June 11th, 2025 | 07:10 CEST

Artificial intelligence predicts a perfect summer – 150% chance with Lufthansa, Credissential, TUI, and D-Wave

It is worth taking a closer look - even if many might blink in disbelief. Despite ongoing geopolitical tensions and a sluggish economy, the DAX 40 index has already surged by 20% in 2025. Investors are clearly no longer allowing themselves to be rattled by tariff threats and bleak headlines because no one wants to be without stocks anymore. Artificial intelligence is now even available as investment advice, which also recommends a healthy diversification across all asset classes, sectors, and countries around the world in order to generate at least 5% per annum. Yes, 5% - that is the ideal scenario for people who already have substantial capital. Risk-aware and even speculative investors would like to see a little more. Summer is approaching – typically a slow season – but AI is predicting temperatures in Germany at times exceeding 40 degrees Celsius. We take a look at stocks that are already in a hot phase.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

LUFTHANSA AG VNA O.N. | DE0008232125 , CREDISSENTIAL INC | CA22535J1066 , TUI AG NA O.N. | DE000TUAG505 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Lufthansa and TUI – Bring on the AI summer

Tech-savvy investors are wondering how modern technologies can be used in the travel market when it comes to traditional tourism stocks. Of course, this market also has user profiles and a lot of data exchange via reviews and complaints, as well as ratings for events, etc. Platforms such as TripAdvisor benefit from such evaluation methods, for which industry leaders such as HolidayCheck and Check24 provide a digital playground with a wide range of application models and subsequent brokerage services to travel companies and event providers. Since the advent of the internet and increasingly with the widespread use of mobile phones, today's travelers can find all the offers they want on their mobile devices, tailored to their needs, because data about their location, movements, payments, and other preferences is constantly being stored in the background. This is called personalized advertising.

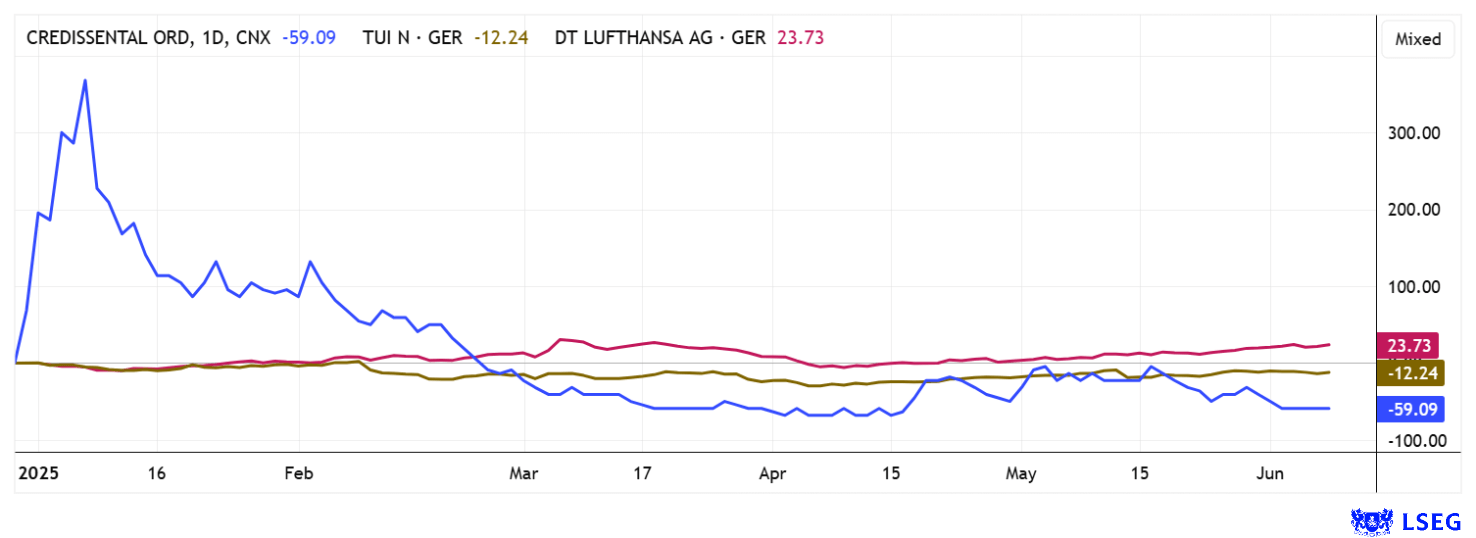

Travel companies such as Lufthansa and TUI are also increasingly using artificial intelligence strategically to optimize efficiency, customer experience, and revenue. Analyzing customer behavior enables tourism providers to use dynamic pricing models, for example, when an offer is viewed frequently online. It should be assumed that this type of use will increase prices. However, AI also helps to predict travel trends, seasonal peaks, and surges in demand. TUI, in particular, uses it to forecast hotel occupancy, transfers, excursions, and events for internal planning purposes. Personalized advertising also enables targeted upgrades or bonuses. This is an exciting, albeit still very young, playground for IT experts. But will it also benefit investors? The share prices of TUI and Lufthansa have undergone a rapid rollercoaster ride, but the lows of 2024 have not been reached again. With prices close to the EUR 7.30 mark, analysts on the LSEG platform set price targets of EUR 10.50 for TUI and a modest EUR 7.05 for Lufthansa. If anything, this seems like an understatement - after all, Lufthansa's book value alone is about 50% higher than its current share price.

Credissential Inc. – Strong performance in digital growth markets

The Canadian IT/AI company Credissential (ticker: WHIP) operates a Software-as-a-Service (SaaS) model. The Company's products are Fintech in nature, as individual solutions pursue a disruptive, digital approach. Since quantum computing also plays a significant role, the Company thought about a quantum encryption layer early on and integrated it into its in-house software Antenna. This ensures a high level of security for its users. Cybersecurity risks have thus become manageable, although not entirely eliminated.

Antenna is currently a secure payment and file transfer platform. In its current stage of development, the Company uses a wide variety of AI approaches and blockchain technology for its innovative software services. Specialized customer groups include car dealers, who can use the DealerFlow app to exchange data quickly and thus sell vehicles more effectively. Integrated escrow services place financial transactions on a secure platform, and digital payment methods in cryptocurrency are also possible. The focus is also on self-employed individuals and small businesses seeking consulting and digitization solutions in the areas of tax, crypto, and compliance.

Credissential also uses AI to develop financial technology that will transform financial services in the long term. By combining advanced analytics, proprietary encryption, and human-centered design, the Company is not only adapting to the future of finance, but helping to shape it. To this end, it is currently looking for certified public accountants to help develop the CoinCMPLY platform, which will be expanded into a B2B solution for the preparation of crypto tax returns. The hiring initiative is in line with Credissential's broader strategic vision of creating a diversified financial technology ecosystem that fills critical gaps in multiple market segments through its software platforms. The goal is to address the real-world challenges of accounting. While the adoption of cryptocurrencies continues to grow steadily in North America, there are still very few service providers capable of helping inexperienced customers navigate the complexities of crypto accounting.

WHIP shares offer investors balanced access to the world of digitalization, which holds promising growth opportunities for many customer groups in its specific forms. The recent NASDAQ correction has pushed the share price back to CAD 0.025, but operationally, the lights are green. The entire Credissential service package is currently valued at only CAD 3 million. An IT giant could quickly snap this up!

D-Wave – A visionary outlook is needed here

Finally, here is a quick look at NASDAQ's most closely watched quantum computing stock. Although the share price halved in April from USD 12 to around USD 6, it was then announced that the latest generation of D-Wave architecture not only delivers enormous time savings in mainframe applications but also consumes significantly less energy. This gave the share price another boost towards USD 18. Management is likely surprised by the high demand for D-Wave shares and has decided on an ad hoc capital increase of USD 400 million. As a reminder, the Company reported annual revenue of USD 8 million in 2024. Although this is expected to climb to over USD 20 million, the price-to-sales ratio for 2025 will still be 245. If analysts' estimates are to be believed, revenues will reach USD 200 million by 2029, a tenfold increase in five years. Investors here are clearly paying for the technology and patents - not the Company's balance sheet. What matters here is the vision, which means the road ahead is likely to remain bumpy!

The stock market has already performed very strongly for a year, during which a recession is forecast. The themes of defense, high tech, and AI really got prices moving, but here too there are slowly signs of fatigue. TUI and Lufthansa, as classic tourism stocks, should benefit from the hot summer booking season, while AI, SaaS, and crypto specialist Credissential offers speculators lower entry prices. If just one business segment really takes off, a quick 150% gain is on the cards!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.