July 31st, 2025 | 07:15 CEST

AI and biotech – A dream team for returns! Evotec and Novo Nordisk in the spotlight, and NetraMark steps on the gas!

The biotech sector is currently undergoing profound change: big data and artificial intelligence are revolutionizing the way drugs are researched and developed. AI-supported systems help identify molecular target structures more quickly and select active ingredients more precisely. Both start-ups and established companies are increasingly using data-based platforms to shorten development times and make clinical trials more successful. Investors are increasingly directing their capital toward companies that combine biotechnology with modern data analysis. The stock market is ruled by daily madness with figures that are not within the expected range. However, innovative growth markets will remain volatile and attractive at the same time, so bet on the winners!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , NOVO NORDISK A/S | DK0062498333 , NETRAMARK HOLDINGS INC | CA64119M1059

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Is anyone collecting here?

Another revenue correction for the current year. Investors reacted with concern to the persistent bad news from Hamburg and sent Evotec's share price into a tailspin after the revenue warning. The share price bottomed out at EUR 5.95 before recovering to EUR 7.80. Was an institutional investor lying in wait? That seems likely, given that Evotec recently reported good operational progress in the realignment of the group. The Hamburg-based company has launched a large-scale research project in the previously underserved field of acute kidney injury (AKI). This complication affects around one-third of patients after heart surgery. At the same time, Evotec is pursuing a realignment of its business model through the planned sale of its biologics site J.POD Toulouse to Sandoz. The deal, which was agreed for a purchase price of around USD 300 million in cash plus technology-related considerations, is intended to reduce capital intensity and shift the focus more towards high-margin services.

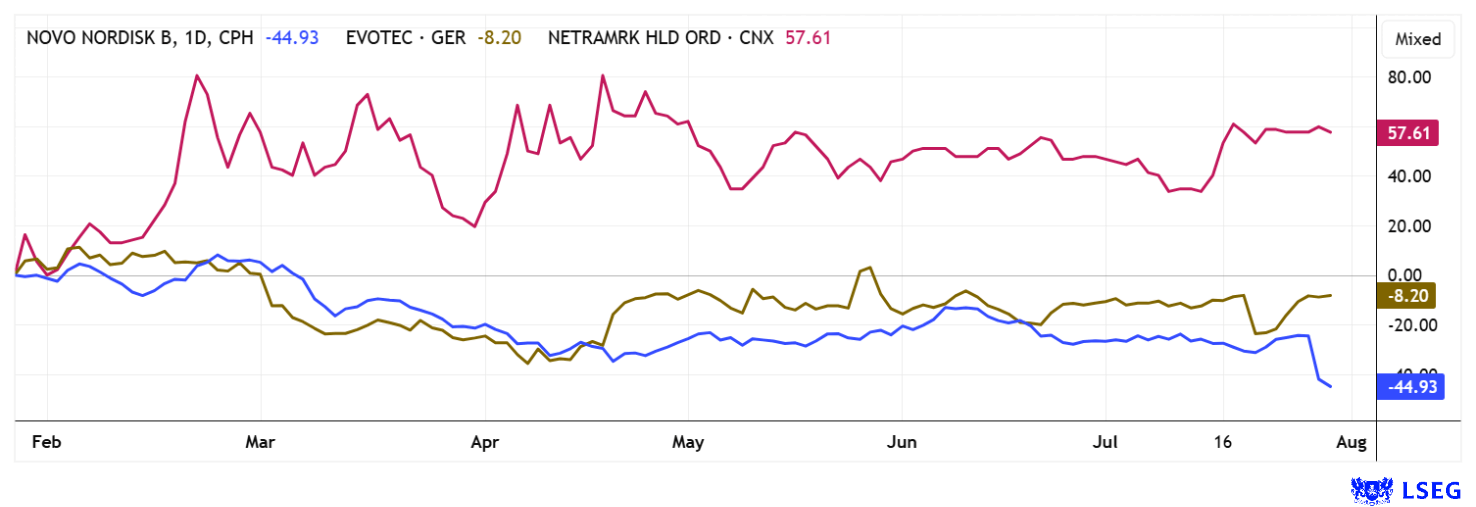

The key point: The sale gives Sandoz access to Evotec's integrated development and production platform, and the collaboration is expected to intensify. Evotec expects the transaction to improve its revenue mix, strengthen margins, and increase capital efficiency. The transaction is expected to close in the fourth quarter of 2025. As Evotec's share price continues to recover, the investment bank confirms its "Outperform" rating with a price target of EUR 11.90. On average, analysts on the LSEG platform expect prices to be around EUR 10.70 over a 12-month horizon. This is at least 50% above the current price of EUR 7.40. Recent high revenues point to acquisitions of larger companies. The stock remains a hot potato.

NetraMark Holdings – A new partnership provides impetus

Canadian company Netramark is attracting attention in clinical research with its new AI platform "NetraAI 2.0". With a strong focus on artificial intelligence, the Company is currently poised for takeoff, and its stock has risen by an impressive 45% since the beginning of the year. A recent study shows that NetraAI analyzes medical data much more accurately than systems such as ChatGPT, DeepSeek, or classic ML methods. The key lies in the reliable identification of patient subgroups, which are crucial for the success of clinical trials.

A new collaboration has now been announced. NetraMark and data analysis specialist Pentara are combining their expertise to significantly improve the quality and reliability of clinical trials. At the heart of the collaboration is an innovative, AI-powered tool that detects unusual behavior patterns in trial centers and among trial participants at an early stage, thereby ensuring the integrity of sensitive trial data. Using advanced algorithms, the system detects unusual patterns in both trial subjects and at the trial site level before assignment to treatment groups. The tool evaluates data variability, the occurrence of statistical outliers, and typical correlations, among other things, to generate an objective risk score for potential irregularities. This allows integrity issues to be identified at an early stage, minimizing subsequent misinterpretations and impairments of study results.

As a pioneer in the analysis of studies on degenerative diseases, Pentara is taking another step forward in providing its customers with particularly accurate and meaningful data analyses. The collaboration with NetraMark represents the use of state-of-the-art AI applications to promote reliable insights in the clinical environment. With this joint approach, risks can now be identified early, and flexible control mechanisms such as real-time alerts and targeted reviews can be implemented. This ensures greater transparency, increases confidence in study results, and lays the foundation for informed adjustments in future clinical trials. Netramark (AIAI) shares continue their positive performance in the CAD 1.45 range, and the valuation of CAD 118 million still appears reasonable given the Company's technological potential. Collect!

CEO George Achilleos presented NetraMark Holdings at the 15th International Investment Forum on May 21, 2025. Click here for the video. https://youtu.be/asqAzE7_2-M

Novo Nordisk – Another profit warning

A veritable sell-off has hit obesity specialist Novo Nordisk. The share price has lost a good 25% this week to just DKK 325. Analysts on the LSEG platform expect an average price of around DKK 550 over the next 12 months, a full 70% higher than the last traded price. Investors have been very unsettled since the renewed profit warning at the beginning of this week. Analysts are mostly negative in their comments. Experts at Bank of America, for example, expect growing challenges for the high-revenue drugs Wegovy (weight loss) and Ozempic (diabetes). The two drugs, which have been the main drivers of the Danish pharmaceutical company's stock market success to date, are likely to come under pressure due to intensified competition and the entry of generic alternatives. The market for Wegovy in particular is already feeling the effects of so-called compounded or generic products, which are weakening demand.

For Ozempic, the situation is exacerbated by the fact that patent protection is expected to expire in Canada from the 2026 fiscal year, a risk that Novo Nordisk has not yet taken into account in its forecasts. In addition, political pressure is mounting in the US, particularly from the Trump administration, which is calling for lower drug prices. Novo Nordisk had previously drastically lowered its forecast for the full year 2025. Expectations for revenue growth were lowered to 8 to 14% from 13 to 21%. Operating profit will also only increase by 10 to 16% instead of close to 20%. The market value loss that has occurred in the meantime amounts to around USD 70 billion this week alone, and since its high, it stands at around USD 400 billion. Anyone buying now could get their fingers burned or catch one of the lows. Casino!

Artificial intelligence is increasingly becoming a key technology in healthcare, far beyond short-term trends. While large pharmaceutical companies such as Novo Nordisk and Evotec are making greater use of AI, their approach often remains conventional and lacking in transparency. Despite high investments, they are reaching methodological limits, particularly in the field of personalized medicine. NetraMark is taking a completely different approach: The Canadian company is breaking new ground with its NetraAI platform. Instead of relying on black-box models, NetraMark combines explainable artificial intelligence with a learning system specially optimized for medical data.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.