The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on April 14th, 2021 | 11:45 CEST

BYD, Defense Metals, Plug Power - China first!

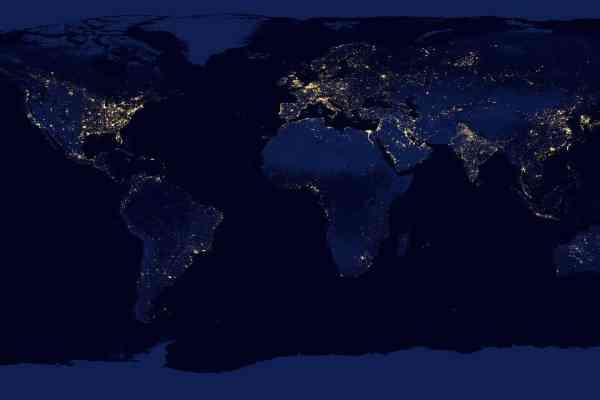

Cars are to run on electricity, trucks are to be powered by hydrogen, and in the future, wind turbines, solar panels and hydroelectric power plants will generate the electricity. All well and good, but beware, dear climate activists, wind, solar energy and electromobility require mineral raw materials that also leave an ecological footprint when they are extracted. These raw materials are not produced in our country, but almost 80% in China. Due to the Middle Kingdom's demand and the ongoing trade war, the Western world is threatened by a shortage of resources, which endangers the well-intentioned but poorly prepared energy transition.

ReadCommented by Stefan Feulner on April 13th, 2021 | 10:04 CEST

Nel ASA, dynaCERT, Everfuel - What is next for hydrogen stocks?

Without a doubt, hydrogen will remain one of the most exciting topics on the capital market in the coming years. If the current German government has its way, Germany will become a global pioneer in using new types of climate-friendly hydrogen energy. Berlin is thus pumping a total of EUR 9 billion into this industry of the future. What happens after the correction? Do the sharply fallen values turn upward again, or do you continue to reduce the inflated valuations? And are there alternatives?

ReadCommented by Stefan Feulner on April 13th, 2021 | 09:38 CEST

BMW, RYU Apparel, Puma - Attention! Wrap up warm!

It is likely that another extension and tightening of the lockdown due to the Coronavirus will be announced this week. As a result, brick-and-mortar retail will remain closed. This acts as a fire accelerator for the industry, which has been in crisis for quite some time. Shopping on the Internet is increasingly becoming the new normal. Innovative brands that provide consumers with a unique customer experience in addition to the pure product are gaining ground here, on all channels. The potential is enormous!

ReadCommented by Stefan Feulner on April 12th, 2021 | 11:30 CEST

JinkoSolar, REVEZ, Alibaba - Welcome to the new world!

Exit restrictions, contact blocks, tightened lockdowns - without a doubt, Covid-19 has been an accelerating force for adopting and advancing digital technologies. Video conferencing, Internet shopping and home offices are part of the new normal. Even virtual tours, events or congresses now run over the net. Companies that want to survive in the future should put their business on a digital footing. The technology companies that cover the new technologies will become the stock market stars of tomorrow.

ReadCommented by Stefan Feulner on April 9th, 2021 | 09:20 CEST

BYD, Kleos Space, SAP - The oil of the future!

Data is an extremely important raw material in today's world. Big Data, the evaluation and processing of large amounts of data using artificial intelligence, will almost certainly become one of the hype topics on the markets in the next few years. The development is still in its infancy. However, the enormous growth rates and the need for intelligent data for almost every industry can already be seen in the few listed companies, such as the US data analysis specialist Palantir Technologies. In addition to Palantir, which currently has a market capitalization of almost USD 50 billion, there are smaller players with huge potential.

ReadCommented by Stefan Feulner on April 8th, 2021 | 09:36 CEST

Plug Power, Blackrock Silver, Nordex - Right on trend!

Historically, silver, along with gold, has been considered a safe haven and protection against inflation. The precious metal is gaining more and more importance due to renewable energies in industrial production. Currently, silver is correcting, but in the long run, the prospects are extremely positive. Strongly rising public debts worldwide, unprecedented support measures of central banks and governments, and increasing concerns about high inflation are undoubtedly good arguments. In addition, there is an enormous demand in the electromobility sector and the photovoltaic industry.

ReadCommented by Stefan Feulner on April 8th, 2021 | 09:32 CEST

Volkswagen, Rock Tech Lithium, NIO - It is getting dramatic for Germany!

Metal processing industries and steel manufacturers in Germany are increasingly reporting delivery problems and rising costs resulting from significantly increasing raw material prices. Due to the strong growth in demand resulting from the energy transition, it is becoming increasingly difficult to secure the supply of raw materials in the long term. The dependence on China, which currently has a virtual monopoly on many metals, has been evident for a long time. As early as 2008, the then German President Horst Köhler called for a raw materials strategy for the Federal Republic. Little has happened since then, but the bottleneck is steadily approaching. According to the motto of a former SPD politician: "Germany is doing away with itself."

ReadCommented by Stefan Feulner on April 7th, 2021 | 09:10 CEST

Palantir, wallstreet:online, NanoRepro - Profit from the correction!

The correction in most technology stocks last month was short and painful. Stocks in sectors that have been hyped in recent months, such as hydrogen, electromobility and e-commerce, lost more than half of their market value at their peak. The most important price barometer for high-tech stocks, the Nasdaq 100, corrected from over 13,800 points to just under 12,200 points at its low. Since then, a dynamic countermovement has set in, which should soon lead to new highs. Take your chance now to invest in attractive stocks!

ReadCommented by Stefan Feulner on April 6th, 2021 | 07:30 CEST

Xiaomi, Pollux Properties, Deutsche Telekom - Strong development!

Delayed vaccination programs, hard lockdown, empty city centers - The DAX has become immune to the uncertain outlook and chaotic crisis management in Germany. At 15,000 points, a new all-time high was climbed last week. The stock market lights continue to be green, both in terms of the chart and fundamentals. The reason for this is the positive developments in the United States. The vaccination marathon, where every adult US citizen is to receive a vaccination offer by the end of May, is to be followed by a gigantic economic stimulus program to revive the economy. These developments should boost the leading stock exchanges on Wall Street and carry the European markets along with them.

ReadCommented by Stefan Feulner on April 1st, 2021 | 11:15 CEST

JinkoSolar, Goldseek Resources, Barrick Gold - Is this the bottom?

Currently, many technology stocks are facing important marks after the correction. Will the loss be extended, or will the stocks resume their upward course in the still existing upward trend? Gold is also running up against a decisive mark at the moment. If it breaks through, the bear market and a clearing phase lasting for months are imminent. If the support holds, the old highs could well be surpassed this year.

Read