July 7th, 2025 | 07:05 CEST

Almonty Industries – Next signs point to an upgrade

Almonty Industries plays a key role in securing the future supply of raw materials for the West. At a time when approximately 90% of the world's tungsten supply originates from China and geopolitical tensions are escalating, the Company is becoming the focus of Western security interests due to its strategically important Sangdong mine in South Korea. Tungsten is indispensable for defense, aviation, electronics, and mechanical engineering, but until now has been virtually unavailable from conflict-free sources. Almonty is not only developing one of the largest deposits outside China, but could also become the most important tungsten producer in the Western world. This represents a unique opportunity from both an economic and geopolitical perspective.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

The West has a problem - Almonty has the solution

What oil was to the global economy, tungsten is to the modern defense and high-tech industries. The problem: 90% of the global tungsten supply comes from a single source, namely China. And that is precisely where the West has been systematically turning off the tap for months: export controls, delivery bans, and strategic restraint.

Beijing is aware of its power and is exploiting it mercilessly. The consequences for the Western world are dramatic: tungsten prices are skyrocketing, while Western countries are forced to watch their reserves dwindle. Without tungsten, the production of precision weapons, aircraft turbines, and hardened materials is impossible. As a result, the West is concerned about its future defense capabilities.

This is where Almonty Industries comes in. The Canadian-American company is developing the Sangdong mine in South Korea, one of the world's largest and highest-grade tungsten deposits outside China's sphere of influence. With a planned lifespan of over 90 years and ore reserves that are around three times higher than the market average, Sangdong is becoming the West's strategic lifeline. The mine is scheduled to go into production this year. This could lead to a scenario that investors have seen before: when political urgency meets scarce resources, the market usually knows only one direction.

Developments – When a niche player becomes a strategic champion

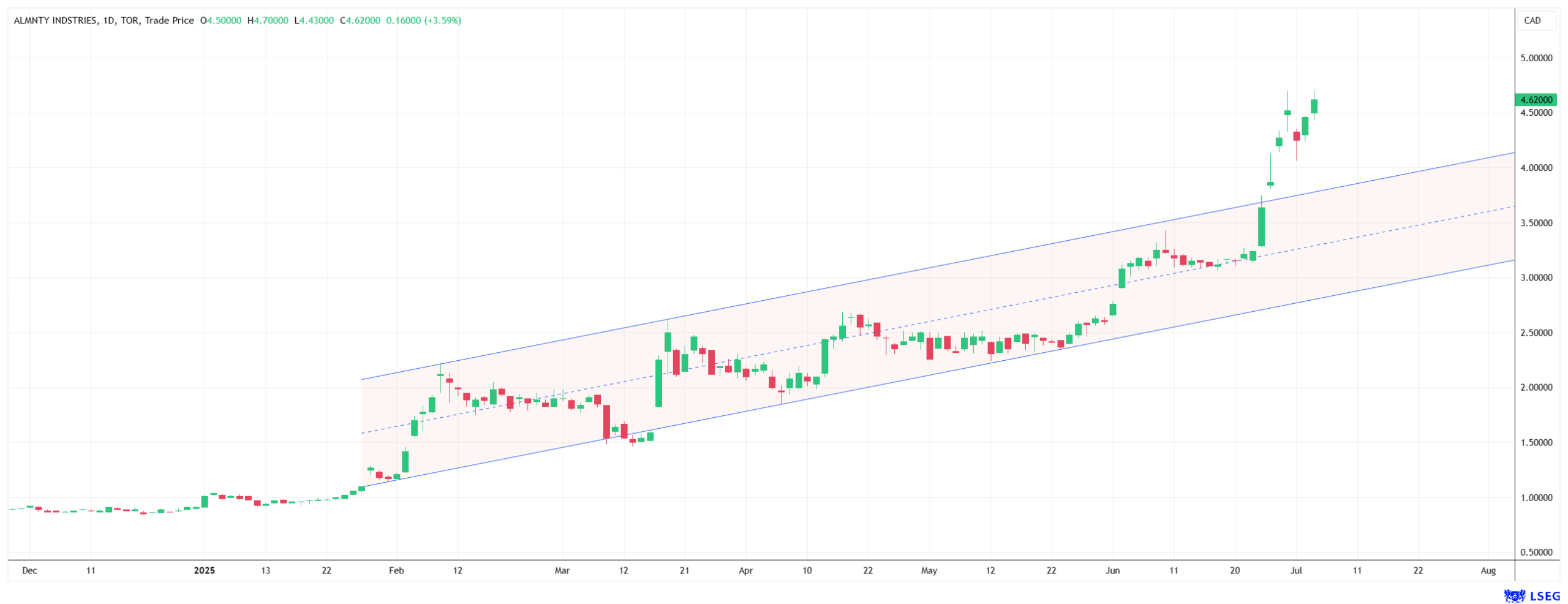

In recent months, the share price has exploded, driven by the prospect of a virtually China-free tungsten supply. Demand is no longer coming solely from private investors; the US defense industry and political circles have also long since positioned themselves. The US company Tungsten Parts Wyoming (TPW) has already secured long-term purchase agreements with Almonty, including a minimum price.

And the development continues. The team, led by experienced CEO Lewis Black, is also planning its own tungsten oxide production and smelting operations to achieve complete independence from the Chinese refining market. This would make Almonty the only fully integrated tungsten source in a region with a stable legal system, which would mean a monopoly that is unparalleled.

The political course is also clear: the relocation of the Company's headquarters to the US was approved by 99.6% of shareholders. With former General Gustave F. Perna and logistics insider Alan Estevez, two high-profile US defense experts now sit on the board. The message behind this move is clear: Almonty is ready to become America's No. 1 tungsten supplier.

Reverse Split – The countdown to NASDAQ is on

The next catalyst for share price momentum is already underway. Almonty is preparing for its big debut on the NASDAQ stage. To technically secure the necessary price of over USD 3, a reverse split at a ratio of 1.5 to 1 was carried out. A listing on the NASDAQ means access to billion-dollar funds, increased international visibility, and potential index inclusion - all of which could attract new, major investors to the stock.

In the short term, the move is causing a stir, as short sellers could come under pressure. Technical changes of this nature have repeatedly led to forced liquidations in the past, as brokers or custodians were unable to deliver on time. Anyone thinking they can sit back comfortably on the short side may soon find themselves nervously watching their screen. In the long term, however, the move is tantamount to a knighthood. Only those who meet the NASDAQ's strict criteria in terms of transparency, corporate governance, and financial standards are eligible to be listed there.

Conclusion: Tungsten is the new oil – and Almonty the tap

What we are seeing here is more than just a mining project. Almonty Industries is poised to become the lifeline of Western commodity strategy in a market that is on the verge of escalation. The situation is clear: China has its hand firmly on the tungsten valve, and the West urgently needs an alternative. Almonty is ready to fill that gap.

With Sangdong in South Korea, strategic partners, US policy backing, and a NASDAQ listing on the horizon, the Company is better positioned than ever before. The market is beginning to understand this, but not everything has been priced in yet. Those who get in now could be part of a new commodity rally.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.