December 15th, 2025 | 07:15 CET

Gold, AI, and Bitcoin – A record year in 2026? Strategy, B2Gold, Kobo Resources, and Allied Gold

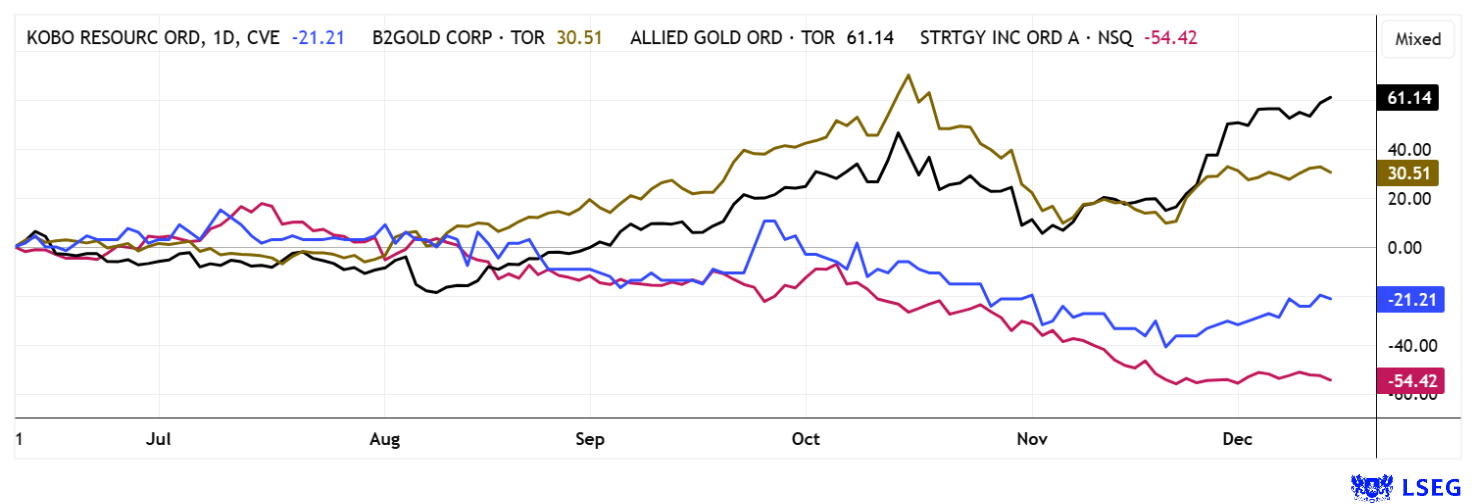

In mid-December, investors are keeping a close eye on the coming year 2026. Will the old winners also be the new ones? Bitcoin was a disappointment in 2025, as the cryptocurrency is actually down slightly to date. Artificial intelligence and sought-after high-tech suppliers were the focus of attention, with returns of several hundred percent, with Palantir and quantum computing specialist D-Wave, for example, achieving extreme performance. But how will things proceed next year? The majority of analysts believe that the highest-valued high-tech segment will cool down. The primary focus is on NVIDIA, which, with a 1,250% increase since 2021, is now one of the most expensive stocks in the world. The outlook is challenging, as a significant correction or even a crash would also be long overdue. Gold has gained over 60% in the last 12 months, and the trend is fully intact. Could it soon reach USD 5,000?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

STRATEGY INC | US5949724083 , B2GOLD CORP. | CA11777Q2099 , KOBO RESOURCES INC | CA49990B1040 , ALLIED GOLD CORPORATION | CA01921D1050

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

B2Gold and Allied Gold – Catch-up potential in Africa

With an extraordinary price performance to over USD 4,300, gold is highly sought after by international investors. Due to low production costs, more and more producers are focusing on the African continent. B2Gold is an international gold producer with a strong presence in West Africa, particularly in Mali, where the mighty Fekola complex is its mainstay. It comprises the Fekola and Cardinal open-pit mines as well as the newly developed Underground and Regional zones, whose development is expected to significantly extend the mine life and increase overall production capacity. For 2025, B2Gold expects the Fekola complex to produce between 515,000 and 550,000 ounces of gold, with the recently commissioned Underground mine alone contributing 25,000 to 35,000 ounces, while the Regional project could add approximately 180,000 ounces per year starting in 2026. For 2025, B2Gold is targeting consolidated production from all operations of nearly 1 million ounces of gold, which includes Mali, Namibia, and the Philippines. Talks with the military government are already well advanced, and all parties appear to be increasingly recognizing their respective financial interests.

Allied Gold is also active in the region and operates several producing gold mines, primarily in Mali and Côte d'Ivoire. The most important property in Mali is the Sadiola mine, which is operated together with the adjacent Korali Sud project and is one of the largest gold producers in the country. Allied has forecast total annual production from its Sadiola, Bonikro, and Agbaou operations in the range of 375,000 to 400,000 ounces of gold for 2025, with the aim of increasing this level in subsequent years. In Côte d'Ivoire, the two producing open-pit mines, Bonikro and Agbaou, are expected to produce a combined total of approximately 175,000 to 195,000 ounces of gold per year. B2Gold's shares have corrected downward from their October high of EUR 5.10 to EUR 3.30. In the last two weeks, however, the stock has caught up tremendously and is trading at just under EUR 4 with a historically low 2026 P/E ratio of 5.7. Allied Gold is one of the best gold stocks on the Canadian stock exchange, with a 98% increase in the last 12 months. But here, too, there is still significant room for improvement in terms of valuation.

Kobo Resources – Speculative opportunity in the West African gold sector

What a turnaround for the shares of Kobo Resources. The unknown seller now seems to have no more shares left, and the stock is already up 30%. Kobo is an emerging gold explorer focused on Côte d'Ivoire, a jurisdiction that continues to benefit from political stability, sustained economic growth, and comparatively well-developed infrastructure - factors that are favorable in a regional context.

Kossou, the Company's flagship project, is located within the prolific Birimian rock belt, one of the most significant gold-bearing structures in West Africa. The bustling capital, Yamoussoukro, is just a stone's throw away. Extensive drilling campaigns totaling several tens of thousands of meters have proven a consistent gold system in the Road Cut and Jagger target areas, which appear to remain open both laterally and at depth. Several high-grade intervals over significant thicknesses stand out relative to regional averages and point to zones of potential economic relevance. These results underpin the current follow-up program of approximately 12,000 to 15,000 meters of additional drilling, designed to support an initial formal resource estimate targeted for 2026.

Kossou gains additional significance due to its location within one of the most densely developed gold districts in the region. Established producers such as Perseus Mining, Endeavour Mining, and Barrick operate nearby and continue to seek expansion opportunities. The direct proximity to Perseus Mining's Yaouré mine, which has been producing more than 200,000 ounces of gold annually since late 2020, appears particularly attractive. The processing plant and infrastructure available there represent a potential strategic advantage for neighboring projects. Against this backdrop, various strategic options are available to Kobo Resources. Should ongoing drilling confirm continuity of mineralization over larger distances, earn-in arrangements, joint ventures, or a potential corporate transaction could become viable medium-term options. The project portfolio is complemented by the Kotobi area, which has only been superficially explored to date.

A recently completed capital measure of just under CAD 4 million provides the Company with the necessary financial flexibility to advance both the resource definition at Kossou and metallurgical testing and further work on the satellite projects without having to raise additional capital in the short term. With a current market capitalization of approximately CAD 32 million, the story is only just beginning. Collect!

Strategy – The Bitcoin business model is out

In contrast to the recent boom in gold investments, the Bitcoin asset management business model appears to have fallen out of favor for the time being. MicroStrategy, the former star among coin accumulators, changed its name to Strategy in 2025. The dazzling figurehead is founder and CEO Michael Saylor, who has made the Company the world's largest Bitcoin owner through stock and bond issues. According to recent reports, Strategy now owns 660,624 BTCs with a current market value of around USD 59 billion. This means that the Company's enterprise value of USD 59 billion corresponds exactly to its crypto holdings. It does not even bear thinking about if the BTC price falls to USD 50,000 and interest of around USD 1 billion is still due. The world's largest index organization, MSCI, recently announced that it is reviewing whether crypto companies that have more than 50% invested in this asset should be excluded from the indices. Michael Saylor and associations such as Bitcoin For Corporations have protested with letters and a petition, calling the proposal misguided. Critics argue that comparable corporations in oil or commodities are also not very diversified, yet they are not excluded. So far, the affected stocks remain in the indices, with a final decision to be made in January 2026. An exclusion of Strategy shares would be another fundamental sell signal.

The precious metals markets have a lot of external influences to deal with. Gold is benefiting from ongoing inflationary pressure, fragile financial systems, and the trend toward physical assets. Crypto asset managers seem to be out for now, and premiums to NAV are at least a thing of the past. Anyone looking to speculate on future properties with potential should take a closer look at Kobo Resources. A takeover as early as 2026 seems possible, as the valuation is far too low.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.