May 28th, 2025 | 07:10 CEST

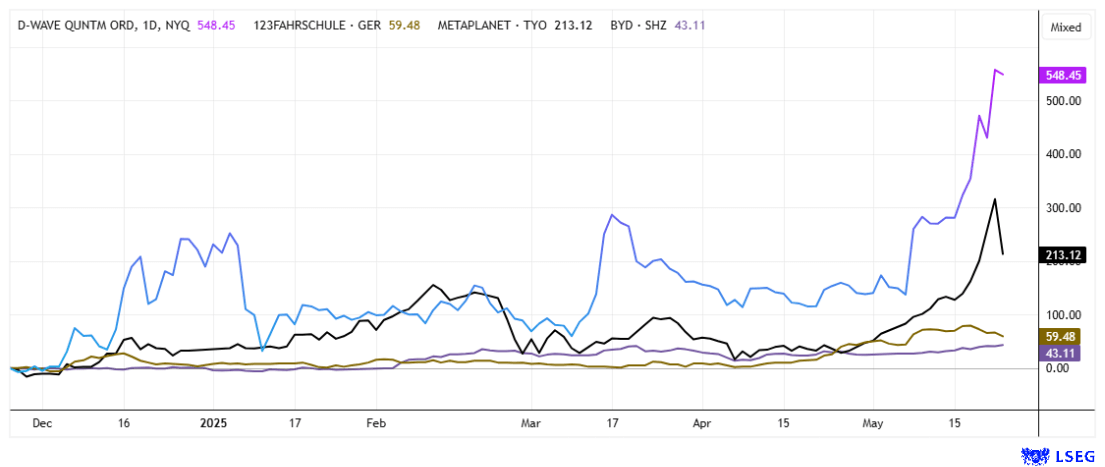

Can you believe it? Stock market darling BYD plunges, while D-Wave, 123fahrschule and Metaplanet go into express mode!

Bull mode every day? While 30-year government bonds in the US have climbed to the magical 5% yield mark, stock markets are rising to new highs almost daily. However, the focus is no longer on the NASDAQ but on the DAX 40 index - the reason: US President Donald Trump's policies are causing international caution toward the formerly close ally. Tariffs are limiting growth, and tourism is collapsing, weakening the US dollar and prompting fund managers worldwide to look for other investment opportunities. Rising interest rates and a growing budget deficit could thus become economic dynamite for the promised land. In contrast, an increase in investment rates has been observed in Europe since the beginning of the year, with investors investing in digitalization and infrastructure following generous public investment decisions. Where do the opportunities and risks lie?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , D-WAVE QUANTUM INC | US26740W1099 , 123FAHRSCHULE SE | DE000A2P4HL9 , METAPLANET INC | JP3481200008

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

123fahrschule – Growth through innovation

The listed driving school provider, 123fahrschule SE, is setting a good example in terms of digitalization. The Company has been investing heavily for some time now, with the aim of increasingly digitalizing the process of obtaining a driver's license. CEO Boris Polenske is an energetic founder, investor, and visionary. He launched KlickTel at the turn of the millennium and listed it on the stock exchange just in time for the technology boom. In 2016, he founded 123fahrschule. Unlike many brick-and-mortar businesses, Polenske recognized the importance of digitization and modernization in the industry early on. The Company's size, digital presence, and focus on innovative technologies such as online registration, app-based appointment management, and driving simulators complement traditional driving school services. Today, his company relies on online services and e-learning to completely revolutionize the driver education system in Germany.

Since March 2025, former Check24 manager Dr. Andreas Günther has been a member of the Executive Board of 123fahrschule SE, and since May 2025 he has been Chairman of the Executive Board. With his many years of experience, starting at Bain & Company, he is considered an expert in scaling, digitalization, and strategic transformation. He is now actively shaping the future and driving the Company's development forward in a sustainable manner. All he needs to do is continue where his predecessor left off. After all, 123 is now one of Germany's largest driving school chains and is focusing on further growth through new openings and acquisitions. With innovative approaches such as a learning app, a driving simulator, intensive theory training courses, and targeted exam preparation, the Company's offering stands out from the competition. The goal is to keep the cost of a Class B driver's license affordable for between EUR 2,000 and EUR 2,500. The Company's current online campaign is also clever: anyone who registers for driving lessons by May 31, 2025, and engages in a bit of social media has the chance to win EUR 500 for a hobby of their choice. This is sure to appeal to the target group of school leavers!

With an 18% increase in revenue to EUR 6.6 million and EBITDA of around EUR 650,000, the Company significantly improved its revenue and earnings compared to the previous year. Polenske remains confident in the current annual guidance of EUR 28 to 30 million in revenue and EUR 1.5 to 2.5 million in EBITDA. The stock price is also performing strongly. Since the beginning of April, the share price has almost doubled from EUR 2.20 to EUR 4.28 at its high. Investors are currently taking some profits, but there is still a 60% gain compared to the start of 2025. NuWays analysts have issued a "Buy" rating with a target price of EUR 7.90, suggesting the rally could continue at a rapid pace.

D-Wave Quantum and Metaplanet – Out of this world

D-Wave and Metaplanet are currently attracting attention with completely different digital concepts. Just a few months ago, analysts were wondering about the high valuation of the Canadian company. Last week, despite all the doom and gloom, the stock rose from USD 8.50 to USD 19.75 in no time at all. The astonishing part: with massive daily trading volumes of over 130 million shares, around 40% of all outstanding shares issued changed hands. There is great euphoria surrounding the quantum stock, as the Company is already cooperating with highly funded organizations such as the Jülich Supercomputing Center. The newly released sixth-generation system eclipses all previous computing performances. What has surprised even experts is that the revolutionary D-Wave technology solves real-world computing tasks and data analyses in significantly less time and with less energy than conventional high-performance computers. Since fall 2024, D-Wave shares have increased fifteenfold. The coming days will be crucial in determining whether this new valuation level - over USD 5 billion, based on estimated 2025 revenues of just USD 27 million - can truly hold.

Things are even crazier at Japanese Bitcoin collector Metaplanet. The stock has been pushed up in recent weeks as a meme stock on various social networks and is extremely volatile. The Tokyo-listed company has set itself the goal of buying Bitcoins off the market. This strategy is already familiar from the US company MicroStrategy. While investors there have to pay around a 100% premium on Bitcoin holdings, Metaplanet was trading at around a factor of 10 yesterday. The Company reported a BTC return of just under 96% for the first quarter, but this is no guarantee of future profits. However, if the BTC price expectations of various experts of between USD 125,000 and USD 250,000 for 2025 come true, then the calculation will, of course, look different. A few days ago, Metaplanet shares were trading at over EUR 20, three times higher than their current price, and are currently correcting. The stock is only for gamblers!

BYD – Sharp price cuts are making the rounds

BYD shares have come under pressure in recent days. The reason: The Chinese market leader in e-mobility announced a drastic price cut for its products over the weekend. The lower prices are intended to boost sales, as more than 5.5 million units are to be delivered this year. The start of the new year was a great success for BYD in Europe. Of the approximately one million vehicles sold by BYD worldwide in Q1 2025, over 416,000 were fully electric. Tesla, on the other hand, only managed 337,000 deliveries, making it the second-largest electric vehicle manufacturer worldwide. The coming months are expected to remain the same, with BYD now slashing prices by up to 34% in its home market. The entry-level Seagull model, which will be sold in German showrooms as the Dolphin Mini, is available in China for less than USD 8,000. BYD has a major advantage in the price war thanks to its vertically integrated supply chain, as it manufactures its own semiconductors and batteries. This leaves a gross margin of 20% on the books. The price battle has officially begun. As a result, BYD's strong-performing share price is down 15%, but this is no big deal because the 12-month outlook shows a 93% gain. Tesla and VW can only dream of such a performance!

The year 2025 is delivering curious price movements with constant ups and downs. The focus is again on forward-looking business models transforming entire industries with digitalization approaches. D-Wave and Metaplanet are highly hyped stocks with insane fluctuations. Those looking for stability and steady value growth are well advised to stick with BYD and 123fahrschule. The medium-term growth expectations here are realistic and anything but overpriced on the stock market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.