February 13th, 2026 | 07:05 CET

Defense Stocks Consolidate: Sideways Phase or 100% Upside Potential? Rheinmetall, RENK, Hensoldt, Power Metallic, and CSG

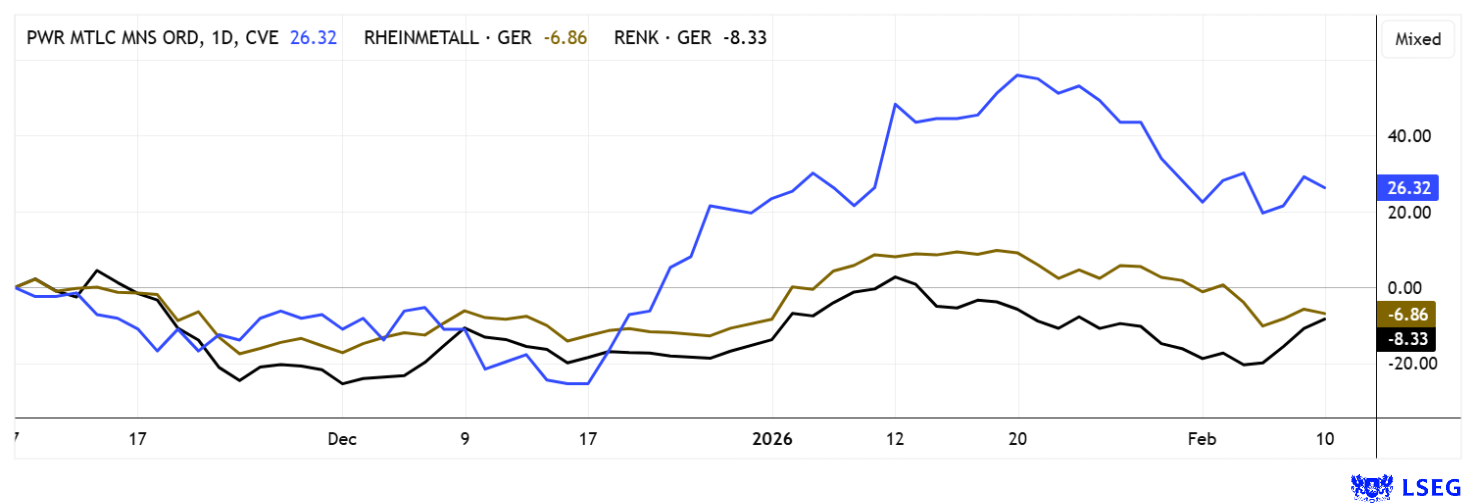

Investors would have hoped for a different outcome since October 2025. While commodity stocks climbed to historic highs, the market's former favorites in the defense sector saw their first significant wave of profit-taking. Rheinmetall fell from EUR 2,005 to EUR 1,450, Renk dropped from EUR 95 to below EUR 50, and Hensoldt declined from EUR 117 to EUR 65. Although these stocks later recovered some percentage points, new record highs have yet to materialize. The situation was quite different in the critical metals sector - the supply chain companies serving the defense sector. Since autumn, one thing has become increasingly clear: materials are running scarce. This is because the growth of the newly beloved defense industry requires huge quantities of metal. With high-tech components embedded in virtually all modern systems, copper in particular is in high demand, along with rare earths and tungsten. The recent explosion in copper prices to over USD 13,500 speaks volumes. Investors may want to consider reallocating their portfolios, as high metal prices are likely to lead to declining margins in the future, particularly in the defense sector. Here are a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005 , POWER METALLIC MINES INC. | CA73929R1055 , CSG NV | NL0015073TS8

Table of contents:

"[...] If we pursue our goals conscientiously, the market will adjust its valuation accordingly, I am sure. Often, all it takes is a trigger. [...]" Ryan McDermott, CEO, Phoenix Copper

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Power Metallic Mines – NYSE listing and supply chain integration by 2030

A perfect example of how new supply chains can form is provided by the dynamic explorer Power Metallic Mines from the Canadian province of Québec. Critical metals such as nickel, copper, cobalt, platinum, palladium, gold, and silver form the backbone of the global energy transition. The rapid rise in the use of artificial intelligence is greatly increasing demand. New AI data centers and cloud infrastructures are springing up at a rapid pace around the world and require massive amounts of electricity. Without sufficient storage solutions and robust networks, much of the wind, water, and solar energy remains unused. Experts estimate that decarbonization strategies will require several terawatt hours of storage capacity by 2040 to close the emerging gaps while supplying data centers and electric vehicles.

The Long Duration Energy Storage Council forecasts investments of up to USD 3 trillion for 1.5 to 2.5 terawatts of long-term storage. In this scenario, metals with electrical properties are gaining strategic importance as they power batteries, cables, and high-tech components for electric mobility, hydrogen, and storage technologies. Power Metallic is positioned precisely in this market environment. Under CEO Terry Lynch, the team is focusing on polymetallic deposits that are essential for the technologies mentioned above. The flagship Nisk project is one of the largest of its kind in North America and includes everything one could desire. Recent acquisitions of Li-FT Power and others have increased the area by over 600% to 313 km², including more than 300 new claims around the Nisk core cell. Québec offers ideal conditions: political stability, mining-friendly regulations, low bureaucracy, and established infrastructure, supported by government subsidies.

Nisk has recently set milestones. Drill results from the summer program confirm high-grade zones in the Lion Zone, with copper equivalents (CuEq) of up to 14.34% and peak values above 27%. These extend in depth and width and form the basis for an upcoming resource estimate (MRE). Geophysical data also indicates unexplored sulfide zones in the Lion-Tiger Deep area. These are complemented by extensions such as Nisk East and Hydro Lands. An ongoing 100,000-meter drilling program, already 50% complete, promises continuous results, supplemented by further testing for a feasibility study. The financial position is extremely solid with over CAD 30 million in cash. A planned NYSE listing could boost visibility and access to capital, as Almonty Industries has shown since 2025. Analysts such as Roth Capital and Red Cloud see enormous potential up to the CAD 2.50 to 3.00 zone. At prices around CAD 1.30, there is clear potential for a doubling. Accumulate!

CEO Terry Lynch, in an interview with IIF host Lyndsay Malchuck, discusses the latest progress in Québec.

Rheinmetall, RENK, and Hensoldt – No returns since October 2025

Rheinmetall, RENK, and Hensoldt currently form the strategic backbone of the listed German defense industry. After these stocks reached their all-time highs in October 2025 with annual returns of 100 to 600% and have since consolidated at a high level, investors should now recalculate. Those who bought in at the peak have had to cope with significant fluctuations of up to minus 45% in the meantime, which shows that the market is paying closer attention to valuation again after the euphoria phase.

The structural tailwind from rising defense spending in Europe remains intact, but the pace of price gains has normalized noticeably due to the already anticipated order situation of the century. Our favorite, Rheinmetall, is an impressive integrated systems provider with a particularly strong systems and ammunition business that benefits from sustained high demand and limited production capacities. This structural supply shortage creates visibility for revenue and margins over several years. Analysts also point to the strategic realignment of the portfolio, which is expected to put the group in a leading position within Europe by 2030. Try to enter between the range of EUR 1,250 and EUR 1,475.

The Augsburg-based RENK Group positions itself as a highly specialized supplier of drive systems for military platforms and scores with a high-margin spare parts and maintenance business, which already accounts for around 40% of revenue. However, the planned expansion of production by the end of the decade and the stronger focus on the defense business increase the company's dependence on the defense cycle. Positive aspects include the solid balance sheet, moderate investment ratios, and expansion plans in the marine sector, which should enable additional growth. Hensoldt, in turn, is benefiting from massive pent-up demand in European air defense and its technological leadership in the field of modern AESA radar systems. Major orders as part of the European Sky Shield Initiative underscore the operational momentum, yet some analysts consider the valuation to be already ambitious.

Analyst price targets on the LSEG platform continue to reflect significant optimism. For Rheinmetall, the average target price is around EUR 2,130, with a range of approximately EUR 1,770 to EUR 2,500; for RENK, the targets range between EUR 63 and EUR 76; and for Hensoldt, the midpoint of expectations is around EUR 90. However, it should be noted critically that these targets implicitly assume the smooth implementation of rearmament programs, stable political majorities, and sustained high defense budgets. Should sustainable peace solutions appear on the horizon or budget problems stop the show, there are high technical downside risks.

CSG – Little movement after two weeks

Czech defense contractor CSG got off to a good start on Euronext. Initial prices rose to EUR 35.50, then the stock moved sideways. For company founder Michal Strnad, it was a windfall of over EUR 3.8 billion, with EUR 750 million going into the company's coffers as a capital increase. At an issue price of EUR 25, the share price initially rose by 40%, even though the euphoria seems to have faded considerably. CSG thus joins the ranks of European defense stocks and can point to similar growth figures. Nevertheless, investors should not expect above-average returns for the sector. According to the issue prospectus, fully consolidated revenue in 2024 amounted to EUR 5.2 billion and is expected to rise to an ambitious EUR 7.6 billion by the end of 2026. With a market valuation of EUR 32 billion, a revenue multiple of 4.2 is already being applied here as well. The bottom line is even slightly higher than for Hensoldt. Too expensive!

The stock market gives and takes. In the defense and security industry, a consolidation trend has established itself after dream returns over the last 24 months. This is a good thing because, fundamentally, operational growth through the end of 2027 has long been priced in. In the critical metals sector, on the other hand, there is a steady upward trend that could culminate in a buying frenzy in the current year. Investors should diversify their investments in order to achieve smoother returns.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.