ALMONTY INDUSTRIES INC.

Commented by Nico Popp on February 25th, 2022 | 10:15 CET

Varta, Almonty Industries, NEL: New battery metal and hydrogen hope

Hydrogen is dead; are batteries the future? Not at all! If you talk to industry representatives, it quickly becomes apparent that energy sources for mobility are undergoing rapid change. Batteries that were the ultimate yesterday may be hazardous waste tomorrow. The reason: new material mixtures make batteries in electric cars more durable and better. Investors who back the wrong horse are quickly left out in the cold. Current developments in hydrogen show that even the lamest horse has a chance in the long term. We take a closer look at three shares for you.

ReadCommented by Carsten Mainitz on February 15th, 2022 | 13:35 CET

Almonty Industries, Mercedes-Benz Group, Varta - Highs and lows, what to do?

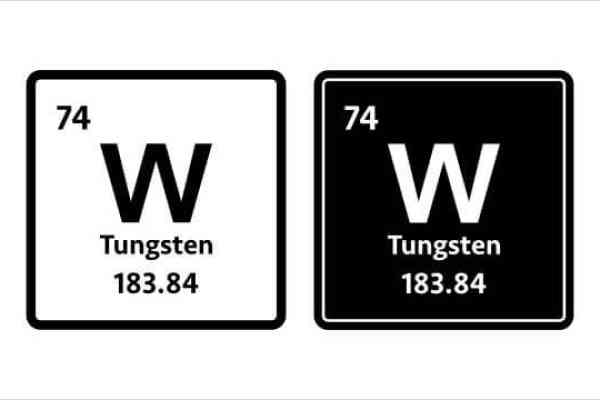

Without raw materials, life in many sectors of the economy comes to a standstill. The economically most important raw materials with a high supply risk are referred to as critical raw materials. The European Commission counts 30 elements in this group, including tungsten and lithium. Demand rising sharply above supply has caused prices to increase significantly for some time. Raw material producers are on the winning side. Buyers have to do their homework.

ReadCommented by Fabian Lorenz on February 8th, 2022 | 11:23 CET

Varta, Nel ASA, Almonty Industries: Get in now?

The electric car is currently outpacing the combustion engine: around 350,000 pure e-cars were registered in Germany alone in 2021. According to the Center of Automotive Management (CAM), this means that the market share has almost doubled to 13% in one year. Germany is now the third-largest single market for pure electric vehicles after China and the United States. However, according to CAM, China is ahead with around 2.7 million electric vehicles. Nevertheless, due to global subsidies, the trend toward electromobility will continue, creating opportunities for investors. The winners in electromobility include battery and raw material producers such as Varta and Almonty Industries. Demand for hydrogen - and therefore Nel - will also increase. All three stocks have lost significant ground. But there are positive developments. Is it worth getting in now?

ReadCommented by Stefan Feulner on February 2nd, 2022 | 12:45 CET

Bayer, Almonty Industries, HeidelbergCement - Delivered

To start, the good news, the inflation rate fell in January for the first time since December 2020. However, the level of 4.9% remains at a threateningly high level, and economists had expected a sharper fall. The main reasons for the inflation are the continued exorbitant rise in energy prices and rising commodities prices. High inflation is reducing consumers' purchasing power. In addition, rising production costs are squeezing companies' margins.

ReadCommented by André Will-Laudien on January 19th, 2022 | 13:45 CET

BYD, Almonty Industries, Varta - E-mobility needs critical metals!

The pandemic has disrupted supply chains in the raw materials sector. In Brandenburg, a new Tesla electric car is expected to roll off the assembly line every 45 seconds in the future. But the permits for the water supply are dragging on. The new plant was supposed to go "online" in 2021. In addition to the regulatory requirements, however, it is primarily the availability of scarce raw materials that hamper the innovative spirit of the high-tech industry today. In particular, metals and battery raw materials are in high demand and have become a bone of contention in globalization. We look at both sides of the increasingly complex supply relationship.

ReadCommented by Stefan Feulner on January 10th, 2022 | 11:56 CET

Steinhoff, Almonty Industries, MorphoSys - Closer and closer to the goal

Will the crisis-ridden international retail group Steinhoff have a happy ending after all? Now that the settlement is likely to be successfully put to bed at the end of January, the highly indebted company's survival is at stake, and it is now striving to gold-plate its well-performing subsidiaries. At Almonty Industries, on the other hand, the signs are pointing to growth. The mega project in South Korea will make the Company one of the most important players in the production of raw materials for the energy transition, with significant upside potential.

ReadCommented by Armin Schulz on January 5th, 2022 | 09:02 CET

Gazprom, Almonty Industries, Standard Lithium - Investing in commodities with high demand

2021 was the year of skyrocketing commodity prices. Many different factors played a role. One, of course, was the Corona pandemic, which caused many companies to cut back on production. As the economy recovered faster than expected, markets were undersupplied. In addition, there were supply chain difficulties, natural disasters, and export restrictions, and this is where some of the dependencies on China became apparent. Currently, too little magnesium is being produced because the Middle Kingdom is suffering from electricity shortages. Today we look at three commodity producers for which we expect demand to remain high in 2022.

ReadCommented by Fabian Lorenz on December 30th, 2021 | 11:40 CET

Varta, Nel ASA, Almonty Industries: Buying opportunities for 2022?

Even though 2021 felt like it was all about COVID-19 and vaccine manufacturers such as BioNTech, Valneva and Novavax, the energy and mobility revolution was one of the dominant themes. Evidence of this is the boom in e-cars in Germany. The Association of International Motor Vehicle Manufacturers (VDIK) estimates that one in four new cars in this country will be electric in 2021. There is a good chance that hydrogen, lithium & Co. will continue to electrify investors in the coming year. Here we present three companies benefiting from the megatrends but whose share prices have come back significantly from their highs: Hydrogen specialist Nel ASA, battery pioneer Varta and future tungsten giant Almonty.

ReadCommented by Carsten Mainitz on December 22nd, 2021 | 11:01 CET

Kinross Gold, Almonty Industries, K+S - Is rising inflation the trigger for commodity stocks?

Two topics are currently occupying the markets: the impact of the new Corona Omicron variant on global supply chains and the further course of inflation. Experts disagree on both topics. While everyone assumes that the Omicron variant will lead to another global wave, most experts now see the supply chains as so stable that a fundamental disruption is now virtually impossible as was at the beginning of the pandemic. Concerning inflation, there are increasing voices that this should not be regarded as merely temporary. That should drive commodity stocks.

ReadCommented by Stefan Feulner on December 10th, 2021 | 13:54 CET

Bayer, Almonty Industries, JinkoSolar - Still considerable room for improvement

Inflation is growing relentlessly. In November, Germany's barometer for price increases climbed to 5.2%; a level last reached 29 years ago. Rising energy prices and exploding commodity prices are found to be the culprits here. Given the energy turnaround, the materials required for this, such as lithium, copper and cobalt, are in fact close to their highs. However, tungsten, which will be essential for electromobility in the future, still has some catching-up potential.

Read