June 16th, 2025 | 07:05 CEST

Iran, nuclear energy, oil – a revival for hydrogen! Nel ASA, Pure Hydrogen, Plug Power, and Oklo

The current attacks on Iran's nuclear facilities by Israel mark a new level of escalation in the Middle East. Of course, a radical regime like Iran cannot be allowed to conduct nuclear research. This region has already experienced too much terror. For the rest of the world, Israel's announcement, backed by the US, means another rise in oil prices, which will quickly shift the focus to alternative energies. Some companies have been promoting a future-oriented hydrogen infrastructure for years and are growing well. Australia's Pure Hydrogen is well advanced, while Nel ASA and Plug Power are still in the turnaround phase. There is currently a lot of movement on the capital markets. Risk-aware investors can benefit from the current trends with the right touch and timing. Where are the opportunities and risks?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PURE HYDROGEN CORPORATION LIMITED | AU0000138190 , PLUG POWER INC. DL-_01 | US72919P2020 , OKLO INC | US02156V1098

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Pure Hydrogen – Paving the way for the green hydrogen economy in Australia

In geopolitically challenging times, it is advantageous for countries to make their energy supply less dependent on international trade relations and focus on local production. The Australian company Pure Hydrogen is taking a very visionary approach, positioning itself as a pioneer in the development and implementation of clean energy solutions, particularly in the field of hydrogen technology. With a strong focus on domestic expansion and international marketing of green hydrogen, the Company has ambitious plans to make Australia a key player in the global energy transition.

The focus is on three types of hydrogen: green, turquoise, and emerald. Green hydrogen is obtained through electrolysis from renewable energies. Turquoise hydrogen is produced by pyrolysis of methane, with solid carbon as a by-product. The largely unknown term emerald hydrogen refers to a new form with a focus on low-emission production, about which little is known to the public. With its "SMARAGD" project, the German association VDGW is pursuing compliance with national and international climate protection targets through the integration of renewable gases in all sectors. According to recent studies, the use of gases and the associated infrastructure is significantly more cost-effective than the complete electrification of energy systems. This means that climate benefits can be quickly realized in the short and medium term through the use of gas as an energy source.

Pure Hydrogen already has a large product portfolio, demonstrating its strategic focus on different markets and areas of application – from emission-free transport to industrial energy supply. The Company is already investing heavily in hydrogen applications and infrastructure, such as the development and production of hydrogen-powered vehicles, including buses, waste collection vehicles, tractors, generators, and marine applications. The development of mobile solutions for the flexible supply of hydrogen is also being taken into account. With Botswana H2 and a stake in gas supplier Botala Energy, the Company is pushing ahead with an international project in southern Africa. Another important milestone is the recently granted gas exploration license for its subsidiary Real Energy Queensland, which has received the green light from the government for the Windorah gas project in the Cooper Basin. The license is valid for 25 years. It highlights the long-term plan to secure energy sources – both for its own production and as a transition technology to support the expansion of hydrogen.

With its broad positioning, the Company is well-placed to play a key role in the energy transition. Its high-growth project portfolio makes Pure Hydrogen an exciting player in the future market of hydrogen. The 373.48 million shares are listed in Australia at around AUD 0.08, bringing the Company's value to just under AUD 30 million. The shares can also be purchased in Frankfurt. Exciting!

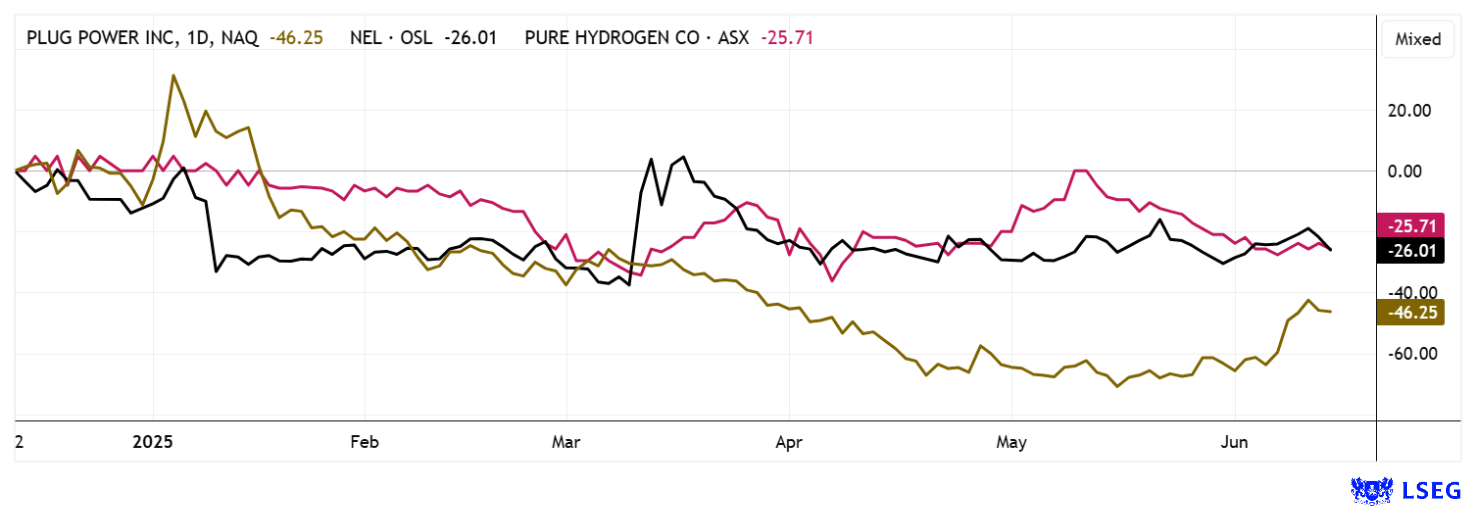

Nel ASA and Plug Power – The latest recovery attempt is causing a stir

Well-known hydrogen stocks from the hype years of 2020 to 2022 have recently attracted new attention. Nel ASA from Norway is a pioneer in the electrolyzer business. The share price recently recovered from lows of around EUR 0.18 and has now at least regained the EUR 0.21 mark. Hopes for a bright future rest largely on new major shareholder Samsung. Since last week, the Korean conglomerate has also been represented on the board of directors. Operationally, the Q1 figures were once again disappointing. Order intake from the public sector is still too thin to support a profitable business model. Technically, however, the Nel share price could still jump upwards without any major reason, as the market appears to be slowly drying up after years of sell-offs. Only for speculators!

Things got down to business at US counterpart Plug Power over the last 10 trading days. From a low of around USD 0.69, the share price catapulted upwards to USD 1.45 – a smooth doubling! The capital increases have finally borne fruit. The news that a new production record was set in Georgia in April with 300 tons of H2 produced is impressive. The stock seems to be reviving, with 6 out of 25 analysts on the LSEG platform recommending it as a "Buy". The average 12-month price target is USD 1.84 – however, after a 100% price increase to USD 1.40 in just two weeks, this represents little potential given the high risks involved. However, if the breakout attempt turns out to have been the trend reversal, prices of USD 2 to 3 are possible again. At the beginning of the year, a possible insolvency was still being discussed in the market. Casino par excellence!

Oklo Inc. – SMR euphoria causes 200% price increase

It is wild! With Donald Trump's announcement that he would like to bring 100 new small modular reactors (SMRs) online in the next 10 years, reactor designers such as nuclear start-up Oklo Inc. went through the roof. The share price corrected to USD 18 in April and peaked at USD 67 last week. The Company does not expect any significant revenue until 2028, but it is one of the biggest speculative stocks in terms of potential. Models for the large-scale use of nuclear energy to generate electricity and hydrogen in the future are repeatedly discussed on the market. Support comes from the high-tech AI industry, which expects a 30% increase in electricity demand for its applications in the coming years. On average, US reactors are now 42 years old and urgently need to be overhauled or completely replaced, which will cost the US administration billions. Oklo shares experienced a rapid renaissance following Donald Trump's latest decrees, but the price now appears overheated. This is indicated by the target price set by analysts on the LSEG platform, which currently stands at an average of USD 56.60, which is, unfortunately, a good 13% below the current price. Perhaps the price targets are not so far-fetched after all, as a consortium of US banks is reportedly set to place shares worth USD 400 million by mid-June. Welcome back, nuclear hype!**

The next geopolitical conflict between Israel and Iran is casting a shadow over the capital markets. Due to the sharp rise in oil and gas prices last week, there are now fears of further escalation. Hydrogen stocks offer an alternative form of energy and could take off again under the current conditions. The innovatively diversified Pure Hydrogen from Australia offers investors a wide range of development opportunities.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.