June 6th, 2025 | 07:10 CEST

Greentech is now exploding – a 300% comeback for hydrogen? nucera, dynaCERT, Plug Power, and Nel ASA

Although the US administration under Donald Trump does not think much of climate change, the outlook for the hydrogen sector is improving all the time. This is because it is no longer the US setting the tone but Europe and Asia. Global efforts to make local transport cleaner and more sustainable are now also reaching the transport, logistics, and mining industries. There is still enormous potential for improvement here in terms of reducing climate-damaging emissions. Innovative technologies such as those developed by dynaCERT are now well-known in the market. Therefore, decision-makers in public office will no longer be able to avoid discussing these issues if they want to remain in their positions in the coming years. The public pressure to combat negative climate change globally is increasing. Forward-looking investors should start positioning themselves now.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , DYNACERT INC. | CA26780A1084 , PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp nucera – Major order gives cause for hope

A major player in electrolyser technology is thyssenkrupp's hydrogen subsidiary, nucera. After a successful IPO in 2023 at EUR 20, the share price initially slumped to EUR 8, but the outlook now appears to be improving steadily. nucera is to develop a comprehensive front-end engineering and design study (FEED) for a pioneering hydrogen project in Europe. This future-oriented project involves the construction of a large-scale water electrolysis plant with a nominal capacity of around 600 MW. The client has not yet been disclosed, but such a scale highlights thyssenkrupp nucera's ambitions to get off to a flying start with innovative solutions. This project also marks a significant step toward an environmentally friendly energy future in the EU, and further inquiries are likely to follow. Although a decision on the specific order volume will not be made until 2026, preliminary work is already underway. The share price has returned to the upper end of the range between EUR 8.00 and EUR 11.00, where it has been trading for a year. All that is missing now is a break above the resistance level of EUR 11.50, after which higher targets can be set again. Compared to other hydrogen stocks, nucera has already proven in the past that it can operate profitably.

dynaCERT – A small spark can ignite big momentum

There has already been a lot of buzz around dynaCERT. The Canadian hydrogen specialist is considered a technology supplier for large diesel engines across all commercial segments. With its in-house hydrogen retrofit devices under the name HydraGEN™, diesel combustion processes can be optimized to such an extent that, depending on usage, fuel savings of between 5 and 15% can ultimately be achieved. In fall 2024, the coveted VERRA certificate was obtained, meaning that dynaCERT customers will also receive credits for emission certificates if they report their driving logs to dynaCERT accordingly. The rollout of the latest retrofit devices is now on schedule. Following the "bauma 2025" trade fair in Munich, pre-production of 1,000 units has already been completed in order to meet growing demand as quickly as possible. With a manageable investment of around CAD 6,000 per unit, valuable fuel can be saved. For public transport companies, logistics providers, and construction machine operators of all kinds, large-scale carbon reductions are a critical ESG issue for the future of their corporate mission and, simultaneously, a door opener for a sustainable customer base.

In 2024, investor Eric Sprott already invested CAD 14 million at around CAD 0.50 per share; currently, the share price is hovering between CAD 0.14 and CAD 0.16. The reason: the wait for certification took nearly two years. Many investors lost patience and sold in line with the downward industry trend. But now, the signs have turned positive. With a German management team on board, industrial capacity expansion is proceeding exactly according to plan, so initial revenue successes should soon be announced. In addition, the stock has been listed on the OTCQB Venture Market in the US since June. Liquidity is likely to increase sharply soon – time to get in!

Nel ASA and Plug Power – Is this the start of a turnaround?

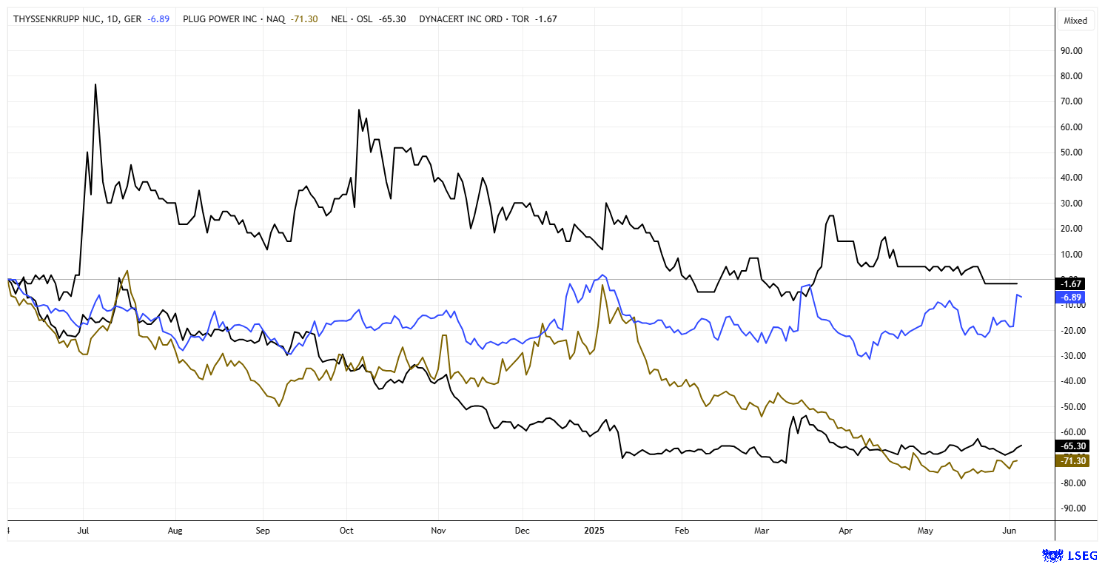

There has been a lot of movement in industry in recent days. After three years of total losses of up to 95%, the protagonists Nel ASA and Plug Power made their first attempts at bottoming out in May.

For Plug Power, it was the announcement of a new production record in Georgia: 300 tons of liquid hydrogen were produced there in April. In Calistoga, California, Plug Power delivered six hydrogen fuel cells for a new emergency power system. This system replaces diesel-powered generators and can supply the city with clean electricity for up to 48 hours - especially during planned power outages aimed at reducing wildfire risks. The Q1 figures were not encouraging, with net losses of USD 196 million on revenues of USD 133.7 million. A cost-cutting program is now expected to save over USD 200 million annually. Despite the ongoing operational woes, 6 out of 25 analysts on the LSEG platform still recommend buying Plug Power shares. The average 12-month price target is USD 1.86 – a chance for speculative investors to double their money!

Investors appear to have lost interest in Nel ASA. Here, too, the ongoing slump in orders is weighing on the Company, which is currently implementing another restructuring program. Not a single expert on LSEG is now recommending the stock as a buy. At EUR 0.21, the share is still 20% above its all-time low of EUR 0.166. There is no sign of an upward trend yet, but at least the major losses now seem to be over. Keep an eye on the price display to react quickly when momentum picks up!

The stock markets are moving from one high to the next. While defense and precious metal stocks have recently been shining, hydrogen stocks are now also coming into play. However, there is still a long way to go before losses are recouped. dynaCERT has positioned itself perfectly at Bauma in Germany to supply the international transport, local transport, and mining industries with energy-saving solutions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.