October 21st, 2024 | 07:15 CEST

DAX 20,000 - Breakout to Mega Bull Market, Enter Strategically Now: BYD, NIO, Almonty Industries, ASML and SMCI

This week could be the week. Just 2.5% separates the DAX-40 index from the magical 20,000-point mark. High-tech remains in demand, and last week, for the first time in months, automotive stocks also rose again. The Paris Motor Show closed its doors yesterday, and the result is clear: China dominated the exhibition with its new releases, showcasing innovation. And to the great chagrin of the EU, with prices on average 27% lower. At least the import duties were set in October, but the battle for the consumer has yet to be fought. Because Chinese vehicles are not only considerably cheaper, they have long since caught up with local manufacturers in terms of technology, features and design. Where are the opportunities for shareholders?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NIO INC.A S.ADR DL-_00025 | US62914V1061 , ALMONTY INDUSTRIES INC. | CA0203981034 , ASML HOLDING EO -_09 | NL0010273215 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and NIO – Pressure to Innovate for Europe

The Paris Motor Show closed its doors yesterday. The important industry trade fair impressively demonstrated the growing influence of Chinese carmakers such as BYD on the European market. With its innovative technologies and short product cycles, BYD is putting European companies such as Volkswagen, BMW and Mercedes-Benz under massive pressure. Since its foundation in 1995, BYD has developed from a battery manufacturer to a global giant in the field of electric mobility. With control over the entire value chain, including battery production, the Company has a decisive advantage in the field of electric vehicles. Its proprietary "Blade Battery" is one of the most advanced units on the market today. While European manufacturers are trying to keep pace with these technological advances, they are lagging in many areas, particularly software solutions and vehicle connectivity.

On the other hand, the European Union is trying to curb the increasing import of Chinese electric vehicles by introducing tariffs to protect the domestic car industry. This is a double-edged sword, as many companies fear that China could restrict market access for EU manufacturers in return. This particularly affects German premium manufacturers, which rely heavily on the Chinese market. However, almost half of Chinese consumers plan to buy electric vehicles, which gives local manufacturers a further boost. Interest is also growing in the EU, with 26% of consumers in Germany planning to buy an electric vehicle in the next two years. The start-up NIO has established a battery exchange system in China, that has not yet been approved in Europe, making it possible to reduce charging times to 10 minutes. Investors should keep an eye on Chinese technology companies, as the automotive market is undergoing fundamental changes.

Almonty Industries – The revaluation is imminent

Large-scale industrial production involves a whole range of critical raw materials. In the field of automotive engineering, high-tech and defense, the heat-resistant hard metal tungsten is in demand. As with many metals, there has been a dependency on China for years because 70% of the world's supply is mined here. The geopolitical changes between the US-dominated West and the newly formed BRICS alliance are becoming increasingly concerning. They are drawing more and more countries into their orbit that have wanted to leave the US dollar system for years. Tungsten, in particular, could, therefore, become a difficult material to procure.

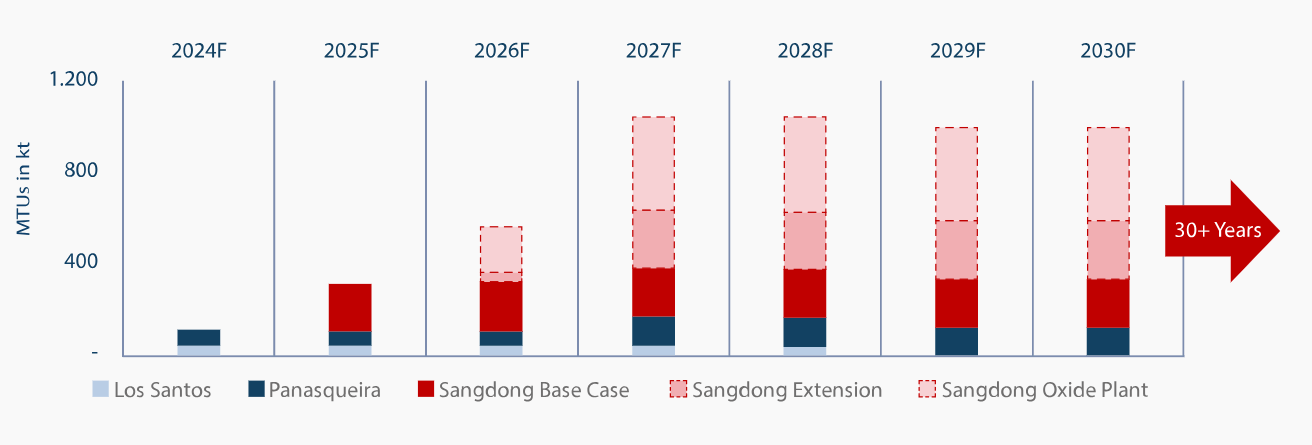

The Canadian company Almonty Industries is on the way to significantly increasing the amount of tungsten available to Western industrial customers. It currently owns four properties in Europe and South Korea. The situation in Sangdong, Korea, is about to become more exciting. The subsidiary Almonty Korea Tungsten Corp. (AKTC) can now report that the test operation of a small pilot plant has been successfully completed. The current renovation of the existing tungsten mine in South Korea is raising hopes that the country will be able to significantly reduce its dependence on China for the metal, which is essential for the production of semiconductors, electric vehicles and missiles. The offtake contracts for delivery from 2026 have already been concluded. The following figure shows the planned production until 2030.

Almonty recently held a site visit at the Sangdong mine, and many interested parties were in attendance. For further financing, the EU should also be prepared to provide significant funding from the perspective of securing strategic supply chains. The substantial reserves of molybdenum are still completely outside of any assessment. The rare element is mainly used to harden alloys and steel. The story in South Korea is now quickly entering the final stages. Almonty is expected to generate initial cash flows from Sangdong as early as 2025, and according to current estimates, the mine could operate for over 30 years and, in its final stage of development, represent one of the largest tungsten resources in the world.

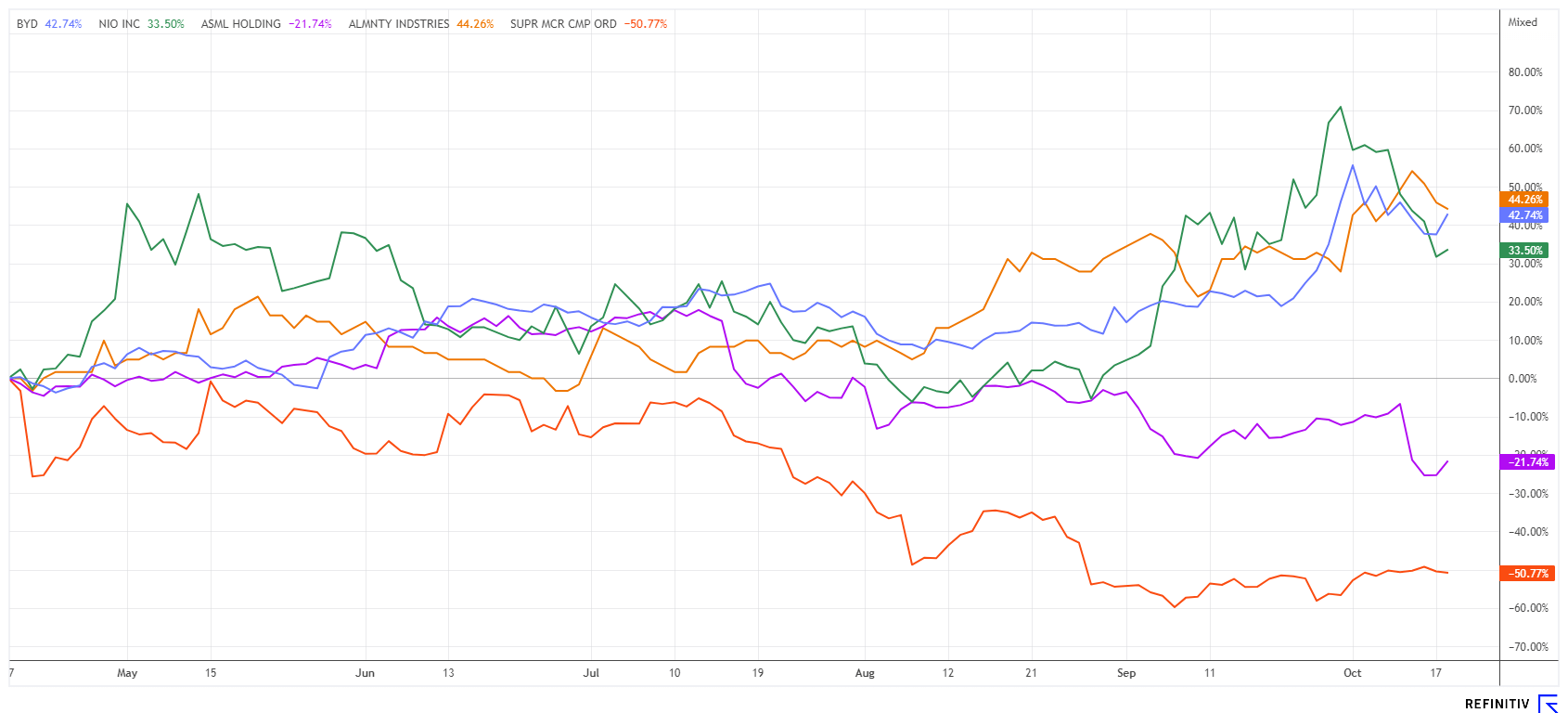

The Canadian holding company Almonty Industries, currently with a market capitalization of almost EUR 140 million, is already being targeted by international mining groups. The share price has risen by 30% in recent weeks to just under CAD 1.00. Almonty has a stable shareholder structure, with CEO Lewis Black holding 19.5%, the Plansee Group (Austria) at 15% and Deutsche Rohstoff AG at 12.8%. The valuation of an operating tungsten mine of the size described could be in excess of USD 1 billion; the current total enterprise value is around CAD 220 million. The story is, therefore, likely to accelerate rapidly soon.

ASML and SMCI – The correction could soon be over

The Dutch technology stock ASML suffered a 20% drop in its share price because experts are expecting lower growth for 2025. ASML posted a profit of EUR 2.1 billion on sales of EUR 7.5 billion in Q3, beating analysts' estimates. However, orders of EUR 2.6 billion fell well short of forecasts, which had been between EUR 4 billion and EUR 6 billion. According to ASML, demand for chips for artificial intelligence (AI) remains high, but other market segments are taking longer to recover from the economic downturn. US bank JPMorgan has left ASML at "Overweight" with a price target of EUR 1057. Analyst Sandeep Deshpande believes that Taiwanese chipmaker TSMC will be an important buyer of ASML products in the coming year and that the current correction to below EUR 650 represents a buying opportunity.

Things have also been anything but rosy for AI supplier and Nvidia partner SMCI over the last four months. The stock had lost 70% of its March peak as the SEC had raised some questions with the Company about the most recently reported figures. Due to negative comments from a short seller, SMCI stock has crashed despite a stock split. However, positive comments are now increasing again; last week, there was a top announcement. A new storage system was announced that is optimized for workloads when using artificial intelligence. The system integrates the state-of-the-art NVIDIA BlueField-3 data processing units (DPUs) to improve performance for AI training, inference and high-performance computing (HPC). Gradually, the chart also seems to be stabilizing.**

The indices are benefiting from the interest rate cut cycle that is now beginning. As soon as inflation returned to tolerable levels, the central banks voted in favour of low interest rates, further driving the technology boom. Bitcoin, gold, silver and other commodities are also making headway. With the opening of the mine in 2025, Almonty Industries could enter a whole new valuation dimension.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.