December 23rd, 2024 | 08:20 CET

100% chance of peace in 2025: Ukraine, Israel & Syria! Rheinmetall, Renk, Almonty and Palantir in focus

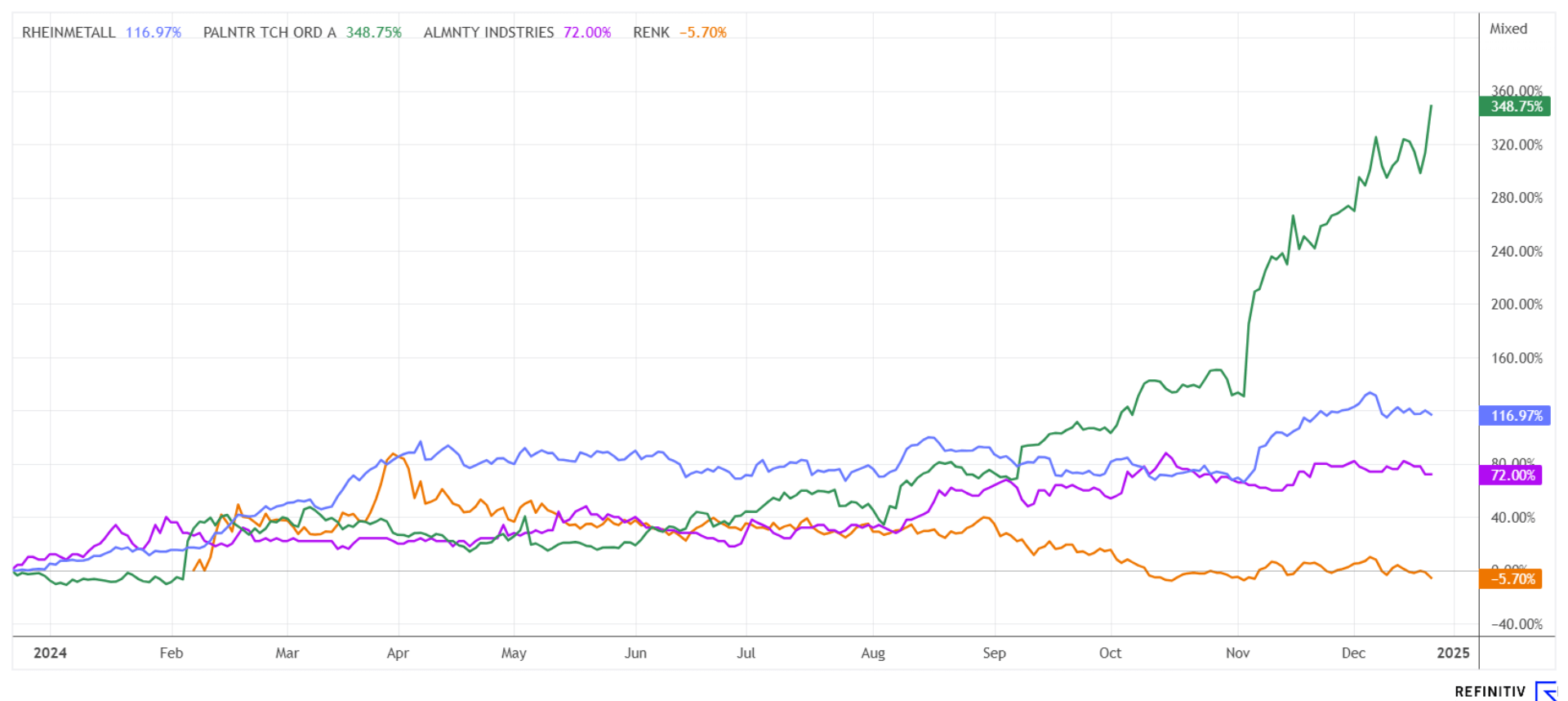

The DAX ran a little hot in December, with a new all-time high of over 20,522 points. Shortly before Christmas, it fell back to 19,850 points. Some say healthy; others say a turnaround. The fact is that the 2024 investment year was only positive for a fraction of the listed stocks despite the recessionary environment. They come from the high-tech, artificial intelligence, banking and defense sectors. With the renewed escalation of Russian attacks at the turn of the year, hopes for peace have been postponed for the time being, leaving defense stocks with their dearly paid-for charm. Producers of strategic metals are again coming into focus because, for Western industrial nations, the task is to secure supply chains as best as possible. Where are the opportunities for investors at the turn of the year?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , RENK AG O.N. | DE000RENK730 , PALANTIR TECHNOLOGIES INC | US69608A1088 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall and Renk – The fundamental outlook remains good

The two defense stocks, Rheinmetall and Renk, have taken different paths. Rheinmetall received the initial impetus for a complete reorientation of the engineering group in February 2022. While its valuation has increased sevenfold since the beginning of the Ukrainian invasion, Rheinmetall is facing one of the largest operational growth spurts in its recent history. Arms deliveries to Ukraine and, above all, the rearmament of European NATO states have gilded the balance sheet of the Düsseldorf-based company. CEO Armin Pappberger formulates his moral mission as follows: "I was convinced from day one that I was doing the right thing, otherwise I would not be doing it. I am doing the right thing because I am convinced that we are defending NATO, that we are defending Germany, Europe, and ultimately also, our democracy. There is nothing reprehensible about that."

How the story will develop in 2025 is not easy to predict. With a P/E ratio of over 20 in 2025, a doubling of revenues compared to 2022, and an expected growth rate of around 15-20% per annum, the figures up to 2027 are essentially priced in. Those who sold at a high of EUR 661 in December may be right in the medium term. However, 16 of 19 analysts on the Refinitiv Eikon platform still hold a positive outlook for Rheinmetall, with an average target price of EUR 712, representing about EUR 100 or a 15% upside. For a long time, experts underestimated the prospects, but now it could be that the euphoria is too great.

At Renk, the 12-month loss has widened to over 17% in the last few days of trading. The departure of CEO Susanne Wiegand and the underwhelming numbers for 2024 continue to weigh on the Company. US bank JPMorgan has lowered its price target for Renk from EUR 30 to 25 and left its rating at "Neutral". The designated new CEO, Alexander Sagel, now has much to do to rebuild confidence. On the Refinitiv Eikon platform, 11 of 13 analysts are positive about Renk, with a 12-month price target of EUR 30.20. This represents a 60% upside from the current price, signaling a potential buying opportunity!

Almonty Industries – A major tungsten deposit goes into production

Anyone who thinks of high-tech, aircraft construction, or the defense industry cannot ignore the need for a secure supply of critical metals. In a recent report, NATO identified a list of 12 critical metals that appear essential for the current demand for defense products. The heat-resistant metal tungsten was classified as "highly critical". Tungsten is a rare metal that occurs in comparatively small quantities in the earth's crust. So far, China accounts for over 70% of global production; it is used in the manufacture of superalloys, filaments and electronic parts, particularly in sensitive technology areas. The conflicts in Ukraine and the Middle East, as well as the rapprochement between Russia and China, demonstrate the international complexity of this issue because Western industrialised countries need security of supply and stable supply chains from safe jurisdictions.

The Canadian company Almonty Industries (AII) already operates tungsten deposits in Europe and is now focusing on developing and revitalising the Sangdong mine in South Korea. This is now becoming the largest mine outside of China, with production of the first commercial oxides set to begin in 2025. The South Korean Ministry of Trade, Industry and Energy (MOTIE) announced at a ceremony at the Korea Local Era Expo 2024 in Chuncheon that six regions in Gangwon Province have been designated as special zones for opportunity development. CEO Lewis Black commented: "We are very pleased with the commitment of the local governments to support our project with a state-of-the-art materials complex near Sangdong. This appointment and planned industrial complex highlights the strategic role of the Sangdong mine as part of South Korea's plan to ensure a stable supply of critical minerals." The AII share is currently trading at around CAD 0.88, bringing the 258.6 million shares to a total market value of approximately CAD 230 million. We believe that the coming year will bring a revaluation of the Company when investors realistically evaluate the outstanding opportunities for the first time. Exciting!

Palantir Technologies – Higher, faster, further?

The winning streak of Palantir's stock continues unexpectedly into the end of the year. Towards the end of December, the provider of Big Data analysis software and security-related AI systems was able to post another valuation jump on the trading floor, with an overall increase of over 380%, although the Nasdaq-100 Index has tended to weaken in recent days. This relative strength is impressive and reminiscent of the short squeeze that recently took place at Tesla Motors. Nevertheless, P/E ratios for 2025 are now around 172. Consequently, the expected revenue of USD 3.5 billion is valued at a market value of USD 183 billion – a factor of 52. On the Refinitiv Eikon platform, only 3 out of 30 analysts still give a "Buy" vote with an average price target of around USD 40. It seems that the market is completely wrong here, or Palantir is set to become one of the negative performers in 2025. A short product might make more sense here than a new entry. In this respect, Cathie Woods' Ark Investment team is in the same boat. She is selling heavily. But be careful: the Nasdaq is known for repeatedly adding premiums to already expensive stocks. Unfortunately, such valuation miracles are rarely found on European stock markets.**

After more than 1000 days of war in Europe, defense and armaments stocks will continue to be in focus. Rheinmetall and Palantir have benefited strongly from these trends in 2024, but we see more opportunities here on the sell or short side. Renk, on the other hand, should soon be able to break away from its downward trend. In the area of strategic metals, Almonty Industries could be a clear outperformer over the next 12 to 24 months.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.