INFINEON TECH.AG NA O.N.

Commented by André Will-Laudien on September 7th, 2022 | 13:41 CEST

Artificial intelligence shopping with these stocks: Infineon, BrainChip, Porsche, VW

It is hard to imagine tomorrow's high-tech applications without them: small, miniaturized chips that take over the intelligent control of our modern appliances. These nimble marvels must not only perform their programmed tasks but also save power and space. Engineering centers worldwide are trying to develop chips that learn from exogenous influences, i.e. that detect their environment through speech recognition or corresponding sensor technology, evaluate states and develop reaction categories. For example, if an object the size of a ball rolls from the right edge of the road across the center of the lane, such systems are supposed to trigger braking with the help of optics and sensor technology. Bravo if it works - where are the opportunities in the current stock downturn?

ReadCommented by Stefan Feulner on August 17th, 2022 | 10:41 CEST

Positive signs - Infineon, Defence Therapeutics, MorphoSys

A well-known rule says that stock markets trade the future. At the moment, politicians and monetary watchdogs are fighting to contain rampant inflation on the one hand and to prevent a global recession from occurring on the other. Added to this are geopolitical tensions in Ukraine and Taiwan. But the capital market has been robust for weeks, with the DAX alone gaining around 1,500 points since the beginning of July in this year's summer slump. But things are not turning out as predicted by the crash prophets, who are again in the spotlight. There are increasing signs that the stock market has already seen its lows.

ReadCommented by Nico Popp on August 16th, 2022 | 12:18 CEST

Gamechanger for chip manufacturers: Infineon, BYD, BrainChip, Volkswagen

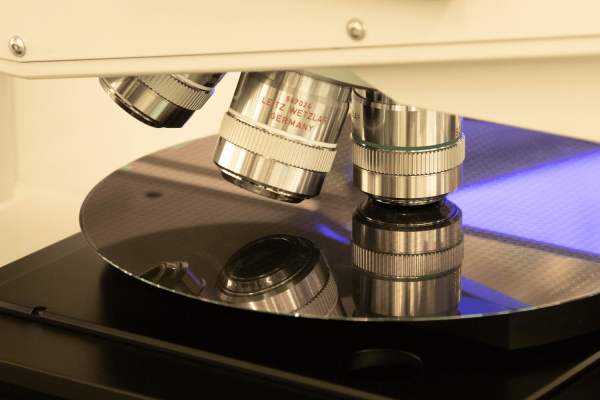

Computer chips remain in demand. German manufacturer Infineon recently told Handelsblatt that the Company is planning deliveries with a lead time of around two years or more together with customers. As the newspaper estimates, this market situation is favorable for investors and ensures robust margins. We get to the bottom of the chip boom and explain where investors can find opportunities and where risks lie.

ReadCommented by Armin Schulz on August 8th, 2022 | 12:45 CEST

Infineon, BrainChip, Nvidia - Chip shortage will continue in 2022

The chip shortage is not only omnipresent in the automotive industry. Most recently, AOK was no longer able to issue electronic health cards to its policyholders because the chips were missing. According to McKinsey, the semiconductor industry is expected to grow by 6-8% annually until 2030. Nancy Pelosi's visit to Taiwan could further fuel the chip crisis in the future. It is important to know that the island nation produces about two-thirds of all microchips needed worldwide. There is a latent danger that China will want to annex Taiwan. The USA is already trying to make itself less dependent on Asia. To that end, a USD 369 billion semiconductor manufacturing stimulus bill has been passed by Congress. Today we look at three companies that will benefit from the investment.

ReadCommented by Stefan Feulner on August 4th, 2022 | 13:53 CEST

Crash! Which shares are attractive now - TeamViewer, Viva Gold, Infineon

The technology sector has been in a sharp correction for months. The leading technology index from the US alone, the Nasdaq-100, recorded price losses of around 34% up to its low. Since the middle of last month, a countermovement has set in. However, many companies are still at an interesting entry level. Currently, the season for the publication of the figures for the second quarter is also underway. Here it becomes clear which companies you can build on in the future or which title you should remove from your portfolio.

ReadCommented by André Will-Laudien on July 11th, 2022 | 15:32 CEST

Take advantage of the crash in these stocks: Infineon, Siemens, BrainChip and Apple in focus!

High-tech, cars, household appliances, smartphones, renewables - the list of products seems endless. What they all have in common is the need for smart chips: But the effects of the global chip shortage are omnipresent. From today's perspective, leaders would undoubtedly like to turn globalization back a bit because the relocation of production sites around the world is creating huge problems ranging from logistics to high procurement prices to completely destroyed supply chains. If Central Europe does not grasp its energy dependence on the East soon, hard times may lie ahead for local industrial locations. Where are the opportunities in a fragile environment?

ReadCommented by Carsten Mainitz on June 15th, 2022 | 15:15 CEST

SAP, BrainChip Holdings, Infineon - Chip stocks before the next wave!

The current interest rate decision is casting its shadow ahead, and the horrendously rising inflation rates are unsettling market participants. In the fight against inflation, the US Federal Reserve will likely shrink its balance sheet further and herald more aggressive interest rate steps. However, there is then a risk of significantly weakening the economy. That would seriously worsen the macroeconomic picture and significantly increase the risk of the US sliding into recession. The biggest losers from a major interest rate hike will likely remain interest rate sensitive growth stocks. However, such a scenario is already priced in for many stocks.

ReadCommented by Stefan Feulner on May 31st, 2022 | 13:22 CEST

Chip shares turn - Infineon, Nvidia and BrainChip in the next upward wave

Despite the chip shortage that has persisted since last year and the associated booming business of manufacturers, they came under a lot of pressure on the stock market in recent weeks in the wake of the weak overall market. The prospects for the industry remain positive, the semiconductor shortage will continue until at least 2023, and the order books of the producers are full to bursting. Now, many companies are starting to bottom out. In the long term, Nvidia and AMD are likely to be quoted significantly higher. A newcomer is also making a run for the top again after a lengthy correction phase.

ReadCommented by André Will-Laudien on May 25th, 2022 | 11:46 CEST

Infineon, BrainChip, Daimler, Volkswagen - High-tech stocks at their best!

The global automotive business is operating according to new laws. That is because e-mobility is a done deal, and if politicians' pronouncements are anything to go by, combustion engines will be history from 2030. As a result, the prerequisites for the industry are also changing because intelligent and powerful chips remain the basis for the further development of future mobility. Supply chains and Chinese reliability are still a problem, and high raw material prices will not make the new vehicles any cheaper. Innovations could be an effective means of combating the erosion of margins. Who is ahead in the market of high-tech players?

ReadCommented by Fabian Lorenz on April 26th, 2022 | 12:15 CEST

Chip industry booming: What are Mercedes partners BrainChip, Nvidia and Infineon doing?

Chip stocks are having a hard time at the moment, although the market is undersupplied and will probably remain so for some time. This was also highlighted by figures from semiconductor equipment supplier ASML. Orders at the world's largest supplier of lithography systems to semiconductor manufacturers were around EUR 7 billion in the first three months of 2022, well above market expectations. In addition, ASML has indicated targets through 2025. The Company intends to expand production capacities in view of the high demand. Mercedes partner BrainChip should also benefit from these positive industry prospects. And, of course, industry heavyweights such as Nvidia and Infineon.

Read