At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on May 27th, 2021 | 07:25 CEST

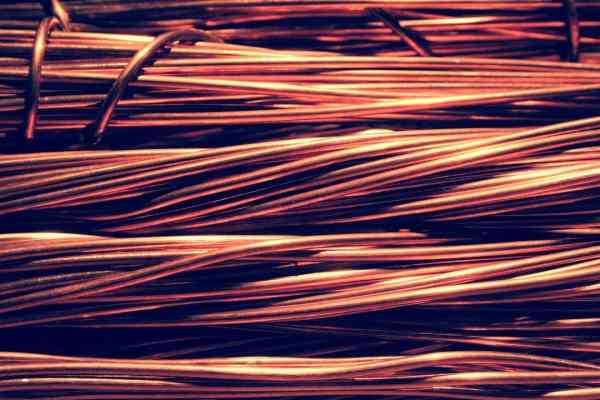

Nevada Copper, Salzgitter, NIO: The Greens and the Copper Price

Since the end of March 2020, the copper price has doubled. The trend is intact and investors are using every minor interim correction to get in. After the pandemic, countries worldwide want to get their economies back on track and fit for the future. Investments in infrastructure have been overdue for years anyway and are the very first measure for many countries. Sustainable solutions, such as charging infrastructure for electromobility, are also on the agenda. The copper price should continue to benefit. Demand from Germany, in particular, is likely to increase - a look at the polls in the election year suggests that it should soon rain billions for electric cars and their charging infrastructure. Some stocks are already benefiting.

ReadCommented by Nico Popp on May 26th, 2021 | 09:36 CEST

White Metal Resources, BASF, K+S: How to react to 4% inflation

As reported by Handelsblatt, the German Bundesbank expects an inflation rate of up to 4% by year-end. Within the eurozone, for which the central bank ECB is responsible, it could be well over 2%. This mixed situation is particularly tricky for Germans. While inflation in Germany is already very high, the lower price momentum within the eurozone could ensure that the ECB leaves its money floodgates open for even longer. In the long term, this could encourage inflation to overshoot. How can investors react to this? We present three stocks.

ReadCommented by Nico Popp on May 26th, 2021 | 08:15 CEST

BioNTech, PsyBio, Bayer: The opportunities of tomorrow

Even after the pandemic, there will be no "business as usual" in the healthcare system, as shown by a survey conducted a few months ago by the Barmer Institute for Health Research. The scientists surveyed called for far-reaching reforms. In addition to billing and uniform rules, digitization could also be a key to meaningful reforms. Innovative drugs also play a role when it comes to treating Covid-19 and concomitant diseases.

ReadCommented by Nico Popp on May 25th, 2021 | 08:44 CEST

Barrick Gold, Newmont, GSP Resource: With this stock from the start

Gold is trading around USD 1,900 again. At the same time, inflation data is picking up and Bitcoin is proving extremely volatile. These are good conditions for companies in the gold and commodities sectors. Although the shares of the best-known representatives are already slowly picking up, there are still numerous laggards. Commodity stocks have a lot to offer, from conservative to speculative - we outline this below using three stocks as examples.

ReadCommented by Nico Popp on May 21st, 2021 | 08:25 CEST

Newmont, Desert Gold, Kinross Gold, Aspermont: Gold outperforms Bitcoin

In about eight weeks, the price of gold has transformed from a problem child to a beacon of hope. The reason: inflation is on the rise. In the US, consumer prices are already at 4.2%. At the same time, more and more economies are taking steps towards normality as the pandemic nears its end. That should ensure that prices continue to rise. Gold is particularly interesting because while demand can explode overnight, supply is slow to grow. Using various companies as examples, we explain how money can be made with this mixture of factors.

ReadCommented by Nico Popp on May 20th, 2021 | 07:55 CEST

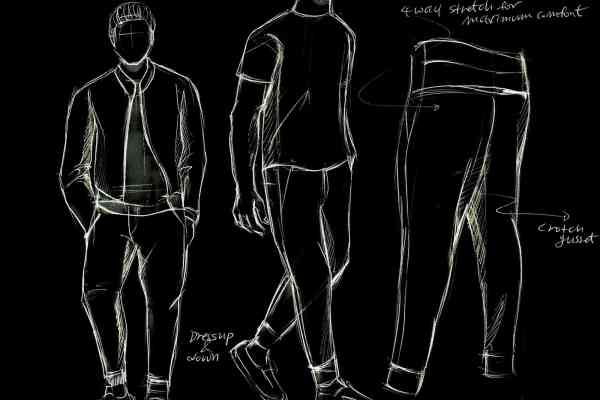

Grenke, TUI, RYU: Success with comeback stocks

When companies are punished by the market, it usually leads to negative exaggerations. When it became clear after the outbreak of the pandemic that tourism was in the doldrums, investors even cautiously priced in bankruptcy for travel and tourism company TUI. When Grenke was confronted with accusations about opaque balance sheets, the share price also plummeted. We look at three shares to see how the market can continue after such price corrections and whether they offer opportunities.

ReadCommented by Nico Popp on May 19th, 2021 | 08:59 CEST

Steinhoff, Scottie Resources, Barrick Gold: Dynamic growth lurks here

Small caps offer great growth opportunities. This is the conclusion of economic studies on the size factor. The smaller a company is, the more likely it is that operational changes will have an impact. Ultimately, this can even lead to shares multiplying. If you enter such stocks at a low level, you have a good chance of attractive returns. We explain which small stocks currently offer potential.

ReadCommented by Nico Popp on May 19th, 2021 | 07:30 CEST

Interview New Peak Metals: Many chances for great success

New Peak Metals from Australia is pursuing a promising approach around precious and industrial metals. The Company is developing several projects on different continents and is fully committed to growth - their goal: to achieve great things with as few resources as possible. David Mason, Managing Director and CEO of NewPeak Metals, explains in an interview what the Company plans to do in 2021, why the Cachi project in Argentina is a sleeping giant and what role the share package of an Australian energy company can play in the long term.

ReadCommented by Nico Popp on May 18th, 2021 | 07:50 CEST

wallstreet:online, flatexDEGIRO, Facebook: Which broker share is the best?

When a high savings rate meets rising inflation, the stock market benefits. Even with the outbreak of the pandemic, private investors rushed to take advantage of promising opportunities: gold, hydrogen, electromobility - all these have recently been the trends that have made investors' hearts beat faster. But shares related to the stock market itself are also in demand. Some business models are so mature that they can benefit from the boom in several ways.

ReadCommented by Nico Popp on May 17th, 2021 | 09:59 CEST

Saturn Oil + Gas, NEL, BYD: Here come the multipliers!

The stock market offers something for every type of investor: the cool calculator, the bold speculator and the rational decision-maker. The bull market in hydrogen stocks around the turn of the year was a case for daring gamblers: the technology is not ready for the market yet, and every investment is a bet on the future. Investors in Saturn Oil & Gas are likely to have felt like gamblers at times during the past year, which was marked by a collapse in the oil price that has now been compensated for. But since the end of last week, it has become clear that the share is also interesting for cool calculators and rational decision-makers. The reason lies in an acquisition that takes the Company to a whole new level and should also mean enormous potential for the share price.

Read