The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on October 25th, 2022 | 14:43 CEST

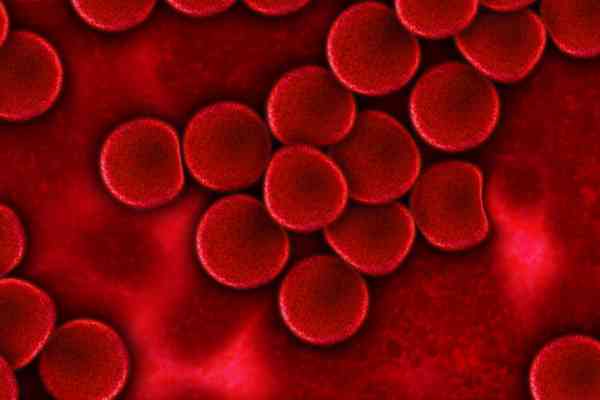

Core One Labs, XPhyto, BioNTech - The second biotech series moves forward

The enormously rapid development of the various COVID vaccines by historical standards showed how important biotechnology already is for humanity. Previously unknown companies such as BioNTech, Valneva and CureVac took center stage on the stock market and were able to multiply their share prices within a few months. Even after the pandemic, the biotech wheel continues to turn. Enormous growth opportunities are said to exist in the market for psychedelic drugs. Here, young growth companies are waiting in the wings with the potential to multiply their share prices in the future.

ReadCommented by Stefan Feulner on October 25th, 2022 | 11:26 CEST

Varta, Barsele Minerals, Nel ASA - Hard-hitting announcements from analysts

The suspense is rising - the third quarter number season is open. It will be interesting to see how companies from various sectors have performed in the months from July to September despite imponderables such as rising raw material and energy costs and the global economic downturn. Due to the partly horrendous share price losses in recent months, interesting buying opportunities could arise at a cheaper level, which should promise high price gains in the long term.

ReadCommented by Stefan Feulner on October 20th, 2022 | 10:27 CEST

Plug Power, Desert Gold, BYD - Discover the opportunities

"If you do not have the stocks when they fall, you do not have them when they rise." These wise words from a famous quote from stock market legend André Kostolany are little consolation to investors whose portfolios have melted considerably in recent months. In the long term, however, there are many attractive opportunities to enter strongly corrected companies at the current level. In addition to the stock market, other asset classes such as cryptocurrencies and precious metals also offer opportunities for disproportionate price gains in the future, despite the current uncertain environment.

ReadCommented by Stefan Feulner on October 19th, 2022 | 10:44 CEST

Deutsche Bank, Meta Materials, Aixtron - A time for optimists

Fears of a global recession and a hard landing of the economy are becoming more likely every day. The sharp rise in the US dollar, the energy crisis in Europe and the slump in growth in China are the main reasons for the prevailing pessimism. Concerns about a further sell-off are also growing on the stock markets. Last week, for example, the Fear & Greed Index peaked at 18 with the verdict "extreme fear". In parallel, the S&P 500 also marked its interim low. Since then, the signs have been pointing to recovery, both in sentiment and on the markets. An opportunity for the optimists!

ReadCommented by Stefan Feulner on October 13th, 2022 | 11:01 CEST

Geely, Kodiak Copper, Aston Martin Lagonda - Copper with the next chance

If investors had followed the sensitive early economic indicator, they would have been spared a loss of almost 25% in the DAX alone. Because already at the beginning of March, the copper price showed the first signs of fatigue after climbing to a new all-time high of USD 10,813.36 per ton. Almost half a year later, the red metal is not only trading more than 20% lower, but the recession has already arrived globally. However, despite the economic downturn, global demand for the red metal far exceeds supply. Due to the upgrading of renewable energies, the gap is likely to widen even further in the next few years, which argues for a rising base price in the long term.

ReadCommented by Stefan Feulner on October 12th, 2022 | 10:25 CEST

Nordex, Defense Metals, Rheinmetall - Critical situation

Due to geopolitical tensions and the ongoing trade war between the US and China, the supply of critical raw materials is on high alert. Especially for the energy transition and the achievement of climate targets, materials that mostly have to be exported from the largest Asian economy are needed. Now, with the Minerals Security Partnership, MSP, an alliance of Western countries has been founded to establish a complete value chain within the partner countries. As a result, mining, processing and recycling projects from Western countries will be the primary beneficiaries in the coming years.

ReadCommented by Stefan Feulner on October 11th, 2022 | 11:09 CEST

Plug Power, First Hydrogen, Lhyfe - The calm before the storm

The long-term outlook for hydrogen as an energy carrier continues to brighten. In order to become independent of Russian oil and gas, politicians worldwide are accelerating the transformation from fossil fuels to renewable energies. Especially in the problematic transportation sector, green hydrogen is considered a key element. The correction in hydrogen and fuel cell companies, which has been ongoing for more than a year, thus offers attractive anticyclical entry opportunities in the long term.

ReadCommented by Stefan Feulner on October 10th, 2022 | 10:43 CEST

BioNTech, Fonterelli GmbH & Co KGaA, Fonterelli SPAC 2 AG, MorphoSys - Bullish forecasts

The capital-intensive biotech and pharma sector has been stuck in a correction since the central banks changed their strategy at the beginning of the stock market year. In particular, vaccine manufacturers, which have exploded since the outbreak of COVID-19, have lost disproportionately in value since their highs in August of last year. However, the pandemic is likely to be with us for the next few years, albeit in a weakened form. The development of new drugs benefits companies that could now face a similar path as the vaccine producers.

ReadCommented by Stefan Feulner on October 7th, 2022 | 12:35 CEST

First Majestic, Manuka Resources, Barrick Gold - Has the bottom been reached?

Fighting inflation at all costs is the motto of the various central bank members in the US at the moment. Despite recession worries in the financial markets, the FED is determined to curb inflation with a tight interest rate policy. The fact that this has already gotten out of hand and is difficult to contain by further interest rate steps without driving the economy to ruin should be obvious, not only to economists. The first voices calling for an end to interest rate hikes are already being heard. This could mean the starting signal for a sustained upward wave of the precious metals.

ReadCommented by Stefan Feulner on October 7th, 2022 | 11:20 CEST

BYD, Altech Advanced Materials, NIO - Battle for the battery of the future

Electromobility is considered a key technology in the transformation of the transport sector. In 2021 alone, the number of new registrations, as well as the market share of battery-powered vehicles, more than doubled. In addition to the charging infrastructure, efficiency plays a decisive role in the spread of e-cars. BYD is currently the leader with its Blade battery. However, a newcomer entered the market in recent months that could shake up the battery market with a novel technology.

Read