BYD CO. LTD H YC 1

Commented by Fabian Lorenz on January 31st, 2024 | 07:30 CET

BYD disappoints! Siemens Energy share gives hope! The cash register is ringing at Klimat X Developments!

The preliminary figures did not generate any positive impetus - BYD shares continued to fall. Profits increased significantly, but analysts had expected more. A trend in the fourth quarter is also ringing alarm bells. Siemens Energy surprised positively last week with preliminary figures. Analysts have since had their say, and the share price targets diverge widely. Will the forecast be raised, or was Q1 a positive blip? Tesla has shown in recent years that one can earn a lot of money with CO2 certificates. Klimat X Developments has fully focused on this business model. In 2023, the reference project was driven forward, and another milestone payment was received. When will the share take off?

ReadCommented by Armin Schulz on January 18th, 2024 | 08:15 CET

Nel ASA, Klimat X Developments, BYD - Green business: The Success Factor of Climate Neutrality

In today's business world, climate neutrality is no longer just a catchphrase - it has become a crucial factor for long-term success and sustainability. More and more companies are recognizing that reducing their carbon footprint is both an ethical and economic necessity. But how does one achieve this coveted climate neutrality? Carbon credits are proving to be a key tool here. In addition, innovative technologies such as hydrogen energy and electromobility are increasingly becoming the focus of companies that view the transition to green energy as an essential building block for a sustainable corporate strategy. Today, we look at three companies that are working towards climate neutrality.

ReadCommented by André Will-Laudien on January 16th, 2024 | 07:15 CET

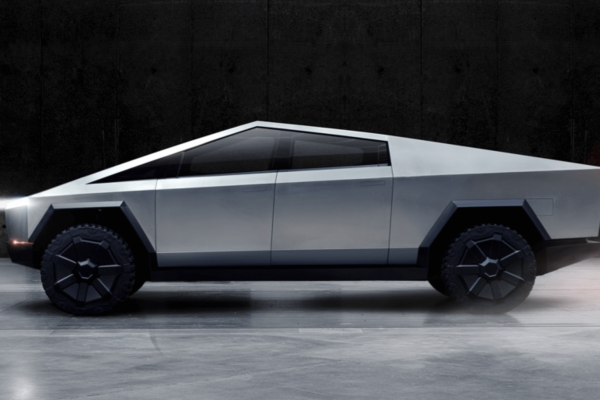

E-mobility boom 2024, when will the German vehicle market take off? BYD, Edison Lithium, VW, BMW

The last word in e-mobility has not yet been spoken. While BYD is leading the sales list worldwide, Tesla is struggling with important supplier parts and has had to halt production temporarily. German manufacturers have used the last two years to catch up on technical backlogs and are preparing to score points in the "electric world", too. Last year, buyers were offered a state environmental bonus on top, but this was cancelled before Christmas. Now, the market has to prove that it can survive with fewer subsidies. Where are the opportunities for investors?

ReadCommented by Armin Schulz on January 11th, 2024 | 07:30 CET

Altech Advanced Materials, BYD, JinkoSolar - The Era of Energy Autonomy

In an era where energy not only needs to be generated but also intelligently managed, batteries and energy storage systems are increasingly taking centre stage. They are the inconspicuous heroes of the energy transition that will significantly shape our understanding of sustainability. While renewable energy from sun, wind and water is increasingly feeding into our power grid, reliable storage solutions are the key to using energy where and when it is actually needed. We look at Altech Advanced Materials, a company offering two exciting solutions for the future, and examine BYD, the top dog of electromobility alongside Tesla. Lastly, we explain why JinkoSolar can benefit from future energy storage systems.

ReadCommented by André Will-Laudien on January 8th, 2024 | 07:00 CET

Start of the year with GreenTech hype! Will BYD, Klimat X Developments, Plug Power and Freyr Battery deliver now?

The year 2024 will be the next test for GreenTech shares. In the past investment year, despite bullish markets, they were the biggest losers in the portfolio. Plug Power and Freyr Battery incurred the most significant negative returns, ranging from 70 to 80%, but BYD and Klimat X also saw a slight decline. However, with the resolutions passed in Dubai and new government climate protection programs, things could pick up again in the new year. But who can win the coveted government contracts? We analyze the opportunities and risks.

ReadCommented by Juliane Zielonka on January 5th, 2024 | 08:45 CET

Altech Advanced Materials, BYD, and Rheinmetall - Growth drivers: innovation, market power and strong cash flow

Made in Germany stands for durability. Battery storage pioneer Altech Advanced Materials stands out as a German company with innovative material developments that can radically change electromobility and stationary energy storage with a 30% increase in efficiency. Meanwhile, the Chinese car manufacturer BYD has established itself as the leader in the electric vehicle market, surpassing Tesla in terms of sales figures in Q4/23. Rheinmetall is also strongly expanding its electromobility divisions and can look forward to a 3-digit million dollar order in its ubiquitous division. Find out who is setting new standards and shaping the future here.

ReadCommented by André Will-Laudien on January 4th, 2024 | 07:15 CET

This is where the music plays: Top values wanted for 2024! Mercedes, Globex Mining, BYD, and NIO to the inspection!

It was a challenging year for the otherwise popular automotive stocks. Berlin and Brussels no longer want combustion engines, but consumers do. Then, to top it off, the environmental bonus was also cut at Christmas. The traffic light coalition believes that e-mobility should now sell itself. Far from it, say the experts: combustion engines still account for 97% of road vehicles. Those in office are governing for minorities, as there has long been a lack of scientific facts and a lack of tact. But well, customers are voting with their feet, turning new vehicles into shelf warmers and buying their beloved diesel SUVs through the used car market. This market could even flourish over the next few years and demand scarcity premiums. Where are the opportunities for investors?

ReadCommented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

ReadCommented by Armin Schulz on January 2nd, 2024 | 08:00 CET

BYD, a pioneer in electromobility: Can First Hydrogen and Plug Power follow suit with hydrogen?

The future of mobility is increasingly environmentally conscious and innovative: now that electric cars have firmly established themselves on the market, hydrogen propulsion is emerging as a promising candidate for a green transportation revolution. Driven by the increased use of renewable energies, we are seeing growing potential for the production of green hydrogen. It is in the spotlight of current energy strategies and could come into its own, particularly in areas of mobility where electric batteries are reaching their limits. We look at the top dog of electromobility and two companies that focus on hydrogen.

ReadCommented by André Will-Laudien on December 27th, 2023 | 07:00 CET

The 2024 share rocket without e-funding - BYD, Defense Metals, Porsche and Volkswagen

With the supplementary budget 2023, the fate of the e-funding was sealed. On December 16, the purchase premium hammer came down in an "ad hoc announcement" from Berlin: The funding of up to EUR 4,500 for the purchase of a new e-vehicle has expired with immediate effect. This was announced by the Federal Office for Economic Affairs and Export Control (BAFA). The deadline for applying for the funding ended on December 17, 2023, meaning that e-mobility is now a thing of the past. Only the reduced tax rate under the company car scheme and the general exemption from vehicle tax remain. Consumer advocates are complaining about the unequal treatment of different mobility concepts that have prevailed for years, and the Federal Constitutional Court will likely have to deal with this issue in due course. Time for investors to rethink - where are the opportunities in the investment year 2024?

Read