ALMONTY INDUSTRIES INC.

Commented by Stefan Feulner on August 11th, 2021 | 12:20 CEST

Coinbase, Almonty, Infineon - Deals for the Future

"Thinking about Tomorrow Today" is a quote that not only corporate leaders need to follow when it comes to establishing new business models to secure the future. It also applies to the energy transition. What use are ever more sharply formulated climate targets by politicians if it is not even certain at the moment where the scarce raw materials for the production of renewable energies such as electromobility, photovoltaics or wind power are to be obtained from over the next few years. The companies that have already thought about tomorrow are therefore becoming the new stars on the stock market.

ReadCommented by André Will-Laudien on August 3rd, 2021 | 11:08 CEST

Volkswagen, Almonty Industries, BYD - World leadership with e-mobility!

Driving electric vehicles is the future! Electromobility is becoming the key to climate-friendly mobility and innovation worldwide. That is because the operation of e-vehicles produces significantly less CO2 than other means of transport, especially when combined with regeneratively generated electricity. With large gensets on board, electric vehicles will be able to compensate for fluctuations in wind and solar power in the future, thus supporting the expansion and market integration of these unsteady energy sources. The German government is promoting the development and ramp-up of electromobility with a comprehensive package of measures that is continuously being expanded and adapted. How can investors best benefit from this trend?

ReadCommented by Nico Popp on July 21st, 2021 | 11:00 CEST

Standard Lithium, Almonty Industries, Newmont: Invest in the super commodity

Achieving climate change requires political will and suitable raw materials. Solar cells, wind turbines and batteries for electric cars and associated motors rely on critical metals. This new industrial demand is turning the raw materials market upside down. Added to this is general progress: new processes often require new raw materials, whether in medical technology or research. Reason enough to keep an eye on the raw materials sector.

ReadCommented by Stefan Feulner on July 13th, 2021 | 10:05 CEST

Bayer, Almonty Industries, Daimler - Shortages without end

The shortage of semiconductors weighs heavily on the auto industry. According to a study by the Duisburg-based Center for Automotive Research, it will be responsible for the loss of production of around five million vehicles this year alone. An end to the chip shortage is not yet in sight. Meanwhile, the next crisis due to the lack of raw materials is already just around the corner. Due to the rapid growth in electromobility, the high demand for lithium-ion batteries means that the next failures are pre-programmed.

ReadCommented by Carsten Mainitz on July 5th, 2021 | 14:19 CEST

Almonty Industries, K+S, Airbus - Rising demand will be reflected in share price increases!

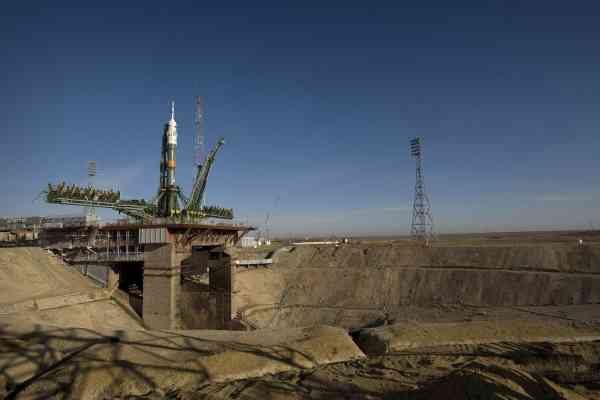

The metal tungsten has special properties that make it unique as a material. The metal is highly resistant to corrosion, as heavy as gold and, as tungsten carbide, as hard as diamond. In addition, at 3,422 degrees Celsius, it has the highest melting point of all metals. However, processing it is expensive and time-consuming. At the moment, researchers in Karlsruhe are working on processing tungsten using 3D printing methods. Due to its unique properties, tungsten plays a vital role in high-temperature applications in energy and lighting technology and space travel and medical technology. How can investors profit from the rising demand? We will show you.

ReadCommented by Armin Schulz on July 2nd, 2021 | 12:15 CEST

Freenet, Almonty Industries, Lufthansa - Setbacks offer entry opportunities

The stock markets have been on the rise for a long time, undoubtedly due to the loose monetary policy and the resulting inflation. Nevertheless, there is no hype as before the bursting of the dot-com bubble. Back then, people subscribed to Infineon and did not even know what the Company was doing. Despite Corona, the markets are higher than before the crisis, and the good news continues. In July, US President Biden is expected to launch his USD 1.2 trillion infrastructure package. Originally, more was planned. But this money will ultimately increase the corporate profits of the subsidized industries. The only important thing for investors is not to buy stocks at the high but to wait for consolidations to get in. That way, one increases the profit potential, and the stop loss is much smaller. Today we look at three companies that have recently suffered a setback.

ReadCommented by André Will-Laudien on June 22nd, 2021 | 12:07 CEST

Varta, BYD, NIO, Tesla, Almonty Industries - Battery becomes next billion-dollar topic!

The extent to which reality sometimes diverges from stock market trends is especially noticeable in hotly traded stocks. Early last week, it was the postponement of CureVac's vaccine launch that caused the stock price to lose 50% briefly. Then on Friday, there was the virtual AGM of Varta AG. The mood was very good in the run-up and the share reached a 5-month high of EUR 142. But then there was a correction of over 10% and the price found itself yesterday at EUR 127. The reason: premium manufacturers like Porsche are now going into battery research themselves. This opens up a competitor for Varta among the intended customers - they certainly had not bet on this, but the battery issue is a billion-dollar thing!

ReadCommented by Stefan Feulner on June 8th, 2021 | 07:47 CEST

NIO, Almonty Industries, Daimler - The power struggle escalates

The US government bans American investments for 59 companies from China. They are accused of cooperating with the Chinese state apparatus and military. The response from Beijing is not likely to take long. The Middle Kingdom is pulling the strings concerning the globally planned energy revolution. Whether solar plants, wind turbines or electric cars. The switch from fossil fuels to a sustainable energy supply based on renewable energy requires many metals. At the moment, more than 80% of the production of rare metals takes place in China. The currently prevailing chip shortage could be just a precursor.

ReadCommented by Nico Popp on June 4th, 2021 | 08:11 CEST

Lufthansa, Almonty Industries, Volkswagen VZ: Fresh starts and takeover fantasies

It starts again. More and more companies are leaving the crisis behind. Restaurants are full even with mandatory testing, carmakers are picking up where they left off before the crisis, and airlines are once again enjoying more vacationers and business travelers. With the economy making a comeback, certain companies are in particular focus. Others reveal great opportunities only at a second glance. We present three stocks.

ReadCommented by Carsten Mainitz on May 26th, 2021 | 10:45 CEST

Almonty Industries, ThyssenKrupp, Klöckner & Co.- Indispensable raw materials!

According to the EU, tungsten is one of the most critical raw materials globally in terms of economic importance and procurement risk. The chemical element has the highest melting and boiling point and is therefore used in many critical industrial sectors. The main application of tungsten is in the form of tungsten steel - a high-alloy steel. Given the resource scarcity, it is reason enough for us to take a closer look at the interface between the steel industry and tungsten production with three promising stocks. Where is the yield driver?

Read