September 22nd, 2022 | 11:32 CEST

BioNTech, XPhyto, Valneva - It is over!

In an interview with the television station "CBS", the most powerful man in the world, US President Joe Biden, declared the pandemic over. While people in Germany have to wear face masks to the Oktoberfest in local and long-distance transport and then blare the latest hits from Mallorca in the marquee, without masks, of course, outside the former growth engine of Europe, relaxation seems to be setting in regarding COVID-19. A blow to the global vaccine industry! Meanwhile, a new market is growing unnoticed in the healthcare industry that could trigger a lasting trend in the near future.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , VALNEVA SE EO -_15 | FR0004056851 , XPHYTO THERAPEUTICS | CA98421R1055

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

BioNTech - Heavy blow

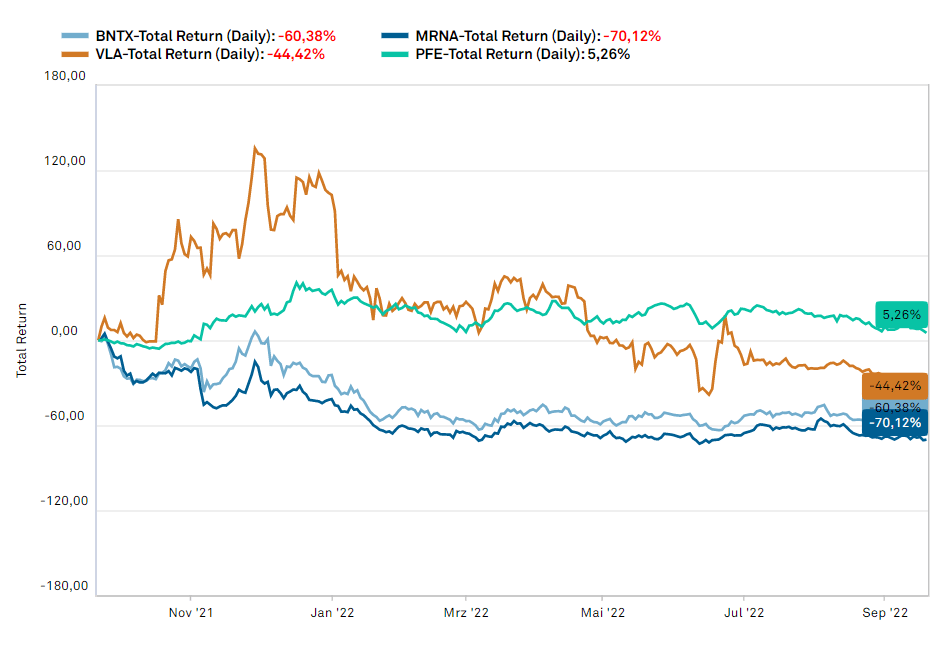

"The pandemic is over," the US-President told a CBS journalist at the Detroit auto show. While Corona remains a problem, he said, and his government continues to work against the virus, the auto show is the best example that the pandemic is now behind the US. German Health Minister Karl Lauterbach is unlikely to like these statements any more than global vaccine manufacturers. Because in the wake of the head of state's remarks, the prices of vaccine producers slumped by double digits.

The BioNTech share is currently quoted at EUR 133.40 and is struggling with a striking support zone. On the one hand, the high for the year 2021 is at the current level. On the other hand, this area has already been successfully tested five times this year. A sustained slide below this level will likely result in a further sell-off, as several stop orders have been placed here in the past. The EUR 121.50 mark should then offer a first stop. From the indicators, little relief can also be expected. Thus, a new sell signal was generated in the MACD on a weekly basis. The relative strength indicator has also been on "Sell" for a short time.

The market capitalization of the single-product Company currently stands at USD 32.39 billion. A possible collapse in vaccine sales is likely to hit the Mainz-based Company hard. Although several therapies are already in the pipeline, especially in cancer research, a second commercial product in addition to the vaccine is not expected in the near future.

.

XPhyto - Scaling up in a growth market

While the vaccine sector against the Coronavirus may have already peaked, the global psychedelic drug market is still beginning a steep growth curve. Between 2022 and 2029, market research firm Data Bridge Market Research predicts an annual growth rate of 13%. At the same time, this would mean an increase in market volume from the current USD 2.39 billion to USD 6.40 billion by then.

Around 350 million people worldwide live with depression. According to estimates by the World Health Organization (WHO), only one in four sufferers receives adequate treatment. That makes depression the most important cause of illness of all. Apart from prescribing antidepressants, which usually have severe side effects, few alternative therapies are currently available. For some years now, however, the "mental health" sector has been revolutionized, primarily by innovative biotech companies. Compass Pathways, financed by self-made German billionaire Christian Angermayer, already achieved unicorn status before the market correction. Currently, the Nasdaq-listed Company has a market capitalization of USD 800 million.

With the same approach but still behind Compass Pathways in development, XPhyto Therapeutics announced a milestone in the development of psychedelic agents. The diversified life sciences accelerator, which focuses on next-generation drug formulations, diagnostics, and novel pharmaceutical agents, was able to file a patent application for its substantial collection of novel psychedelic compounds.

In doing so, the compound database can be targeted for treating neuropsychiatric, neurodegenerative and neuroinflammatory disorders, including depression, tobacco, opiate and cocaine addiction, or alcoholism, among others. In doing so, XPhyto secures a platform technology with its database of psychedelic molecules, where variations of the molecules can be used for different indications. The development work was carried out in cooperation with Applied Pharmaceutical Innovation, but XPhyto owns the intellectual property rights.

Compared to Compass Pathways, XPhyto, which has research and development sites in North America and Europe, with an operational focus in Germany, is still hardly noticed by the psychedelic medicine market. Its market capitalization is currently CAD 34.66 million. The Canadian Company intends to disclose further details regarding the novel database shortly. Thus, an important player in the multi-billion Mental Health market could emerge.

Valneva - All dams broken

As if the news mentioned above from the United States was not enough, the Austrian-French biotechnology company followed up with a horrendous announcement. Valneva and partner IDT Biologika announced the termination of their collaboration. It is to take place after the delivery of the COVID-19 vaccine VLA2001 to Valneva and in consideration of the current order situation and existing stocks.

Due to the lower purchase volume from the EU Commission, Valneva stopped production of the vaccine. In addition, the Company will pay its partner IDT Biologika EUR 36 million as compensation plus the equipment cost of approximately EUR 4.5 million.

With the vaccine fantasy now gone, investors felt compelled to dump the stock, whatever the cost. The share lost more than 30% of its value within 5 trading days and is currently trading at an all-time low of EUR 6.20. A countermovement after the strong price losses is possible, but as an investment and speculation on a recovering vaccine market, there are better alternatives.

The statements of the US President about a possible end of the Corona pandemic caused heavy price losses for vaccine manufacturers. BioNTech is at an important support line, and Valneva has already broken through it. In contrast, XPhyto, with its patented database of novel psychedelic agents, could be facing a reassessment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.