May 7th, 2025 | 09:55 CEST

High-grade discovery at Tocvan Ventures – Gold corridor within reach at Gran Pilar

Volatility on the capital markets reached record levels in the first quarter of 2025. Geopolitical upheavals and unpredictable US policy have caused stock prices to fluctuate wildly. Precious metal investments could provide a good hedge against turbulence in the financial system and a devaluation of the US dollar. With spot prices recently reaching new record highs, investors are increasingly strengthening their exposure to the commodities sector. Gold has so far met expectations with prices of up to USD 3,500 and an annual gain of just under 20% in 2025, while silver has also reached high prices of over USD 35. In addition to producers, the spotlight is now shifting to the second tier of explorers. This is because the valuations of in-ground resources are at their lowest level in decades. Canadian gold explorer Tocvan Ventures (CSE: TOC | WKN: A2PE64 | ISIN: CA88900N1050 | CAD 0.69) has recently seen a string of positive announcements. The latest update on recent drilling at the Pilar gold-silver project in Sonora delivered impressive gold and silver grades.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TOCVAN VENTURES C | CA88900N1050

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Sonora – A historic location for gold and silver

Sonora is Mexico's best-known state when it comes to the mining industry in the Central American country. The tradition of gold and silver mining dates back to the Spanish colonization. As early as the 18th century, particularly between 1783 and 1790, the Tarasca mine was known as a major producer of gold and silver. In modern times, Sonora continues to play a leading role in Mexican precious metal production. In 2024, Sonora was Mexico's largest gold producer, contributing nearly a quarter of the country's gold output. In addition, Mexico is still the world's largest silver producer. In 2024, the country produced 6,300 tons of silver, which is about 25% of global silver production. Several well-known mining companies are active in the area, including Fresnillo, Pan American, Heliostar, and Minera Alamos. Tocvan Ventures (CSE: TOC | WKN: A2PE64 | ISIN: CA88900N1050 | CAD 0.69) is currently on track to become a producer and is delivering milestone after milestone.

Tocvan's gold-silver projects are located in the mining-friendly state of Sonora, Mexico. As part of its ongoing exploration programs, the Company has encountered high potential at its Gran Pilar Gold-Silver Project over the past two years, where it holds 100% interests in over 21-square kilometers and a 51% interest in a one square kilometer area shared with Colibri Resources. Tocvan also wholly owns the Picacho gold-silver project in the Caborca Trend in northern Sonora. After extensive exploration, management believes that the geological trends host some of the largest gold deposits in the region. Work is facilitated by excellent infrastructure, which allows full access. Pilar is located 130 km southeast of Hermosillo, the capital of Sonora. Sonora's long mining history has led to the establishment of industry experts, enabling rapid mine development. A mineral resource estimate is now expected in the fall. A subsequent mining permit is expected in the second quarter of 2025.

Reverse circulation drilling hits the mark

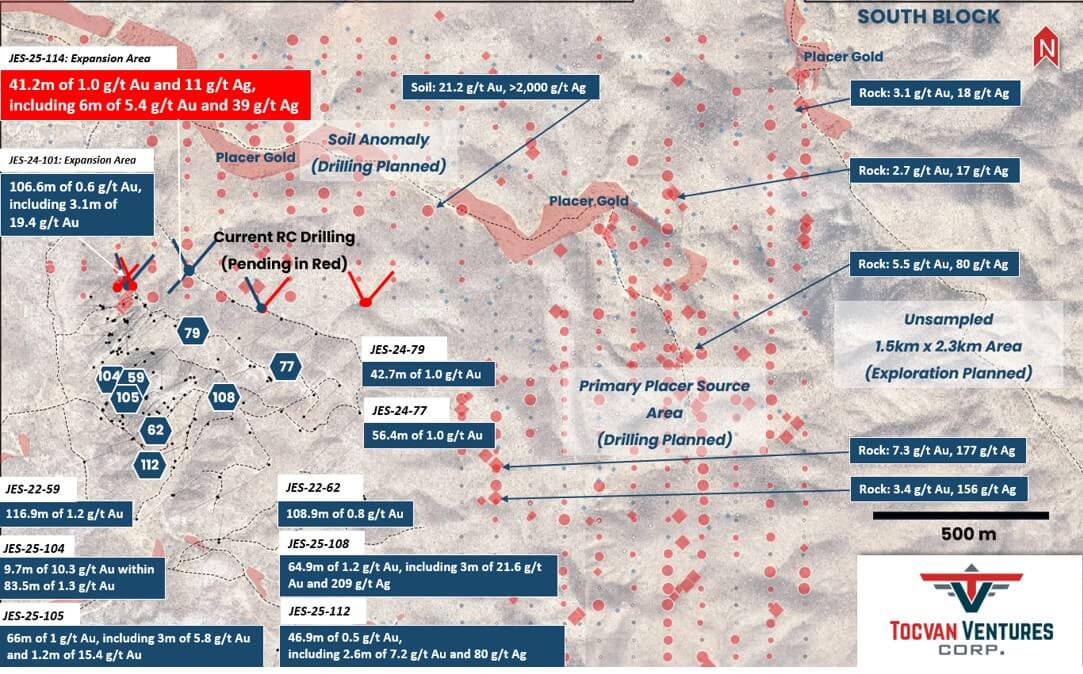

Tocvan Ventures (CSE: TOC | WKN: A2PE64 | ISIN: CA88900N1050) today announced the first reverse circulation (RC) drilling results from its most recent drilling program at the Gran Pilar project. Drilling is now focused on the 100% controlled extension area, where recent exploration drilling has already returned significant mineralization. Today's results include a continuation of exploration drill hole JES-24-102, which previously returned 16.8 meters grading 0.4 g/t Au and 6 g/t Ag. The results are highlighted by: 129.63 meters grading 0.34 g/t Au and 4.0 g/t Ag from a drill hole depth of 4.58 meters, including 6.1 meters grading 5.4 g/t Au and 39 g/Ag within 41.2 meters grading 1.0 g/t Au and 10 g/Ag from a drill hole depth of 33.6 meters and approximately 20 meters vertical from surface (JES-25-114). This drill hole represents the most northeastern high-grade occurrence.

Follow-up drilling is now underway to determine whether this mineralization is connected to the 4-T corridor, which is well defined 380 meters to the southeast. The discovery coincides with a resistivity anomaly that extends vertically for 250 meters. JES-25-114 is also located 170 meters east of JES-24-101 (3.1 meters grading 19.4 g/t AU within 106.6 meters grading 0.6 g/t AU), and the close association of high-grade gold with an intrusion unit in both drill holes suggests that this may be part of the same mineralized trend. Follow-up drilling on JES-24-101 has now been completed, and mapping of the surrounding area has identified underground workings further to the north. RC drilling in this area has intersected several vein zones similar to the mineralized intersections discovered in JES-24-101, with results for these holes currently pending.

CEO Brodie Sutherland commented: "We are excited by these initial results from our latest drilling program at Gran Pilar, which continue to demonstrate the project's significant near-surface, high-grade potential. The discovery of another high-grade corridor in the extension area, combined with a geophysical anomaly extending vertically for 250 meters, underscores the size and continuity of the mineralization at Gran Pilar. With results from seven additional drill holes, including follow-up to the exceptional grades intersected in JES-24-101, still pending, we are eager to further define this emerging zone and realize its full potential. These results, combined with the robust economics of our planned pilot plant, position Gran Pilar as an outstanding gold-silver project in Sonora, particularly in light of record high gold prices."

Additional metallurgical studies

Tocvan Ventures (CSE: TOC | WKN: A2PE64 | ISIN: CA88900N1050) has achieved gold recovery rates of 95% to 99% to date, with silver recovery rates of 73% to 97%. The drill core mix from a depth of 120 meters showed a recovery of 99% for gold and 73% for silver. Based on management's expectations for the project's potential, the Company is now outlining a permitting and operating strategy for a pilot plant at Gran Pilar. The plant will aim to process up to 50,000 tons of material in a robust test mine scenario. Schedules and budgets are now being prepared with the goal of advancing development quickly. With gold prices recently reaching all-time highs, the Company believes that the test mine will provide important economic parameters and demonstrate the area's mineral potential. In 2023, the Company conducted an externally performed bulk sample that demonstrated the potential to recover gold and silver through various methods, including heap leaching, gravity, and agitated leaching.

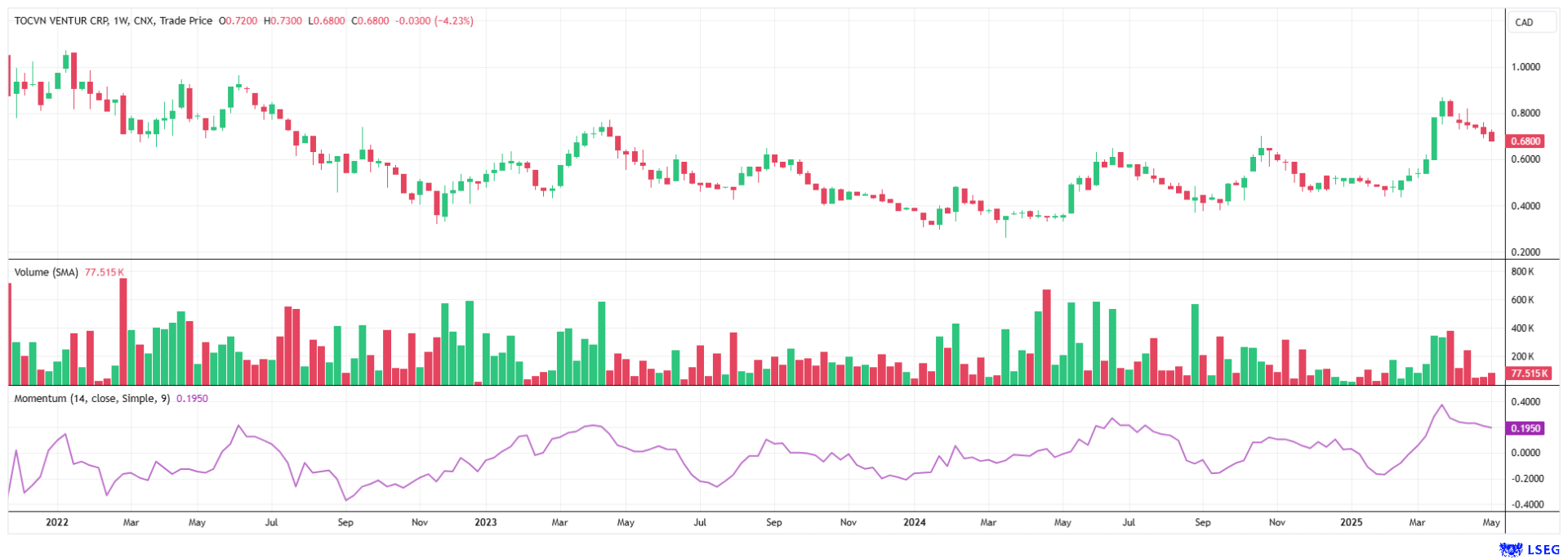

The time is ripe for a significant revaluation

Tocvan Ventures is attractive due to the low number of Tocvan shares issued (59.74 million), meaning that investors have not yet experienced any dilution. The share price has been extremely robust over the past three months, rising by over 100% at times. This is primarily due to the project's good progress in Sonora, with a resource estimate now expected in the current year. With a current market capitalization of around CAD 41 million, the exploration company is significantly undervalued. The current consolidation offers good opportunities for additional purchases or new investments.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.