RHEINMETALL AG

Commented by Nico Popp on April 12th, 2022 | 18:33 CEST

The biggest crisis since 1945: Rheinmetall, Kleos Space, Airbus

Foreign Minister Annalena Baerbock has spoken out in favor of supplying "heavy weapons" to Ukraine. For years, arms deliveries were a thorn in the side of the Greens. It is remarkable that Baerbock, who has always been considered "Realo", is now even counted among the "hawks" on the big international political stage. Even though critics from all ranks may interpret the move negatively, Baerbock is demonstrating pragmatism and toughness. These qualities could be the key to de-escalation in the most profound crisis since World War II. We examine the current economic climate and look at three companies and their shares.

ReadCommented by Stefan Feulner on April 9th, 2022 | 07:27 CEST

BioNTech, Triumph Gold, Rheinmetall - Uncertainties everywhere

The ongoing fighting in Ukraine and concerns about an escalation of the situation are worrying capital markets worldwide. Nevertheless, the leading stock market barometers were able to distance themselves significantly from their lows. Now, the next blow has followed with the publication of the FED's meeting minutes. The US Federal Reserve wants to accelerate the reduction of its balance sheet total and let bonds worth up to USD 95 billion expire without buying again. In doing so, the monetary authorities are hitting technology stocks in particular, which have already been in a sharp correction since the beginning of the year. Gold, on the other hand, is barely reacting despite the expected interest rate hikes, a strong sign for the precious metal.

ReadCommented by Armin Schulz on April 4th, 2022 | 12:21 CEST

BASF, Defense Metals, Rheinmetall - Shares that depend on rare earths

The Ukraine crisis has shown us how dependent we are on Russian energy imports. The German government now wants to step on the gas pedal even more for renewable energies. The problem is that new technologies such as electric vehicles or wind turbines almost always require rare earths. But rare earths are not only needed there; the defense industry needs these raw materials to optimize steel or as magnets in a wide variety of weapons technologies. But rare earths are also present in the household, in smartphones, notebooks and many other technological devices. Today we take a look at three companies around rare earths.

ReadCommented by Nico Popp on March 30th, 2022 | 10:09 CEST

Turn of the times! Stock winners and losers: Rheinmetall, Ximen Mining, ThyssenKrupp

Disputes surrounding the Ukraine war are taking on various dimensions drawing wide international circles. After China, India's role in the conflict could now also increase. According to reports by Deutsche Welle, there have been lively exchanges between Russia and India in recent weeks. India is seeking a permanent seat on the UN Security Council and has recently begun to buy Russian oil. Cooperation between the two financial systems is also conceivable. That would give Russia access to the capital markets again.

ReadCommented by André Will-Laudien on March 28th, 2022 | 13:40 CEST

Rheinmetall, Hensoldt, Kleos Space - These stocks have the Ukraine perspective!

No one would have thought that the sense of peace and security that Europe has built over the past 75 years could dissolve in just 4 weeks. The war in Ukraine is taking on unimagined traits, with threats between East and West intensifying at what feels like 24-hour intervals. With each verbal attack by Joe Biden, communications become tighter and more threatening. What will our world look like after another 4 weeks? We do not know. At any rate, the capital markets are trying to price in the consequences of the war. They are still relatively optimistic, possibly even too positive, considering the enormous inflationary pushes and the still unclear economic effects. We look at some price outliers in this explosive environment.

ReadCommented by Carsten Mainitz on March 25th, 2022 | 13:13 CET

Defense Metals, Hensoldt, Rheinmetall - Special boom for the defense industry

The war in Ukraine is giving the defense industry more weight. But what is the focus? Defense, deterrence, or war of aggression? The shares of industry representatives have recently benefited significantly from higher defense budgets and orders. What one thinks of this from a moral point of view is another matter. On a more sober note, stronger demand and earnings growth lay the groundwork for higher share prices.

ReadCommented by Stefan Feulner on March 23rd, 2022 | 14:01 CET

Rheinmetall, Altech Advanced Materials, K+S - Seizing the momentum

Since the outbreak of the Ukraine conflict about three weeks ago and the announcement of sanctions against Russian goods and companies, the winners and losers on the stock market have clearly emerged. While defense companies were not an investment object for fund managers or private investors from an ethical point of view in the recent past, there is now a strong investment in companies such as Rheinmetall, Hensoldt & Co. At the same time, no defense contracts have yet been awarded by the German government, nor is it clear whether the necessary raw materials will be available. Therefore, it would come as little surprise if the currently inflated valuations were to implode soon.

ReadCommented by Armin Schulz on March 23rd, 2022 | 12:01 CET

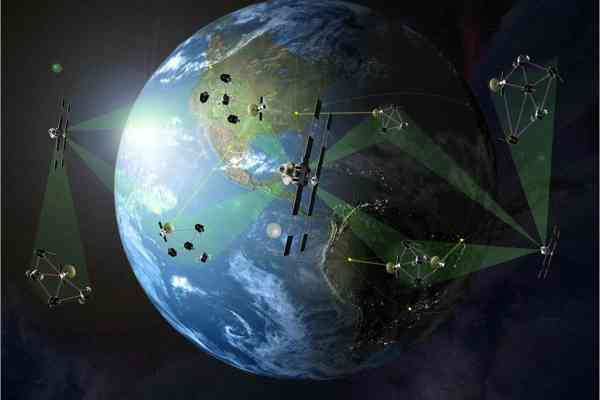

Rheinmetall, Kleos Space, Lufthansa - Which shares benefit from the war-related supply chain problems?

Supply chain problems began in earnest with Corona, and just when it seemed the situation was returning to normal, the Ukraine conflict started. We are already seeing the effects in the supermarket today. Once again, no toilet paper, and you also have to be lucky with cooking oil, pasta and flour. But the industry is also suffering, with the automotive, pharmaceutical and chemical sectors being particularly affected. It is not only due to a lack of materials but also to longer transport routes, as Russia, for its part, has closed its airspace to foreign machinery. Imports from China thus have a longer route - the only alternative remains shipping, which in turn is significantly slower.

ReadCommented by Fabian Lorenz on March 22nd, 2022 | 12:31 CET

Analysts enthusiastic about S&T, Rheinmetall and Phoenix Copper - TUI share under review

The shares of S&T and Rheinmetall were among the day's winners yesterday. Austrian IT services provider S&T gave a positive outlook for the current year and fended off Viceroy's short attack. The loss of sales in its Russian business is expected to be partially offset by orders in the armaments and cybersecurity sectors. The guidance from January was raised slightly, and the dividend is also expected to increase. Analysts were pleased and the stock gained more than 10%. Rheinmetall shares benefit from positive analyst recommendations, with the price targets increasing up to EUR 210. In contrast, Jefferies is not convinced by the share of TUI. Phoenix Copper is benefiting from the commodity market. The experts at SISM Research see more than 100% upside potential for the commodity explorer.

ReadCommented by Armin Schulz on March 11th, 2022 | 11:19 CET

Rheinmetall, Triumph Gold, Siemens Energy - Safe havens despite the crisis?

The Ukraine crisis finally broke the camel's back. Previously, neither the announcement of interest rate hikes nor galloping inflation could move the stock markets to a proper correction. With the beginning of the Russia attack on Ukraine, the indices have lost significant value. Mutual economic embargoes weaken each other, and in the end, the consumer will pay the bill. But as in every crisis, there are winners. Weapons manufacturers are suddenly booming, the price of gold has soared, and renewable energies are being given extra support to ensure independence from Russian energy imports. Today, we look at one company from each of the three sectors.

Read