September 30th, 2025 | 07:35 CEST

High-tech super boom! 1,000% no problem—here is more from D-Wave, NetraMark and Palantir!

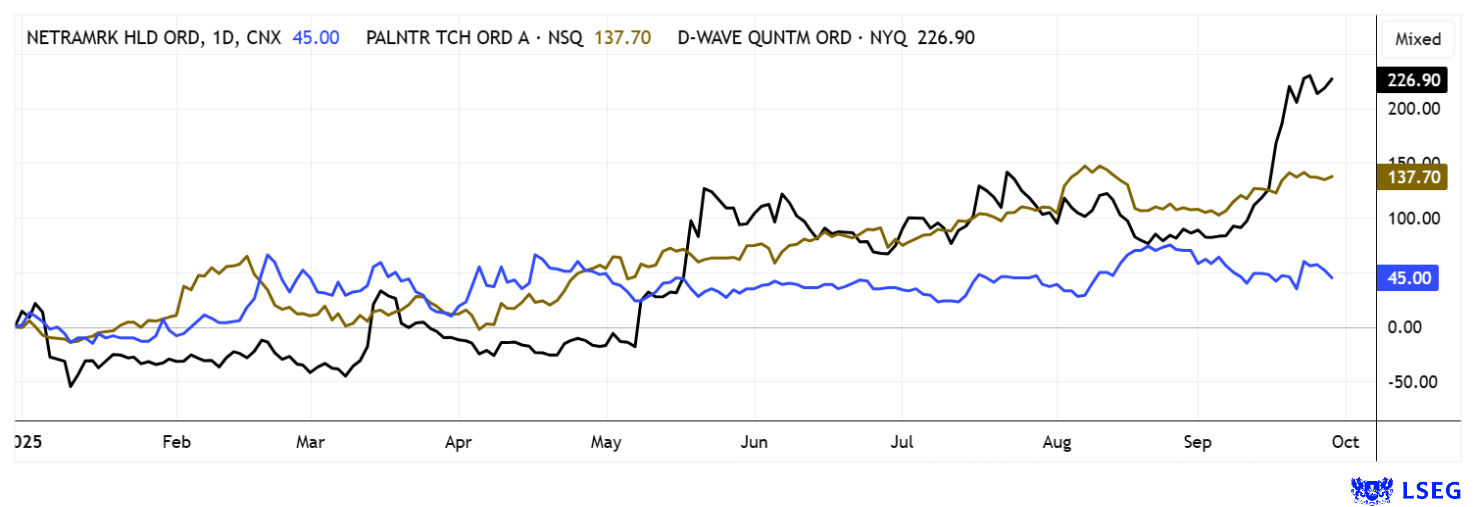

Artificial intelligence (AI) is currently revolutionizing drug development by analyzing enormous amounts of data in a very short time and making clinical trials much more targeted. Modern AI systems make it possible to select drug candidates with precision and predict the potential success of a therapy with a high degree of accuracy. Companies like NetraMark are already using these technologies profitably. Players such as D-Wave and Palantir are also among the pioneers of the new AI-driven economy and have seen their share prices rise by over 1,000%. Expectations for further growth are virtually limitless. The advent of quantum computer technology also marks the beginning of a new chapter in ultra-fast data processing. For forward-looking investors, this opens up attractive entry opportunities in dynamically expanding future markets. Those who bet on the right players early on can benefit from this change to an above-average extent.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , NETRAMARK HOLDINGS INC | CA64119M1059 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

NetraMark – Launch of a groundbreaking collaboration with a leading medical center in the US

NetraMark is increasingly becoming a pioneer in the use of explainable artificial intelligence for the pharma and biotech industries. With its NetraAI platform, the Company is able to divide even small and complex patient data sets into explainable and unexplainable subsets, a decisive advantage over many conventional AI methods, which often lead to overfitting. Based on this differentiated analysis, NetraAI can provide more precise hypotheses, identify variable influencing factors, and thus significantly increase the chances of success in clinical trials. The Canadians are therefore creating an innovative approach to segmenting diseases in a differentiated manner and targeting specific patient groups for therapies.

NetraMark has strategically expanded its field of activity in recent months. With the introduction of NetraAI 2.0, the Company is attracting the attention of pharmaceutical companies seeking more efficient clinical trials with higher success rates and lower costs. An outstanding example is the collaboration with Asclepion Pharmaceuticals, in which NetraAI is being used in a Phase III trial in the field of pediatric heart surgery. Here, the platform helps identify subgroups of children who benefit particularly strongly from treatment with L-citrulline.

Now comes the next big step: NetraMark is launching a groundbreaking AI collaboration in glioblastoma research. In cooperation with a leading US medical research center, the Company will gain access to advanced clinical and biomarker data derived from proteome analyses. The goal is to develop an AI-supported decision-making and analysis tool for future glioblastoma studies, one of the most aggressive and treatment-resistant cancers. Median survival is only 15 months, and more than 90% of previous studies have failed, often due to heterogeneous patient populations and a lack of precise biomarkers. This is exactly where NetraAI comes in: by creating so-called NetraPersonas, explainable patient subgroups are identified, unlocking new insights into disease progression, treatment response, and resistance mechanisms.

Specifically, NetraMark is taking on the challenge of deciphering the following aspects in longitudinal cerebrospinal fluid (CSF) data: differentiation of glioblastomas from non-tumor controls, differentiation from other brain tumors, analysis of tumor development in recurrences, molecular effects of surgical interventions, responses to chemoradiation and immunotherapies. Data sets generated on the SomaLogic platform are available for this purpose, supplemented by de-identified research material. The goal: greater efficiency and higher success rates in glioblastoma studies thanks to targeted patient selection and biomarker-based strategies.

With this initiative, NetraMark is positioning itself as a key player in precision oncology. The combination of explainable AI with high-quality academic data resources not only opens up new perspectives for cancer research but could soon fundamentally transform clinical development. For investors, this represents a highly exciting growth story at the intersection of medical breakthroughs and AI innovation - a field that is just beginning to unfold its full potential. Given this momentum, it is hardly surprising that the share price has recently climbed to around CAD 1.80. One gets the sense that CEO George Achilleos is just getting started. Buy!

To learn more, register to listen to CEO George Achilleos present live at the upcoming 16th International Investment Forum (IIF) on October 8, 2025, at 5:30 pm CET.

D-Wave Quantum – The next generation leap is lurking here

D-Wave Quantum's stock is making waves with a 12-month performance of over 2,400%. In the field of medicine, D-Wave supports the market with its quantum annealing technology AI applications, which can be particularly helpful in drug development and diagnosis. One example is the collaboration with Japan Tobacco, where D-Wave is developing quantum-based AI applications for accelerated drug discovery. Quantum computing makes it possible to efficiently analyze complex biological systems and large amounts of medical data, for example for personalized medicine, genomics, or cancer diagnostics. Quantum-based AI can recognize patterns in data that cannot be found as quickly or accurately with classical systems, leading to earlier diagnosis and optimized treatment plans.

D-Wave recently unveiled its new Advantage2 quantum computer system, marking a key milestone for its entry into commercial applications. The Company has also announced partnerships in South Korea and completed a USD 400 million capital raise, strengthening its financial position and providing more room for development. Whether these latest moves will sustain the steep upward trend remains uncertain. D-Wave could soon see some big short attacks, so investors should exercise caution.

Palantir Technologies - The price is unstoppable

Things are also pretty crazy at Palantir Technologies. With its AI-based espionage systems, the Nasdaq big data stock is now part of the inner circle of highly sensitive technology companies. Here, any valuation is fair in order to protect the brilliant inventions from outside interference. The Company now has dozens of contractual relationships with Western administrations and military units. CEO Alex Karp is proud to be doing important reconnaissance work for Ukraine. Investors are keeping a close eye on the stock's unbroken upward trend. With a 2026 P/S ratio of 20 and a P/E ratio above 100, investors should always be on their guard and consistently adjust their stops.

Artificial intelligence is revolutionizing healthcare and is increasingly becoming an indispensable tool in diagnostics, therapy planning, and the evaluation of clinical studies. Companies like NetraMark are impressing with transparent, explainable AI models that analyze medical data precisely and make research processes significantly more efficient. Examples such as D-Wave and Palantir illustrate how strongly future expectations have already driven up company valuations in this sector. However, there is no guarantee that these leading positions will continue to hold in the next three years. At NetraMark, on the other hand, there are many indications that the growth path will continue on a solid footing, as the business model has the potential to bring about lasting change in the industry.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.