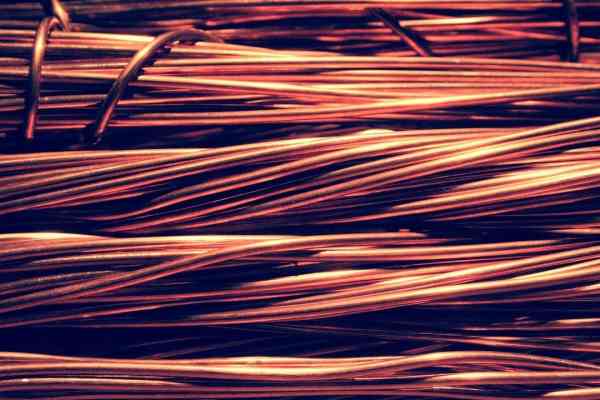

Varta, NIO, Standard Lithium, QMines: Total Copper Boom - Watch out!

Availability of copper is one of the bottlenecks in electromobility. Its price hit a new record high last week at USD 10.445 per ton. Other commodities such as iron ore and uranium have also been in high demand recently. There are reasons for the price boom on both, the demand and supply side. Demand is currently highly driven by the prospect of rapid economic improvement. The accelerating rate for Corona vaccinations gives hope for fewer restrictions and an upturn in economic activity. Supply is currently unable to keep up, especially for technological commodities such as copper, nickel and lithium. We take a look at key industry players.

ReadCommented by Nico Popp on May 10th, 2021 | 09:40 CEST

Ballard Power, Varta, Defense Metals: This trend is still in its infancy

All investors want to invest in the future. But what does this future look like? For many private investors, hydrogen was the topic of the future for many months. But hydrogen investors are now pretty much left out in the cold. Car manufacturers have turned their attention to battery cells, and there are other opportunities for investors to profit from the technologies of the future. But what about the current representatives of hydrogen technology? Are the opportunities for entry favorable right now? Or should investors take to their heels?

ReadCommented by Armin Schulz on May 7th, 2021 | 13:11 CEST

Kodiak Copper, BASF, Varta - Copper study ignored

The International Copper Study Group (ICSG) sees a slight oversupply of the copper market in 2021 and 2022. The main reason for this is said to be dwindling Chinese demand. The demand is decreasing because China is expanding mine production and copper refining by about 3% each. After the study's publication, the price per ton of copper rose again to over USD 10,000. Possibly driven by the news from Chile, which produced 2.2% less copper than last year. Similar news can be heard from other major copper producing countries such as Peru. Copper concentrate supply is low at the moment. We, therefore, look at one copper explorer, one copper producer and one consumer.

ReadCommented by André Will-Laudien on May 6th, 2021 | 10:52 CEST

Deutsche Rohstoff, Varta, ThyssenKrupp, Glencore: These stocks are on the rise!

Commodity companies around the world are producing at the limits of their capacity. The omnipresent supply deficit is not only boosting commodity prices themselves, but it is also giving the mine operators a good boost. The first quarter of 2021 is showing one of the strongest inflationary pushes in the resources sector in 10 years. Copper, for example, is now trading at the USD 10,000 mark, nickel is at a 10-year high of USD 17,700, and there is no stopping palladium. We take a closer look at some of the profiteers.

ReadCommented by Carsten Mainitz on May 6th, 2021 | 10:37 CEST

BYD, Nevada Copper, Varta - A dedicated line for share price gains?

Electromobility is an important component of mobility concepts. To what extent other types of drive will overtake the electric car, or whether we will have to realize in 10 years that the whole topic was politically misguided, is another matter. The fact is that the demand for electric cars and batteries is growing enormously. The demand for the raw materials used in them, such as lithium and copper, is also increasing. We present three promising investments that reflect different facets of the investment trend.

ReadCommented by Nico Popp on May 5th, 2021 | 09:10 CEST

Varta, BYD, SunMirror: Short-term prospects in check

Shares related to electromobility and hydrogen have been the yield drivers in recent months. But why are stocks like Varta and BYD weakening now? After the enormous price increases, speculators are pulling back. But this is not necessarily a bad signal. Stocks showing relative strength in the current phase could be at the forefront of the subsequent rise. We outline three exciting investment stories.

ReadCommented by André Will-Laudien on May 2nd, 2021 | 19:04 CEST

BYD, NIO, Varta, Kodiak Copper: No e-mobility without copper!

The copper price is just about to climb the USD 10,000 mark. For many market participants, the scenario for the industrial metal is set. Because since the public declaration of the automotive industry to make the e-vehicle the No. 1 means of transportation, the demand for copper and battery metals is shooting through the roof. Mine operators worldwide are alarmed, but how do you increase capacity in the short term when there are too few developed projects? We dive into the market.

ReadCommented by Armin Schulz on April 23rd, 2021 | 07:27 CEST

Varta, Deutsche Rohstoff, JinkoSolar: World Economic Forum praises climate investments

According to a study by the World Economic Forum, USD 500 billion was invested in renewable energy worldwide in 2020. The study compared 115 countries and the experts conclude that all 10 leading economies have improved environmentally, specifically in carbon in the energy mix. Leading the way are Sweden, Norway and Denmark. Germany ranks 18th, mainly because of its coal-fired power plants.

The electrification of the world is also progressing; 400 million people have gained access to electricity since 2010. Despite all the developments in renewables, around 80% of the world's energy is still generated from fossil fuels. In this context, today, we take a look at stocks from the energy sector.

Commented by Nico Popp on April 21st, 2021 | 09:19 CEST

NEL, Varta, Kodiak Copper: The market has missed this news

The mobility revolution is real. Last year, stocks like NEL sparked hydrogen fantasy among investors, but battery-powered electromobility will come back into focus in 2022. The reason: Companies such as Volkswagen and Daimler are increasingly committing to electromobility. And that opens up opportunities. We present three stocks.

Read