DRONESHIELD LTD

Commented by André Will-Laudien on January 12th, 2026 | 07:20 CET

Boom & Bust 2026 – Where can investors still position themselves? BYD, BMW, DroneShield, and Power Metallic Mines

New highs every day – it is nothing short of a miracle. The international trouble spots around Ukraine, Gaza, and Venezuela appear to be growing with the addition of Syria and Iran. This means the next gear for the arms industry. The under-militarized NATO countries, in particular, are likely to continue to push ahead, as the US's guarantee of support for Western countries is no longer considered viable. Those who can no longer defend themselves today are at risk of being overrun by trigger-happy dictators. This makes things interesting for DroneShield and Power Metallic. The automotive industry must also show how it can get consumers back behind the wheel. The capital markets remain highly valued and extremely exciting, but the eternal one-way street of high tech still seems to have many potholes. Which stocks can overtake on the right?

ReadCommented by Fabian Lorenz on January 7th, 2026 | 07:35 CET

+23% price increase in just a few days! DroneShield, BioNTech, and WashTec shares!

DroneShield shares have already gained over 23% in the first few trading days of the year. The drone defense specialist is receiving a boost from two orders placed shortly before the turn of the year. Is it now heading towards an all-time high? WashTec shares are also performing strongly. While German stocks are weakening overall, WashTec shares are at their highest level in a long time, and analysts see further upside potential. BioNTech has important study data coming up in 2026. But first, the acquisition of CureVac will be completed. This marks the end of a stock market story that caused only brief euphoria.

ReadCommented by Nico Popp on January 7th, 2026 | 07:00 CET

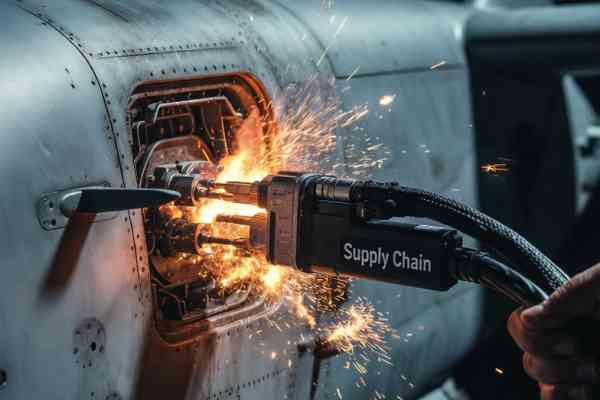

Trade war over batteries: China's export restrictions force the West to act – and position NEO Battery Materials as a potential game changer for AeroVironment and DroneShield

The geopolitical map of the technology sector is currently being redrawn. After China drastically tightened export controls in recent weeks on critical drone components and high-performance batteries, Western defense companies are increasingly facing supply chain risks. In this strategic environment, the Canadian company NEO Battery Materials is evolving from a pure technology developer into a strategically relevant industrial partner. With the recently announced market readiness of its silicon-based battery technology, NEO offers a non-Chinese alternative that could become highly attractive for drone manufacturers such as AeroVironment and counter-drone specialists like DroneShield, as they seek to reduce dependence on Asian supply chains and secure long-term production reliability.

ReadCommented by André Will-Laudien on January 6th, 2026 | 07:35 CET

Up and down: Doublers and halvers among themselves! BYD, VW, DroneShield, and Power Metallic

And once again, it is full steam ahead. While last year saw a sunny scenario in terms of returns for AI, defense, and silver stocks, these sectors are performing even better in the new year. Rumors of a physical silver shortage have now been confirmed by futures exchange warehouses. This could mean that the "one-way movement" in strategic metals will continue. Rumor has it that the shortages may even be spreading to a range of industrial metals. As the world's largest producer of these raw materials, China is tightening export controls and redirecting resources toward its domestic industry. Much of this is still unconfirmed, but the recent price explosion to over USD 12,000 for copper speaks volumes. Investors would be well advised to diversify their allocations to be ready for the most important developments!

ReadCommented by Armin Schulz on January 6th, 2026 | 07:05 CET

Defense 2.0: Why Almonty Industries, DroneShield, and Palantir are the new strategic assets in the defense boom

While attention is focused on large defense contractors, a less noticed but lucrative ecosystem is emerging in the shadow of the defense boom. The real winners in the new security landscape are often companies that provide the essential foundations, from critical raw materials for high technology to defense against ubiquitous drone threats to analysis of crucial data streams. These companies are structurally benefiting from billion-dollar budgets and redefining modern security architecture. Three specialized players illustrate this momentum: Almonty Industries, DroneShield, and Palantir.

ReadCommented by Armin Schulz on January 2nd, 2026 | 06:55 CET

Battery raw materials are the bottleneck in many areas – Power Metallic Mines, DroneShield, and Volkswagen under review

A historic turning point is shaping the markets. Geopolitical ruptures and critical raw material dependencies are defining the new investment era. In this volatile era, security, resource sovereignty, and industrial change are becoming the most valuable assets. Global electrification is putting battery raw materials at the center of attention in both the defense and automotive industries. Today, we take a look at Power Metallic Mines, a future producer of polymetals, and DroneShield, whose drones require powerful batteries, as do Volkswagen's electric vehicles.

ReadCommented by André Will-Laudien on December 29th, 2025 | 07:15 CET

Record year – Will 2026 be even better for BYD, Kobo Resources, Palantir, and DroneShield?

After an exceptionally strong 2025, investors are asking whether the rally can continue into 2026. Gold and silver reached new all-time highs at the turn of the year, and promising gold stocks such as Kobo Resources have gained more than 40% in recent weeks. Palantir Technologies, expensively valued but still widely recommended by analysts, has continued to reward shareholders. The V-shaped movement at DroneShield is also exciting, with its shares already doubling from their December sell-off lows. Meanwhile, BYD is entering a decisive phase as it accelerates its expansion strategy in Europe. What should investors focus on next?

ReadCommented by André Will-Laudien on December 23rd, 2025 | 10:10 CET

Top tips for 2026 – Critical metals and armaments! DroneShield, Pasinex, RENK, and Heidelberger Druck in focus

In 2025, there was a pronounced rally in critical metals starting in the summer. This was largely triggered by China, which imposed export restrictions on rare metals and strategic raw materials in response to arbitrary tariff demands from the White House. The metal markets reacted with strong upward movements, and the procurement centers of Western industry reacted even more severely. In view of the needs of the near future, a large number of properties would have to be brought into production in the areas of copper, graphite, lithium, uranium, zinc, and rare earths. However, it takes around 10 years to set up a mine, including all permits and preliminary investigations. Because this is far too long for the current needs, the market is looking at projects that are about to start production or are already producing. We offer a few ideas from the supply chain and potential customers.

ReadCommented by André Will-Laudien on December 22nd, 2025 | 06:55 CET

Will 2026 start with another surge? We evaluate BYD, NEO Battery Materials, and DroneShield

In December, many market participants start thinking about the next investment period – in this case, the year 2026. The 2025 investment year was one of the best periods of the past 20 years for both the DAX and the NASDAQ, with gains of 18.7% and 20.8%, respectively. Even the Trump tariff crash in April was offset entirely within just two weeks. The drivers of the upswing remain the US administration's policy, which is perceived as "supportive," as well as ongoing geopolitical conflicts and still tolerable interest rates between 2.7% (Bund) and 4.0% (USD Treasury) in the ten-year range. For the coming year, some experts expect another wave of inflation, high commodity prices, and rising energy costs. These are all factors that could once again stifle the economic upturn and bring additional volatility to the markets. And let's not forget: AI and defense seem to be at their peak — so who will lead the next revaluation of the stock markets?

ReadCommented by Armin Schulz on December 22nd, 2025 | 06:00 CET

The key to billions in profits: High-performance batteries in the spotlight at NEO Battery Materials, Volkswagen, and DroneShield

While sluggish economic data currently dominates, disruptive technologies are unleashing enormous profit potential. Artificial intelligence, electromobility, and new safety requirements are fueling demand for specialized high-performance batteries. These key components are driving not only autonomous vehicles, but also AI infrastructures, robotics, and drone systems, generating growth markets worth billions. We analyse NEO Battery Materials, a manufacturer of high-performance batteries, electric vehicle manufacturer Volkswagen, and drone specialist DroneShield.

Read